Unbreakable: 3 Crucial Reasons Why a $1000 Emergency Fund is Your Financial Lifeline

Related Articles: Unbreakable: 3 Crucial Reasons Why a $1000 Emergency Fund is Your Financial Lifeline

- Essential 5-Step Credit Monitoring: Unlocking Your Financial Power

- Continuous Demand Finance Careers from now to 100 years into the future

- The Crucial Role Of Financial Advisors: 5 Ways They Can Transform Your Financial Future

- The Ultimate Guide To 5 Essential Cryptocurrency Concepts

- Unlock Your Financial Potential: 5 Powerful Strategies To Boost Your Credit Score

Introduction

With great pleasure, we will explore the intriguing topic related to Unbreakable: 3 Crucial Reasons Why a $1000 Emergency Fund is Your Financial Lifeline. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unbreakable: 3 Crucial Reasons Why a $1000 Emergency Fund is Your Financial Lifeline

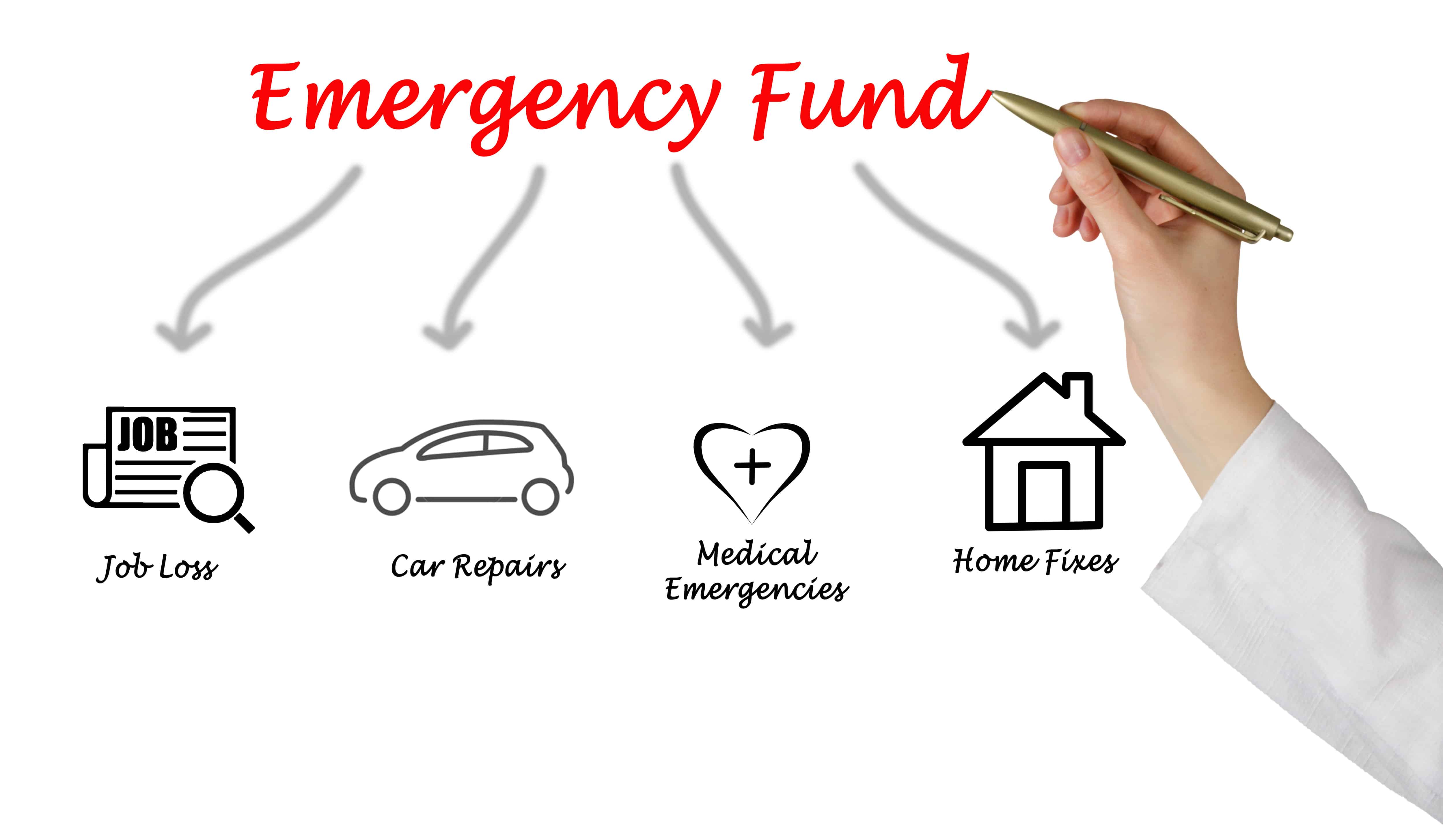

Life is unpredictable. One minute you’re cruising along, enjoying the smooth ride of stability, and the next, a curveball throws you off course. A sudden illness, unexpected car repairs, or a job loss can quickly turn your well-ordered finances into a chaotic mess. This is where an emergency fund steps in, acting as your financial airbag, absorbing the impact and preventing a catastrophic crash.

While building an emergency fund might seem like a daunting task, especially when you’re struggling to make ends meet, it’s an investment that yields incredible returns – peace of mind, financial security, and the ability to weather life’s storms without resorting to desperate measures.

