Crucial Power of 5: Why Effective Financial Management is Non-Negotiable

Related Articles: Crucial Power of 5: Why Effective Financial Management is Non-Negotiable

- Unbreakable: 5 Pillars Of Financial Resilience For A Secure Future

- 5 Powerful Strategies To Conquer Unexpected Expenses And Keep Your Finances Strong

- 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer For Your Financial Future

- 5 Powerful Financial Tools And Apps That Can Transform Your Finances

- 5 Powerful Strategies To Unleash Your Money’s Unstoppable Growth

Introduction

With great pleasure, we will explore the intriguing topic related to Crucial Power of 5: Why Effective Financial Management is Non-Negotiable. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Crucial Power of 5: Why Effective Financial Management is Non-Negotiable

In the tapestry of life, financial management is often treated as an afterthought, a chore to be tackled when time permits. Yet, the reality is far more profound. Effective financial management is not a mere suggestion; it’s a non-negotiable pillar for a fulfilling and secure future. It’s the cornerstone upon which individuals, families, and businesses build their dreams, navigate life’s inevitable storms, and achieve a sense of true financial well-being.

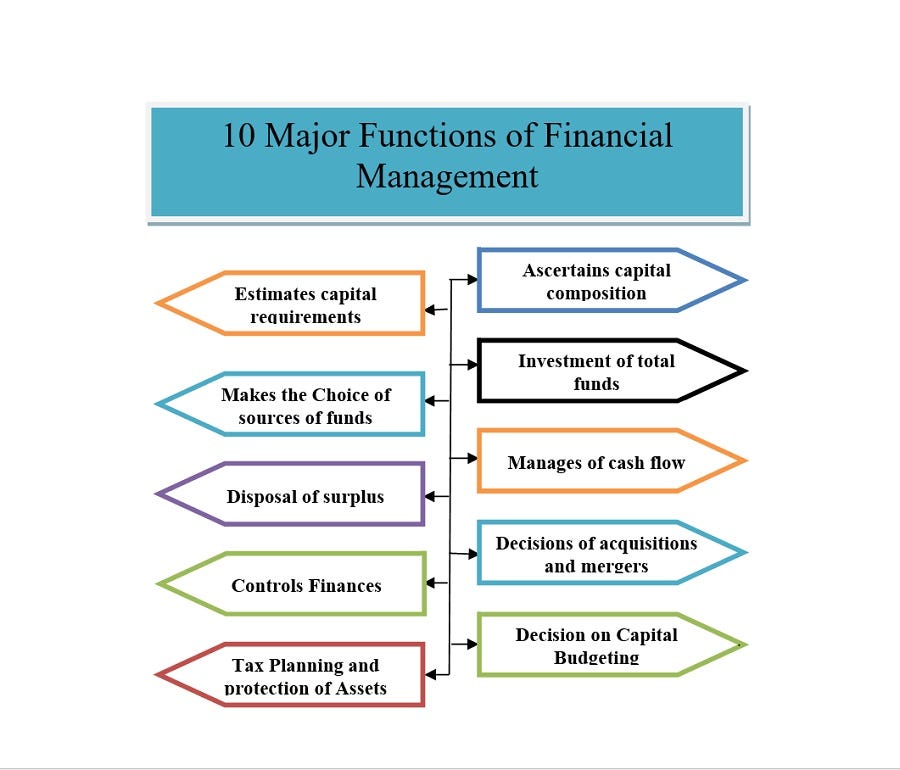

This article delves into the crucial power of 5 key aspects of financial management, highlighting their profound impact on individual lives and societal prosperity. By understanding and implementing these principles, you can unlock the transformative potential of financial control and embark on a journey of financial empowerment.

