Conquering the 5% Monster: A Guide to Understanding Inflation

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Conquering the 5% Monster: A Guide to Understanding Inflation. Let’s weave interesting information and offer fresh perspectives to the readers.

Conquering the 5% Monster: A Guide to Understanding Inflation

Inflation. The word itself can strike fear into the hearts of many, conjuring images of empty shelves, skyrocketing prices, and dwindling purchasing power. But understanding inflation is crucial for navigating the economic landscape, making informed financial decisions, and ultimately, securing your financial future. This guide will demystify the concept of inflation, explore its causes and consequences, and provide practical strategies for navigating its impact on your life.

What is Inflation?

In essence, inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. This means that the same amount of money buys less goods and services today than it did yesterday. Imagine a loaf of bread that cost $2 last year now costs $2.50. This is a simple example of inflation in action.

Measuring Inflation:

Economists use various measures to track inflation, with the most common being the Consumer Price Index (CPI). The CPI is a basket of goods and services commonly purchased by households, and its changes reflect the overall price fluctuations in the economy.

Causes of Inflation:

Understanding the causes of inflation is crucial for understanding its potential impact. Here are some of the most common drivers:

- Demand-Pull Inflation: This occurs when there is an increase in demand for goods and services faster than the supply can keep up. Think of a surge in consumer spending fueled by government stimulus, leading to increased demand for goods and services, which in turn pushes prices upward.

- Cost-Push Inflation: This arises when the cost of production for businesses increases, forcing them to raise prices to maintain their profit margins. Rising oil prices, wage increases, or supply chain disruptions can all contribute to cost-push inflation.

- Built-in Inflation: This type of inflation is driven by expectations. If consumers and businesses anticipate future price increases, they may start spending more and demanding higher wages, creating a self-fulfilling prophecy of inflation.

- Imported Inflation: This occurs when the prices of imported goods increase, leading to a rise in the overall price level. A weakening domestic currency or rising global commodity prices can contribute to imported inflation.

Consequences of Inflation:

Inflation, while often perceived as a negative force, can have both positive and negative consequences. Here’s a breakdown:

Negative Consequences:

- Reduced Purchasing Power: The most immediate impact of inflation is the erosion of purchasing power. Your money simply buys less than it used to, making it harder to afford essential goods and services.

- Increased Cost of Living: Inflation directly affects the cost of living, making it more expensive to put food on the table, pay rent, and cover other essential expenses.

- Uncertainty and Investment Risk: High inflation can create uncertainty in the economy, making it difficult for businesses to plan and invest, potentially leading to slower economic growth.

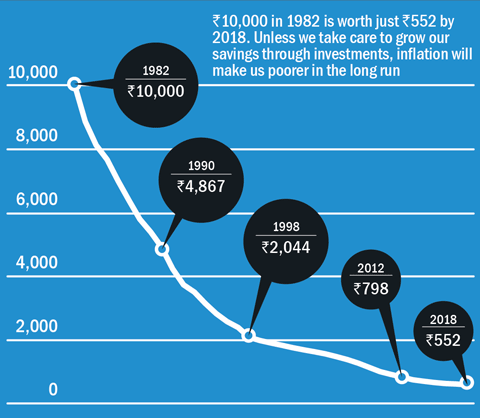

- Erosion of Savings: Inflation can erode the value of your savings over time. If your savings are not growing at a rate that outpaces inflation, their real value will decline.

Positive Consequences:

- Encourages Spending: Mild inflation can encourage spending as consumers anticipate prices to rise further, leading to increased economic activity.

- Wage Growth: Inflation can lead to higher wages as workers demand compensation for the rising cost of living.

- Debt Reduction: Inflation can make it easier to pay off debt, especially fixed-rate loans, as the real value of the debt decreases over time.

Navigating Inflation:

While inflation can be a challenging economic phenomenon, there are strategies to mitigate its impact on your personal finances:

- Invest Wisely: Invest your savings in assets that can outpace inflation, such as stocks, real estate, or inflation-protected bonds.

- Increase Income: Seek opportunities to increase your income through promotions, salary negotiations, or taking on additional work.

- Reduce Spending: Look for ways to cut back on unnecessary expenses and prioritize essential needs.

- Negotiate: Don’t be afraid to negotiate prices with vendors, especially for large purchases, to offset the impact of inflation.

- Stay Informed: Keep up-to-date on economic trends and inflation data to make informed financial decisions.

The Bottom Line:

Inflation is an inevitable part of the economic cycle. Understanding its causes, consequences, and strategies for navigating its impact is essential for maintaining financial stability and achieving your financial goals. By staying informed, being proactive, and making smart financial decisions, you can effectively manage the "5% monster" and protect your purchasing power in a world of rising prices.

Closure

Thus, we hope this article has provided valuable insights into Conquering the 5% Monster: A Guide to Understanding Inflation. We thank you for taking the time to read this article. See you in our next article!

google.com