Unleash Your 5-Year Financial Powerhouse: Crafting a Vision for Abundance

Related Articles: Unleash Your 5-Year Financial Powerhouse: Crafting a Vision for Abundance

- 5 Powerful Reasons Why Multiple Income Streams Are A Game-Changer For Financial Freedom

- 7 Powerful Strategies To Transform Your Financial Health

- Unleash Your Financial Freedom: 5 Steps To A Powerful And Effective Financial Plan

- I have earned my highest income on teachers pay teachers after 6 months

- Essential 5-Step Credit Monitoring: Unlocking Your Financial Power

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleash Your 5-Year Financial Powerhouse: Crafting a Vision for Abundance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unleash Your 5-Year Financial Powerhouse: Crafting a Vision for Abundance

The yearning for financial freedom is universal. We dream of escaping debt, building wealth, and achieving financial security. But how do we translate these dreams into tangible realities? The answer lies in crafting a powerful financial vision – a roadmap that guides us towards our desired future.

This vision isn’t just about numbers on a spreadsheet; it’s about defining your financial aspirations, understanding your values, and aligning your actions with your goals. It’s about visualizing a future where money works for you, not the other way around.

Step 1: Dig Deep – Understanding Your Financial “Why”

Before diving into specific numbers and strategies, it’s crucial to understand the underlying motivations driving your financial aspirations. Why do you want financial freedom? What does it represent to you?

- Uncover Your Values: What are your core values related to money? Are you driven by security, independence, generosity, or legacy?

- Define Your Dreams: What specific experiences or goals does financial freedom enable? Is it travel, early retirement, starting a business, supporting your family, or leaving a charitable legacy?

- Connect Your Values to Your Dreams: Align your values with your financial goals. For example, if independence is a core value, your financial vision might focus on building a business or achieving passive income.

Step 2: Paint a Picture – Visualizing Your Financial Future

Once you understand your “why,” it’s time to paint a vivid picture of your desired financial future. This is where the power of visualization comes into play.

-

- Set a Timeframe: Define a realistic timeframe for achieving your financial goals. A 5-year vision can be a great starting point.

- Imagine the Details: Imagine yourself living in your desired financial reality. What does your life look like? What are you doing? What emotions do you feel?

- Write It Down: Document your financial vision in detail. This could be a written description, a vision board, or a combination of both.

- Make It Personal: Infuse your vision with your personality and passions. This will make it more engaging and motivating.

Step 3: Set SMART Goals – Turning Your Vision into Action

A clear vision is essential, but it’s just the first step. To achieve your financial goals, you need to break them down into actionable steps. This is where SMART goals come in.

- Specific: Clearly define what you want to achieve. Instead of saying “I want to save more,” state “I want to save $10,000 by the end of the year.”

- Measurable: Set quantifiable goals that can be tracked. This allows you to monitor progress and make adjustments as needed.

- Achievable: Set realistic goals that are challenging but attainable. Avoid setting yourself up for failure by aiming too high.

- Relevant: Ensure your goals align with your overall financial vision and values.

- Time-Bound: Set deadlines for achieving your goals. This creates a sense of urgency and accountability.

Step 4: Craft Your Financial Strategy – Building the Path to Success

With a clear vision and SMART goals in place, you can start building your financial strategy. This involves identifying the specific actions you need to take to achieve your goals.