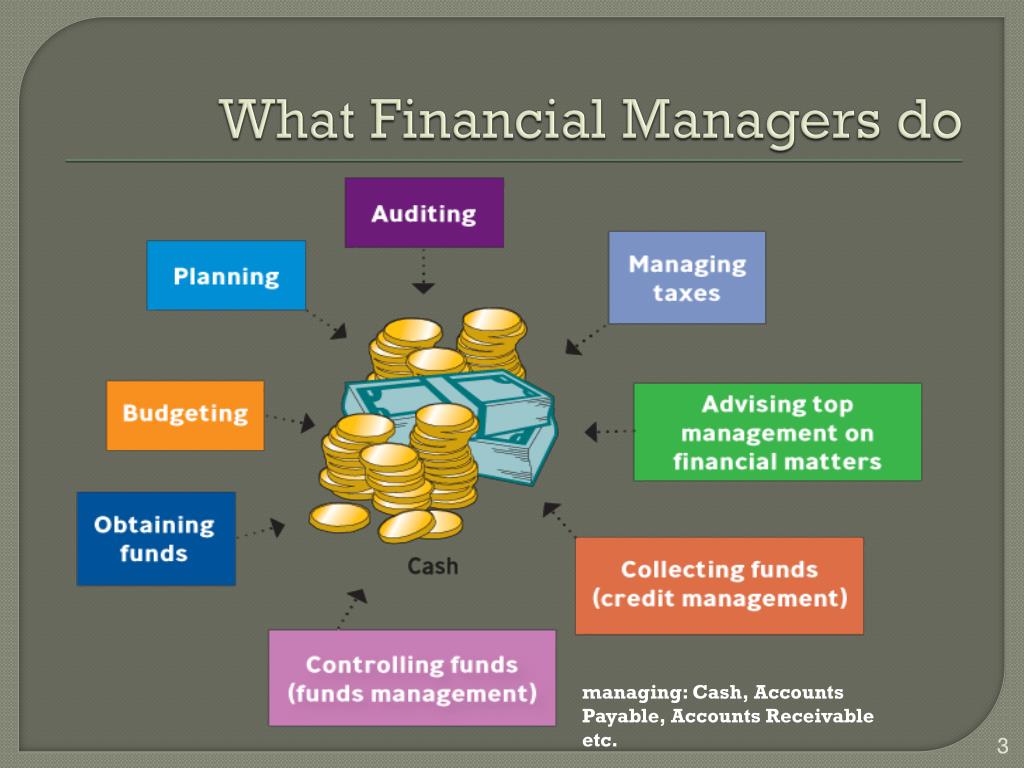

1. The Foundation: Budgeting and Financial Planning

Imagine a house built without a blueprint. It’s likely to be haphazard, unstable, and prone to collapse. Similarly, without a well-defined budget and financial plan, your financial life risks becoming chaotic and unsustainable.

Budgeting is the process of meticulously tracking your income and expenses, ensuring that your spending aligns with your financial goals. It’s the cornerstone of financial management, providing a clear picture of where your money is going and identifying areas for improvement.

Financial planning, on the other hand, takes a broader perspective, encompassing long-term goals such as retirement planning, education savings, and homeownership. It involves creating a roadmap that outlines how you will achieve these goals, considering factors like investment strategies, risk tolerance, and time horizon.

Benefits of Budgeting and Financial Planning:

-

- Reduced Financial Stress: By understanding your spending habits and aligning them with your goals, you can eliminate unnecessary expenses, reduce debt, and gain peace of mind.

- Increased Savings: A well-structured budget allows you to allocate funds towards your financial goals, whether it’s saving for a down payment on a house, funding your child’s education, or building a comfortable retirement nest egg.

- Improved Decision-Making: Having a clear picture of your financial situation empowers you to make informed decisions about spending, borrowing, and investing.

- Enhanced Financial Security: A well-planned budget and financial strategy provide a safety net against unexpected events like job loss, medical emergencies, or market fluctuations.

2. Managing Debt: The Path to Financial Freedom

Debt can be a double-edged sword. While it can provide access to necessary resources like education or a home, uncontrolled debt can quickly spiral out of control, leading to financial strain and even bankruptcy.

Effective debt management involves a two-pronged approach:

- Minimizing Debt Accumulation: By becoming a mindful spender, you can limit the amount of debt you accrue in the first place. This involves prioritizing needs over wants, avoiding impulsive purchases, and exploring alternative financing options.

- Strategically Managing Existing Debt: If you already have debt, it’s crucial to develop a plan to pay it down efficiently. This might involve consolidating high-interest debt, negotiating lower interest rates, or prioritizing payments towards debts with the highest interest rates.

Benefits of Effective Debt Management:

- Increased Financial Flexibility: By reducing debt, you free up more cash flow to pursue your financial goals, invest in your future, or simply enjoy a greater sense of financial freedom.

- Lower Interest Payments: Debt often comes with high interest rates, which can significantly drain your finances. By paying down debt, you reduce these interest payments, saving you money in the long run.

- Improved Credit Score: Carrying a high debt load can negatively impact your credit score, making it more difficult to obtain loans or credit cards in the future. By managing your debt responsibly, you can improve your creditworthiness and unlock better financial opportunities.

- Reduced Financial Stress: The weight of debt can be a significant source of stress and anxiety. By tackling your debt head-on, you can alleviate this burden and experience a greater sense of peace of mind.

