Conquer Your Taxes: A 5-Step Guide to Understanding the System

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Conquer Your Taxes: A 5-Step Guide to Understanding the System. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquer Your Taxes: A 5-Step Guide to Understanding the System

Taxes. The very word can induce a shudder, a feeling of impending doom, or at the very least, a significant sigh. Navigating the complexities of the tax system can feel like scaling Mount Everest in flip-flops, but it doesn’t have to be. Understanding the basics is the first step towards conquering your taxes and achieving financial peace of mind. This guide provides a five-step process to help you demystify the process and gain control over your financial future.

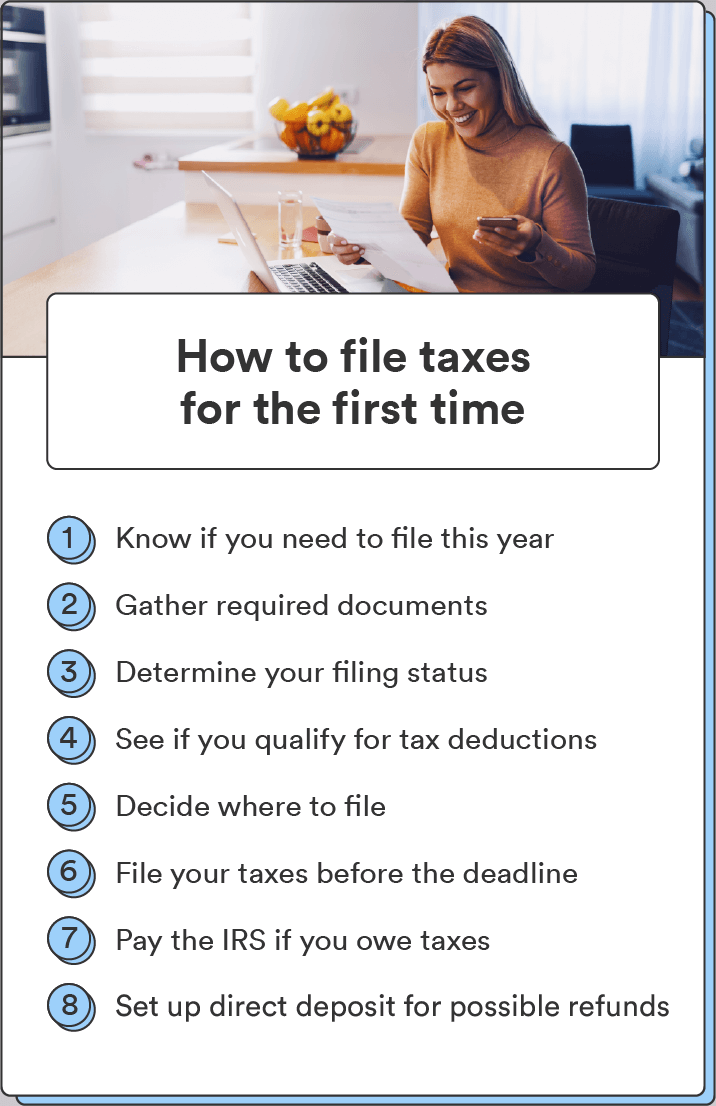

Step 1: Identifying Your Taxable Income

Before you can even think about filing, you need to understand what constitutes your taxable income. This isn’t simply your gross income – the total amount you earned before any deductions. Instead, it’s the amount left after various adjustments and deductions are applied. Understanding these nuances is crucial for accurate tax calculations.

-

Gross Income: This includes wages, salaries, bonuses, tips, interest from savings accounts, dividends from investments, rental income, and capital gains from selling assets (like stocks or property). Essentially, it’s everything you earned during the tax year.

-

Adjustments to Income: These are deductions you can take before calculating your adjusted gross income (AGI). Common adjustments include contributions to traditional IRAs (Individual Retirement Accounts), student loan interest payments (up to a certain limit), and health savings account (HSA) contributions. These reduce your overall taxable income.

-

Adjusted Gross Income (AGI): This is your gross income minus your adjustments to income. Your AGI is a crucial figure used in determining your eligibility for certain deductions and credits.

