Effortless 5-Step Guide to Conquer Your Finances: Master Your Monthly Budget Today!

Introduction

With great pleasure, we will explore the intriguing topic related to Effortless 5-Step Guide to Conquer Your Finances: Master Your Monthly Budget Today!. Let’s weave interesting information and offer fresh perspectives to the readers.

Effortless 5-Step Guide to Conquer Your Finances: Master Your Monthly Budget Today!

The idea of budgeting can feel daunting, like a tedious chore that sucks the joy out of spending. But what if we told you that a well-structured budget isn’t about restriction, but empowerment? It’s about taking control of your finances, making informed decisions, and ultimately, achieving your financial goals. This guide will empower you to create a simple, effective budget that will bring peace of mind and financial freedom.

Step 1: Track Your Spending – Unveiling Your Financial Fingerprint

The first step to conquering your finances is understanding where your money is going. This might seem daunting, but it’s the key to creating a budget that actually works.

Here’s how to track your spending:

- Choose a method: There are many ways to track your spending. You can use a simple spreadsheet, a budgeting app, or even just a notebook. Choose the method that best suits your style and comfort level.

- Gather your data: Collect all your financial documents, including bank statements, credit card statements, and receipts.

- Record your expenses: For at least a month, diligently record every single expense, no matter how small. This will give you a clear picture of your spending habits.

Pro-Tip: Many budgeting apps automatically connect to your bank accounts, making tracking your spending a breeze.

Step 2: Calculate Your Income – Knowing Your Financial Power

Once you understand where your money is going, it’s time to determine how much money you have coming in. This will help you understand your financial capacity and set realistic budget goals.

Here’s how to calculate your income:

- List all income sources: Include your salary, wages, any side hustles, and even regular income from investments.

- Calculate your net income: Subtract taxes, deductions, and other withholdings from your gross income to arrive at your net income, which is the actual amount of money you have available to spend.

Step 3: Create Your Budget – Building Your Financial Fortress

Now it’s time to put your financial knowledge into action and create a budget that aligns with your financial goals.

Here’s a step-by-step guide to creating your budget:

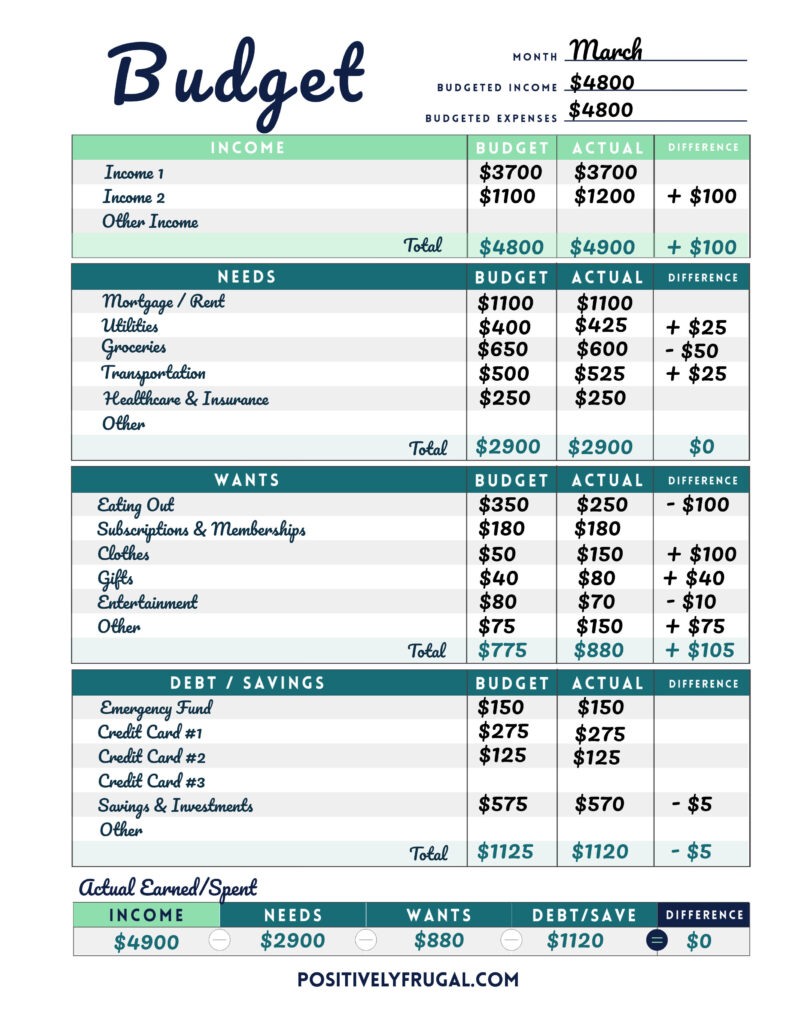

- Categorize your expenses: Group your expenses into categories like housing, transportation, food, utilities, entertainment, and debt payments.

- Allocate funds to each category: Based on your spending habits and financial goals, assign a specific amount of money to each category.

- Prioritize needs over wants: Ensure that essential needs like housing, food, and utilities are covered before allocating funds to discretionary spending.

- Use the 50/30/20 rule: This popular budgeting rule suggests allocating 50% of your net income to needs, 30% to wants, and 20% to savings and debt repayment.

Step 4: Review and Adjust – Ensuring Your Budget Stays On Track

A budget is not a set-in-stone document. It’s a living, breathing plan that should be reviewed and adjusted regularly.

Here’s how to keep your budget on track:

- Review your budget monthly: Check your spending against your budget and make adjustments as needed.

- Track your progress: Monitor your progress towards your financial goals and celebrate milestones.

- Be flexible: Life happens. Adjust your budget as your circumstances change.

Step 5: Automate Your Savings – Building Your Financial Future

One of the most effective ways to ensure you reach your financial goals is to automate your savings.

Here’s how to automate your savings:

- Set up automatic transfers: Schedule regular transfers from your checking account to your savings account.

- Utilize direct deposit: Set up your direct deposit to split your paycheck between your checking and savings accounts.

- Consider a high-yield savings account: Choose a savings account with a higher interest rate to maximize your returns.

Bonus Tips for Budget Success:

- Be realistic: Don’t try to make drastic changes overnight. Start with small, achievable goals.

- Find your support system: Talk to a friend, family member, or financial advisor for support and accountability.

- Reward yourself: Celebrate your progress and acknowledge your hard work.

- Don’t be afraid to ask for help: There are many resources available to help you create a budget and achieve your financial goals.

Conclusion: Your Journey to Financial Freedom Starts Now

Creating a budget doesn’t have to be a chore. It’s a powerful tool that can empower you to take control of your finances, achieve your financial goals, and build a brighter future. By following these steps and embracing a mindful approach to spending, you can unlock the power of budgeting and experience the freedom that comes with financial security. Remember, every small step you take towards a better financial future is a victory worth celebrating. So, embrace the journey, and let your financial freedom blossom!

Closure

Thus, we hope this article has provided valuable insights into Effortless 5-Step Guide to Conquer Your Finances: Master Your Monthly Budget Today!. We thank you for taking the time to read this article. See you in our next article!

google.com