The Power of Preparedness: A $1,000 Emergency Fund as Your Financial Shield

A $1,000 emergency fund might not seem like a lot, but it can be a game-changer, especially when you consider the potential costs of unexpected events. Imagine facing a sudden medical bill, a broken-down car, or an unexpected job loss without any financial cushion. The stress and anxiety can be overwhelming, forcing you to make difficult choices that could have long-term consequences.

Here are three compelling reasons why building a $1,000 emergency fund should be a top priority:

1. Avoiding Debt’s Grip: The Emergency Fund as Your Debt-Free Guardian

Debt is a financial burden that can weigh you down for years. When an unexpected expense arises and you lack an emergency fund, you’re often forced to turn to high-interest credit cards or loans, creating a cycle of debt that can be difficult to break.

A $1,000 emergency fund acts as a buffer, preventing you from falling into the debt trap. Instead of relying on expensive loans, you can use your emergency savings to cover the unexpected expense, keeping your credit score healthy and your finances stable.

Case Study: The Unexpected Car Repair

Sarah, a single mother of two, was struggling to make ends meet. She was barely able to cover her monthly expenses, and the thought of building an emergency fund seemed impossible. One day, her car broke down, leaving her stranded and facing a hefty repair bill. Without an emergency fund, she had no choice but to use her credit card, accumulating a large debt with high interest rates. This debt added significant financial stress to her already strained budget, making it even harder to get back on her feet.

2. The Peace of Mind Advantage: Living with Confidence and Stability

Building an emergency fund isn’t just about money; it’s about peace of mind. Knowing that you have a financial safety net in place can alleviate the constant anxiety and stress that comes with facing life’s uncertainties.

With an emergency fund, you can approach unexpected situations with confidence, knowing that you have the resources to handle them without jeopardizing your financial stability. You’ll be able to sleep soundly at night, free from the worry of unforeseen events.

Case Study: The Unexpected Job Loss

Mark, a young professional, had been working hard to build his career. He was making good progress, but he didn’t have an emergency fund. Then, he was unexpectedly laid off from his job. Without any savings, he was forced to rely on unemployment benefits, which were barely enough to cover his essential expenses. The stress of job searching and financial insecurity took a toll on his mental health and overall well-being.

3. Empowering Your Financial Future: Unlocking Opportunities and Building Stability

Having an emergency fund is not just about surviving; it’s about thriving. It provides the financial freedom to pursue opportunities and make positive changes in your life.

With an emergency fund, you can:

-

- Take advantage of unexpected opportunities: A new job offer in a different city, a chance to start your own business, or an investment opportunity that requires upfront capital.

- Invest in your education or skills: Take a course, pursue a certification, or further your education to enhance your career prospects.

- Make necessary home repairs: Fix a leaky roof, upgrade your appliances, or improve your home’s energy efficiency.

- Travel and explore: Take a long-awaited vacation or a much-needed break.

Building Your $1,000 Emergency Fund: A Step-by-Step Guide

Building an emergency fund doesn’t have to be overwhelming. Start small, be consistent, and celebrate your progress along the way. Here’s a step-by-step guide to help you get started:

1. Assess Your Current Finances:

- Track your income and expenses: Use a budgeting app or spreadsheet to monitor your spending habits and identify areas where you can cut back.

- Identify your financial goals: Set realistic goals for building your emergency fund, starting with a $1,000 target.

- Calculate your savings rate: Determine how much you can realistically save each month.

2. Prioritize Saving:

- Make saving automatic: Set up automatic transfers from your checking account to your savings account each payday.

- Find ways to cut expenses: Look for opportunities to reduce your monthly expenses, such as dining out less, canceling unnecessary subscriptions, or finding cheaper alternatives for everyday items.

- Use the “50/30/20” rule: Allocate 50% of your income to essentials, 30% to discretionary spending, and 20% to savings and debt repayment.

3. Stay Motivated:

- Visualize your goals: Create a visual reminder of your financial goals, such as a picture of a dream vacation or a chart tracking your progress.

- Reward yourself: Celebrate milestones along the way, such as reaching the $500 or $750 mark.

- Find a saving buddy: Partner with a friend or family member to stay motivated and accountable.

4. Consider Additional Strategies:

- Side hustles: Take on a part-time job, freelance, or sell unwanted items to supplement your income.

- Negotiate your bills: Call your utility providers, internet service providers, and insurance companies to negotiate lower rates.

- Sell unused assets: Sell items you no longer use on online marketplaces or consignment shops.

The Power of Small Steps: Building a Secure Future, One Dollar at a Time

Building an emergency fund might seem like a daunting task, but it’s a journey worth taking. Even small, consistent savings can make a significant difference over time. Remember, it’s not about how much you save, but about making saving a habit.

By prioritizing your financial well-being and building a $1,000 emergency fund, you’re taking a proactive step towards financial security and peace of mind. You’re creating a safety net that will protect you from life’s unexpected curveballs, empowering you to navigate challenges with confidence and resilience.

So, start building your emergency fund today, and take control of your financial future. You’ll be glad you did.

Closure

Thus, we hope this article has provided valuable insights into Unbreakable: 3 Crucial Reasons Why a $1000 Emergency Fund is Your Financial Lifeline. We thank you for taking the time to read this article. See you in our next article!

google.com