5 Powerful Reasons Why Transformative Financial Planning is Essential for Your Future

Related Articles: 5 Powerful Reasons Why Transformative Financial Planning is Essential for Your Future

- 5 Powerful Strategies For Mastering Your Unexpected Financial Windfall

- The Unleashing Power Of 5 Crucial Financial Education Benefits

- Budgeting Tips For The Future

- 5 Unbeatable Strategies For Crafting A Rock-Solid Budget

- 5 Powerful Strategies For Unleashing Your Financial Future: Making Informed Decisions

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Powerful Reasons Why Transformative Financial Planning is Essential for Your Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Reasons Why Transformative Financial Planning is Essential for Your Future

In a world brimming with financial complexities, it’s easy to feel overwhelmed. From navigating volatile markets to planning for retirement, the path to financial security can seem daunting. But amidst the chaos, there exists a powerful tool that can empower you to take control: comprehensive financial planning.

More than just budgeting or investing, comprehensive financial planning is a holistic approach to your financial life. It’s a roadmap, a compass, a guide that helps you navigate the complexities of money management and achieve your financial goals. The benefits of this approach extend far beyond mere financial stability; they encompass a sense of peace, freedom, and control that can profoundly impact your overall well-being.

1. Clarity and Control: Mapping Your Financial Journey

Imagine embarking on a road trip without a map. You might stumble upon beautiful sights, but you’d also likely face detours, delays, and frustration. Financial planning acts as your roadmap, providing clarity and direction for your financial journey.

A comprehensive financial plan starts with a detailed assessment of your current financial situation. This includes:

- Income and Expenses: Analyzing your income sources and expenditure patterns helps identify areas where you can maximize savings and minimize unnecessary spending.

- Assets and Liabilities: Understanding your assets (e.g., savings, investments, property) and liabilities (e.g., loans, credit card debt) provides a clear picture of your net worth and financial health.

- Financial Goals: What are your aspirations? Do you dream of buying a home, starting a business, or retiring comfortably? Financial planning helps you define and prioritize your goals, creating a tangible path to achieve them.

By gathering this information, your financial planner can create a customized plan tailored to your unique circumstances. This plan outlines strategies for:

-

- Budgeting and Spending: Developing a realistic budget that aligns with your goals and helps you track your spending habits.

- Debt Management: Creating a plan to pay down debt efficiently, reducing interest payments and freeing up cash flow.

- Investing: Designing an investment portfolio that aligns with your risk tolerance, time horizon, and financial goals.

