Crush 10% Interest: Mastering the Art of Student Loan Refinancing

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Crush 10% Interest: Mastering the Art of Student Loan Refinancing. Let’s weave interesting information and offer fresh perspectives to the readers.

Crush 10% Interest: Mastering the Art of Student Loan Refinancing

The weight of student loan debt can feel crushing, especially when you’re staring down the barrel of a hefty interest rate. That 10% interest, or even higher, can feel like a financial anchor dragging you down. But there’s good news: you don’t have to be a slave to your student loan debt. Refinancing can be a powerful tool to break free from the shackles of high interest rates and gain control over your financial future.

This article will guide you through the process of student loan refinancing, equipping you with the knowledge and strategies to potentially secure a lower interest rate, reduce your monthly payments, and ultimately, pay off your loans faster.

Understanding the Basics of Refinancing

Refinancing essentially means taking out a new loan to pay off your existing student loans. This new loan can offer you more favorable terms, such as a lower interest rate, a longer repayment term, or both. While refinancing can be a fantastic way to reduce your overall debt burden, it’s crucial to understand the nuances and potential risks before diving in.

Why Refinancing Can Be Your Financial Savior

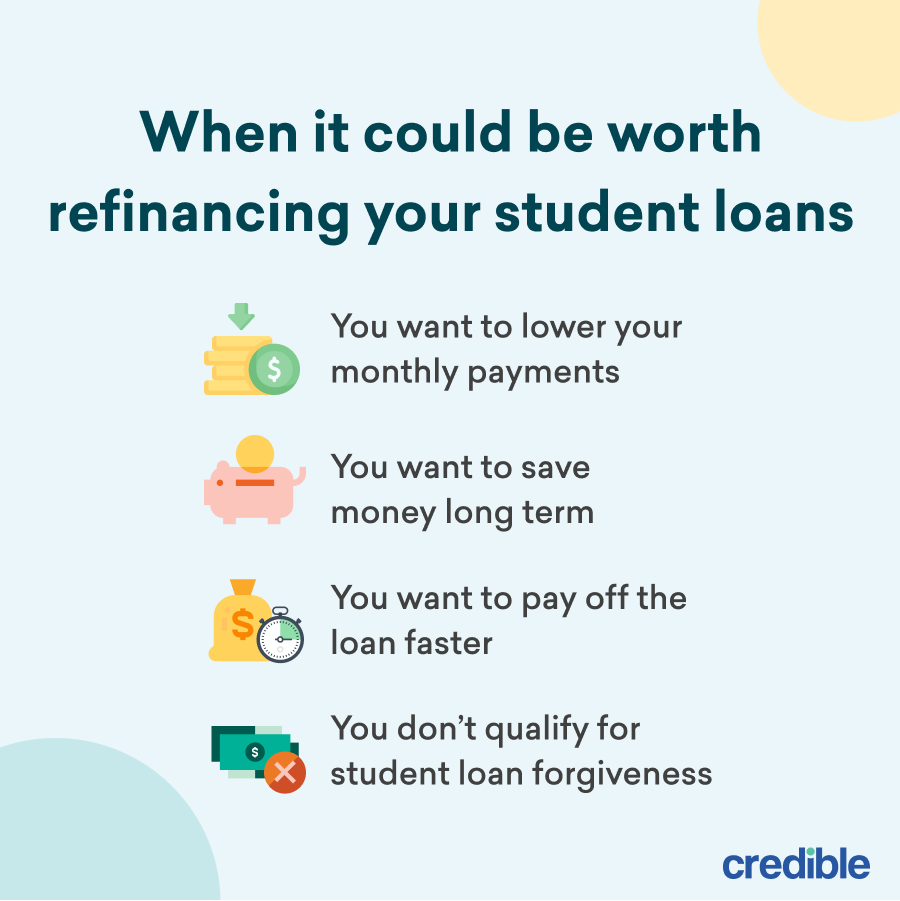

- Lower Interest Rates: The primary benefit of refinancing is the potential to secure a lower interest rate. This can significantly reduce your monthly payments, freeing up cash flow for other financial goals.

- Reduced Monthly Payments: With a lower interest rate, your monthly payments will be smaller, making it easier to manage your budget and stay on top of your financial obligations.

- Shorter Repayment Term: While a longer repayment term can result in lower monthly payments, it often means paying more interest over the life of the loan. Refinancing allows you to explore shorter repayment terms, potentially leading to faster debt repayment and less interest accrued.

- Consolidation: Refinancing can consolidate multiple student loans into one, simplifying your repayment process and providing a clearer picture of your overall debt.

Factors Influencing Refinancing Eligibility and Rates

Several factors play a crucial role in determining your eligibility for refinancing and the interest rate you qualify for.

- Credit Score: Your credit score is a major factor. A higher credit score typically translates to lower interest rates. Aim for a score above 700 to secure the most favorable terms.

- Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, is another important factor. A lower DTI generally indicates a stronger financial position, potentially leading to better refinancing options.