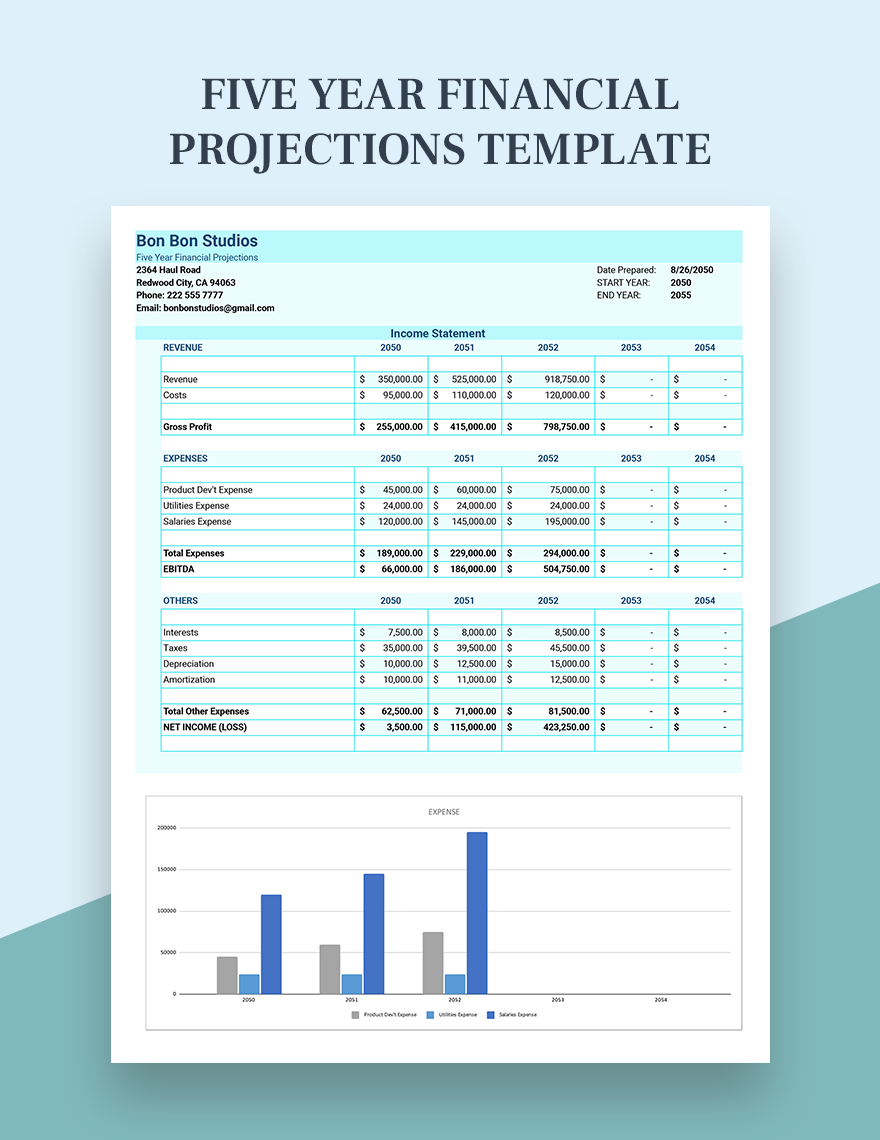

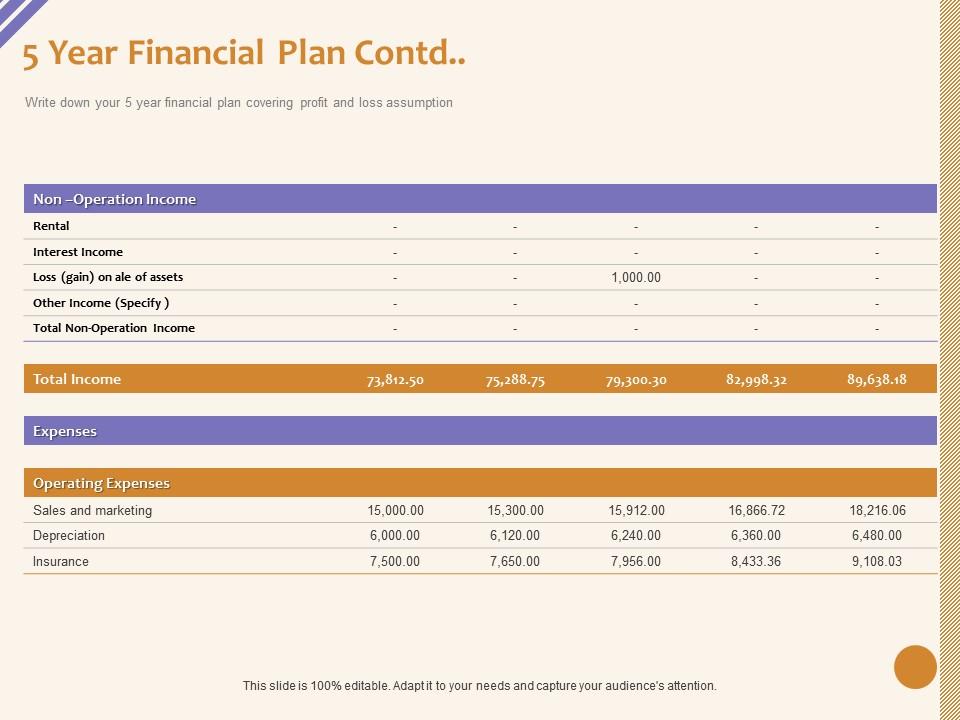

- Budgeting: Create a realistic budget that tracks your income and expenses. This will help you identify areas where you can save money and allocate funds towards your goals.

- Investing: Develop an investment strategy that aligns with your risk tolerance and time horizon. Consider different investment options like stocks, bonds, real estate, or mutual funds.

- Debt Management: Create a plan to manage and reduce debt. This might involve consolidating debt, negotiating lower interest rates, or prioritizing debt repayment.

- Income Generation: Explore ways to increase your income. This could involve taking on a side hustle, asking for a raise, or developing new skills.

Step 5: Monitor and Adjust – Staying on Course

Your financial vision is a living document, not a static plan. It’s essential to regularly monitor your progress and make adjustments as needed.

- Track Your Progress: Use a spreadsheet, financial tracking app, or other tools to track your progress towards your goals.

- Review Your Vision: Periodically review your financial vision to ensure it remains relevant and aligned with your evolving priorities.

- Adjust Your Strategy: Don’t be afraid to make adjustments to your strategy based on your progress, market conditions, or changes in your life.

Beyond Numbers – Embracing the Mindset of Abundance

A powerful financial vision goes beyond numbers and strategies. It’s about cultivating a mindset of abundance and believing in your ability to achieve financial success.

- Shift Your Perspective: Focus on what you have, not what you lack. Gratitude can shift your mindset and attract more abundance into your life.

- Challenge Limiting Beliefs: Identify any negative beliefs about money or your ability to achieve financial success. Replace them with empowering beliefs that support your vision.

- Embrace Action: Don’t just dream about financial freedom; take action to make it a reality.

The Power of a Financial Vision

Crafting a powerful financial vision is not a one-time event; it’s an ongoing process of self-discovery, goal setting, and strategic action. It’s about aligning your actions with your values and beliefs, and ultimately, creating a life of financial freedom and abundance.

5 Key Takeaways for Creating Your Financial Vision:

- Define your “why”: Understand the underlying motivations driving your financial aspirations.

- Visualize your desired future: Paint a vivid picture of your financial freedom.

- Set SMART goals: Break down your vision into actionable steps.

- Craft a financial strategy: Develop a plan to achieve your goals.

- Monitor and adjust: Stay on course by tracking your progress and making adjustments as needed.

By embracing this process and cultivating a mindset of abundance, you can unlock your financial potential and create a future filled with financial security and the freedom to pursue your dreams.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your 5-Year Financial Powerhouse: Crafting a Vision for Abundance. We appreciate your attention to our article. See you in our next article!

google.com