-

Standard Deduction vs. Itemized Deductions: Once you have your AGI, you need to decide whether to use the standard deduction or itemize. The standard deduction is a fixed amount determined by your filing status (single, married filing jointly, etc., and age). Itemizing involves listing individual deductions, such as charitable contributions, state and local taxes (subject to limitations), mortgage interest, and medical expenses exceeding a certain percentage of your AGI. You choose the option that results in a lower taxable income.

-

Exemptions: While exemptions were largely eliminated in the Tax Cuts and Jobs Act of 2017, it’s important to understand that certain situations, such as dependents, might still offer tax benefits. Always check the current IRS guidelines for the most up-to-date information.

Step 2: Understanding Tax Brackets and Rates

The tax system uses a progressive structure, meaning that higher earners pay a higher percentage of their income in taxes. This is achieved through tax brackets. Each bracket has a corresponding tax rate. Your taxable income is divided across these brackets, and you pay the applicable rate for each portion. It’s crucial to remember that you don’t pay the highest bracket rate on your entire income; only the portion that falls within that bracket.

For example, if the tax brackets are structured as follows (these are simplified examples and are subject to change):

- 10% on income up to $10,000

- 12% on income between $10,001 and $40,000

- 22% on income between $40,001 and $89,000

Someone earning $50,000 would pay 10% on the first $10,000, 12% on the next $30,000, and 22% on the remaining $10,000. The calculation would be: ($10,000 x 0.10) + ($30,000 x 0.12) + ($10,000 x 0.22) = $6,400. This is a simplified illustration; the actual tax calculation might involve additional factors.

Step 3: Claiming Tax Credits and Deductions

Tax credits and deductions are powerful tools that can significantly reduce your tax liability. Understanding the difference between them is essential.

-

Tax Credits: These directly reduce the amount of tax you owe, dollar for dollar. For example, the Earned Income Tax Credit (EITC) and the Child Tax Credit are valuable credits for eligible taxpayers.

-

Tax Deductions: These reduce your taxable income, thereby lowering the amount of tax you owe. However, the impact depends on your tax bracket. A deduction is more valuable to someone in a higher tax bracket than someone in a lower tax bracket.

Research available credits and deductions relevant to your situation. These can include credits for education expenses, childcare expenses, adoption expenses, and others. Always verify your eligibility for each credit and deduction before claiming them.

Step 4: Choosing the Right Filing Status

Your filing status significantly impacts your tax liability. The common filing statuses include:

- Single: For unmarried individuals.

- Married Filing Jointly: For married couples filing a single return.

- Married Filing Separately: For married couples filing separate returns.

- Head of Household: For unmarried individuals who maintain a household for a qualifying child or dependent.

- Qualifying Widow(er) with Dependent Child: For surviving spouses who meet specific criteria.

Choosing the correct filing status is crucial for accurate tax calculations. Consult the IRS guidelines to determine your appropriate filing status.

Step 5: Utilizing Resources and Seeking Professional Help

Navigating the tax system can be challenging, and there are many resources available to assist you.

-

IRS Website: The IRS website (irs.gov) is a treasure trove of information, including publications, forms, and instructions.

-

Tax Software: Tax preparation software can simplify the process, guiding you through the steps and performing calculations.

-

Tax Professionals: If you find the process overwhelming or have complex tax situations, consider consulting a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA). They can provide expert advice and ensure you’re taking advantage of all available deductions and credits.

Conclusion:

Conquering your taxes doesn’t require a degree in accounting. By understanding the fundamental principles outlined in this guide and utilizing available resources, you can gain control over your financial future and approach tax season with confidence. Remember to stay informed about tax laws and changes, as they can impact your tax liability. Proactive planning and a clear understanding of the system are your best allies in navigating the complexities of taxes. Don’t let the fear of the unknown paralyze you; take control, and conquer your taxes!

Closure

Thus, we hope this article has provided valuable insights into Conquer Your Taxes: A 5-Step Guide to Understanding the System. We hope you find this article informative and beneficial. See you in our next article!

google.com