- Loan Type: The type of student loans you have (federal or private) can affect your refinancing options. Federal loans often offer more flexible repayment options and forgiveness programs, making them less attractive for refinancing. Private loans, on the other hand, are typically more open to refinancing.

- Income and Employment: Your income and employment history are considered by lenders. A stable income and a consistent work history can strengthen your application.

- Cosigner: If you have a low credit score or limited income, having a cosigner with a strong credit history can improve your chances of approval and secure a lower interest rate.

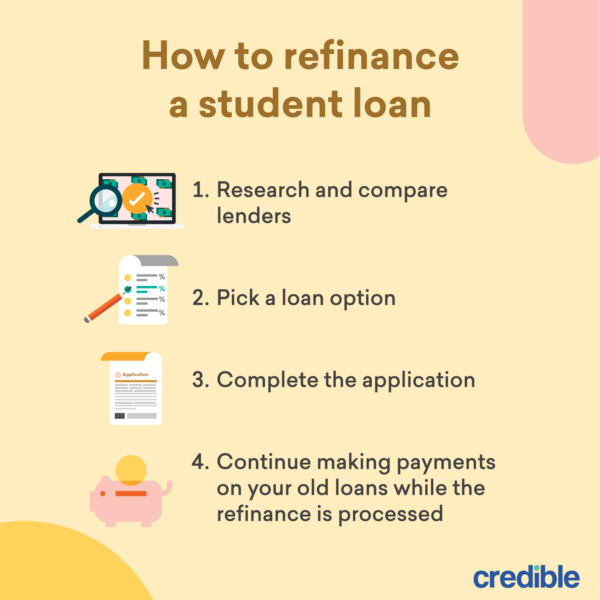

Navigating the Refinancing Process

- Assess Your Current Loan Situation: Before you jump into refinancing, take a close look at your current student loans. Understand your interest rates, loan balances, and repayment terms.

- Shop Around: Don’t settle for the first offer you receive. Compare interest rates, fees, and repayment terms from multiple lenders. Utilize online refinancing platforms or work with a financial advisor to get a comprehensive picture of your options.

- Check Your Credit Score: A good credit score is essential for securing favorable refinancing terms. Pull your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and address any errors or negative marks that could be affecting your score.

- Consider Your Financial Goals: Refinancing should align with your overall financial goals. Consider your budget, repayment timeline, and future financial aspirations.

- Read the Fine Print: Before signing any refinancing agreement, carefully review the terms and conditions, including interest rates, fees, and repayment options. Understand the potential risks and benefits of refinancing.

Potential Pitfalls of Refinancing

While refinancing can be a powerful tool for reducing your student loan burden, it’s not without potential drawbacks.

- Loss of Federal Loan Benefits: Refinancing federal student loans into private loans can result in the loss of certain benefits, such as income-driven repayment plans, loan forgiveness programs, and deferment or forbearance options.

- Higher Interest Rates: While refinancing often leads to lower interest rates, it’s not guaranteed. If your credit score is low or your financial situation has worsened, you may end up with a higher interest rate than your existing loans.

- Prepayment Penalties: Some lenders may impose prepayment penalties if you pay off your loan early. Be sure to check the terms of the loan agreement before signing.

- Increased Repayment Term: Extending your repayment term can lower your monthly payments but may lead to paying more interest overall.

Making the Right Decision for You

Refinancing student loans can be a smart move if it aligns with your financial goals and helps you reduce your overall debt burden. However, it’s crucial to carefully weigh the pros and cons, consider your eligibility, and shop around for the best rates and terms. By taking a proactive approach and understanding the nuances of refinancing, you can potentially save thousands of dollars in interest payments and gain control over your financial future.

Beyond Refinancing: Additional Strategies to Manage Student Loan Debt

- Income-Driven Repayment Plans: If you have federal student loans, explore income-driven repayment plans. These plans adjust your monthly payments based on your income and family size, making it easier to manage your debt.

- Loan Forgiveness Programs: Some professions, such as teaching, public service, or working in low-income areas, qualify for loan forgiveness programs. Explore these programs to see if you’re eligible.

- Consolidation: Consolidating your federal student loans can simplify your repayment process and potentially lower your interest rate.

- Budgeting and Savings: Develop a budget that prioritizes student loan repayment and explore ways to increase your income or reduce expenses.

Conclusion

Student loan debt can be a significant financial burden, but refinancing can be a powerful tool to reduce your interest rate, lower your monthly payments, and accelerate your debt repayment journey. By understanding the process, exploring your options, and making informed decisions, you can potentially crush those high interest rates and take control of your financial future. Remember, knowledge is power, and with the right strategies, you can overcome the challenges of student loan debt and achieve financial freedom.

Closure

Thus, we hope this article has provided valuable insights into Crush 10% Interest: Mastering the Art of Student Loan Refinancing. We appreciate your attention to our article. See you in our next article!

google.com