3. The Power of Saving: Building a Secure Future

Saving is not merely about accumulating money; it’s about building a secure future for yourself and your loved ones. It’s about having a financial cushion to weather life’s unexpected challenges and pursue your dreams without financial constraints.

Effective saving involves:

- Setting Clear Savings Goals: Having specific financial goals, such as retirement planning, emergency funds, or down payments, provides motivation and direction for your savings efforts.

- Choosing the Right Savings Vehicles: Different savings accounts offer varying interest rates, liquidity, and features. Choosing the right vehicle for your needs and goals is essential for maximizing your returns.

- Automating Savings: Setting up automatic transfers from your checking account to your savings account ensures that you consistently save, even when you’re busy or forget.

- Increasing Savings Regularly: As your income grows, consider increasing your savings contributions to accelerate your progress towards your goals.

Benefits of Effective Saving:

- Financial Security: A healthy savings account provides a safety net against unexpected events, such as job loss, medical emergencies, or market downturns.

- Goal Achievement: Saving allows you to achieve your financial goals, whether it’s buying a home, funding your children’s education, or enjoying a comfortable retirement.

- Investment Opportunities: Savings can be invested in various assets like stocks, bonds, or real estate, potentially generating higher returns and accelerating your financial growth.

- Peace of Mind: Knowing that you have a financial cushion can provide a sense of security and peace of mind, allowing you to focus on other aspects of your life.

4. The Art of Investing: Growing Your Wealth

Investing is the art of putting your money to work, with the potential to generate returns and grow your wealth over time. While it involves risk, it’s a crucial component of long-term financial success.

Effective investing involves:

- Understanding Your Risk Tolerance: Investing involves different levels of risk and potential returns. It’s essential to understand your own comfort level with risk before making any investment decisions.

- Diversifying Your Portfolio: Don’t put all your eggs in one basket. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can mitigate risk and potentially enhance returns.

- Long-Term Perspective: Investing is a marathon, not a sprint. It’s essential to have a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations.

- Regularly Monitoring and Adjusting: Markets are constantly changing. It’s crucial to regularly monitor your investments and make adjustments as needed to align with your goals and risk tolerance.

Benefits of Effective Investing:

- Wealth Growth: Investments have the potential to generate returns, growing your wealth over time and outpacing inflation.

- Financial Security: Investing can provide a source of income in retirement, ensuring financial independence and security in your later years.

- Potential for Higher Returns: Compared to traditional savings accounts, investments often offer the potential for higher returns, accelerating your financial growth.

- Inflation Protection: Investments can help protect your savings from the eroding effects of inflation, preserving your purchasing power over time.

5. The Importance of Insurance: Protecting Your Assets

Life is full of uncertainties. Unexpected events like accidents, illnesses, or natural disasters can have devastating financial consequences. Insurance provides a safety net, protecting your assets and financial well-being against these risks.

Effective insurance planning involves:

- Assessing Your Needs: Identify the risks you face and determine the appropriate insurance coverage to mitigate those risks.

- Choosing the Right Policies: Different types of insurance offer varying levels of coverage and premiums. Selecting the right policies for your needs and budget is crucial.

- Regularly Reviewing and Updating: Your insurance needs can change over time as your life circumstances evolve. Regularly reviewing and updating your policies ensures that you have adequate coverage at all times.

Benefits of Effective Insurance Planning:

- Financial Protection: Insurance provides financial protection against unexpected events, preventing catastrophic financial losses.

- Peace of Mind: Knowing that you have insurance coverage can provide peace of mind, allowing you to focus on other aspects of your life without worrying about financial ruin.

- Legal Compliance: In some cases, insurance may be required by law, such as auto insurance or homeowners’ insurance.

- Business Continuity: For businesses, insurance can provide crucial protection against risks that could disrupt operations or lead to financial losses.

Conclusion: Unlocking the Power of Financial Management

Effective financial management is not a luxury; it’s a necessity. It’s the key to unlocking financial freedom, achieving your goals, and building a secure future for yourself and your loved ones. By embracing the crucial power of 5 key aspects – budgeting and financial planning, debt management, saving, investing, and insurance – you can take control of your finances and embark on a journey of financial empowerment.

Remember, financial management is an ongoing journey, not a destination. It requires commitment, discipline, and a willingness to learn and adapt. By staying informed, seeking professional guidance when needed, and continuously refining your financial strategies, you can navigate the complexities of the financial world with confidence and achieve your financial aspirations.

Closure

Thus, we hope this article has provided valuable insights into Crucial Power of 5: Why Effective Financial Management is Non-Negotiable. We appreciate your attention to our article. See you in our next article!

google.com