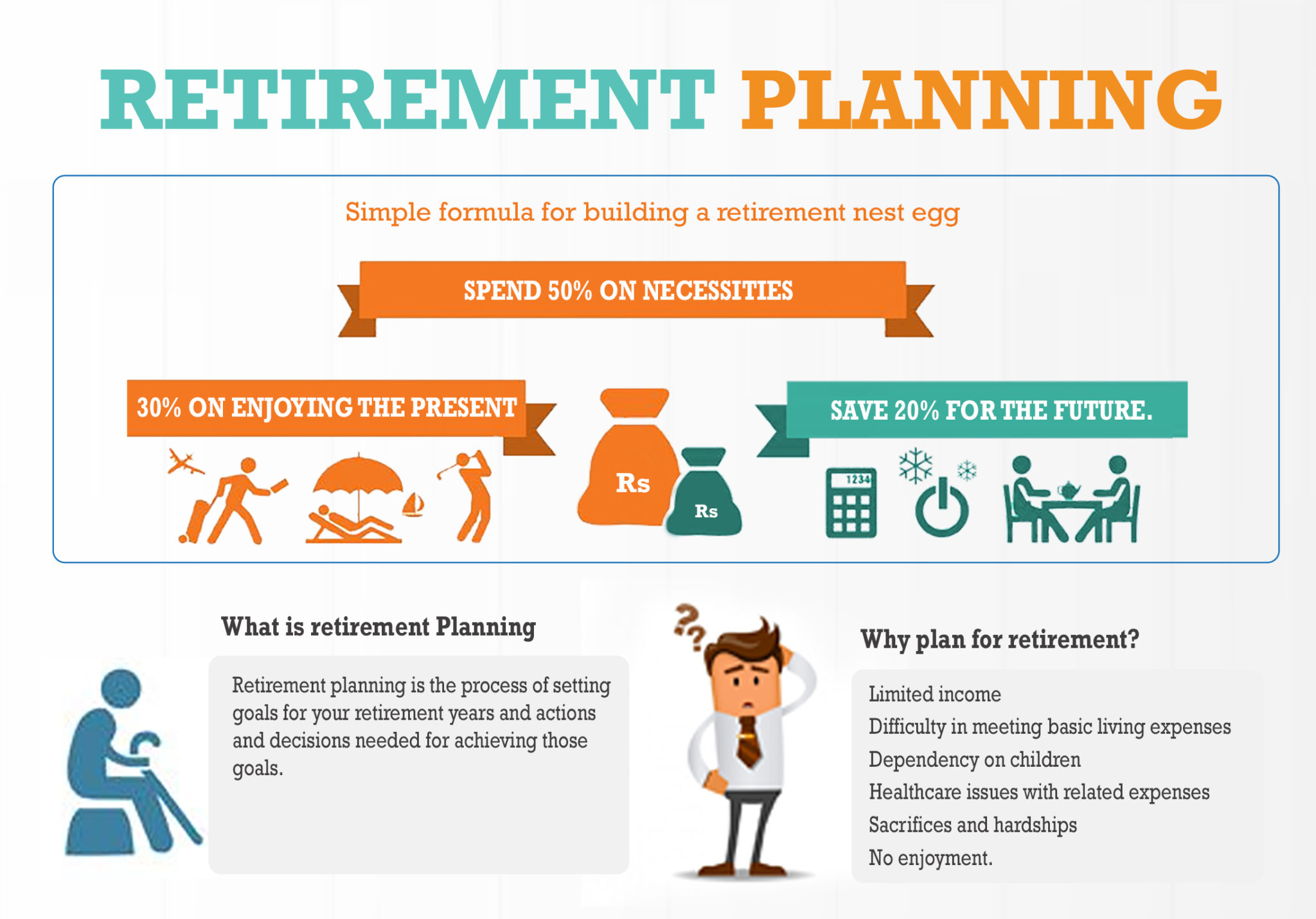

- Retirement Planning: Determining how much you need to save and invest to achieve a comfortable retirement.

- Estate Planning: Ensuring your assets are distributed according to your wishes, minimizing taxes and protecting your loved ones.

This detailed roadmap provides a sense of control and empowers you to make informed financial decisions. You’ll know where you stand, where you’re going, and how to get there.

2. Peace of Mind: Navigating Uncertainty with Confidence

Life is full of unexpected twists and turns. A sudden job loss, a medical emergency, or a market downturn can throw your financial plans into disarray. Comprehensive financial planning provides a buffer against these uncertainties, offering peace of mind and a sense of security.

Emergency Fund: A well-funded emergency fund acts as a safety net, protecting you from financial hardship in the event of unexpected expenses. Your financial planner will help you determine the appropriate amount to save and guide you in creating a strategy for building this crucial safety net.

Insurance: Comprehensive financial planning includes a thorough review of your insurance coverage, ensuring you have adequate protection for your assets, health, and family. This may involve exploring various insurance options, such as health insurance, disability insurance, life insurance, and property insurance, to ensure you’re adequately protected against unforeseen events.

Risk Management: Financial planning involves assessing your risk tolerance and developing strategies to manage financial risks. This may involve diversifying your investments, hedging against inflation, or taking steps to protect your assets from market fluctuations.

By addressing these potential risks proactively, financial planning helps you navigate uncertainty with confidence. Knowing that you have a plan in place to handle unexpected challenges can provide immense peace of mind, allowing you to focus on your goals and enjoy life without constant worry.

3. Maximizing Your Potential: Unlocking Financial Growth

Financial planning is not just about avoiding financial pitfalls; it’s also about maximizing your potential for growth and wealth creation. By implementing strategic planning, you can unlock opportunities to:

Invest Wisely: A financial planner can help you create an investment portfolio that aligns with your risk tolerance and financial goals. They can guide you in selecting the right investments, diversifying your portfolio, and rebalancing it over time to ensure you’re on track to achieve your financial objectives.

Reduce Taxes: Financial planning can help you minimize your tax liability through strategies such as tax-efficient investing, retirement planning, and estate planning. A financial planner can help you navigate complex tax laws and identify opportunities to save on taxes throughout your life.

Save for Retirement: Retirement planning is a critical aspect of financial planning. Your planner can help you determine how much you need to save, choose the right retirement accounts, and develop a plan to ensure a comfortable retirement.

Build Wealth: By combining smart saving, investing, and debt management strategies, financial planning can help you build wealth over time. It empowers you to take control of your finances and make informed decisions that lead to financial growth.

4. Achieving Your Goals: Turning Dreams into Reality

Financial goals are the driving force behind your financial journey. Whether you dream of owning a home, starting a business, or traveling the world, comprehensive financial planning provides the framework to turn those dreams into reality.

Goal Setting: Financial planning begins with clearly defining your financial goals, both short-term and long-term. This involves identifying your aspirations, prioritizing them, and setting realistic timelines for achieving them.

Action Plan: Once your goals are defined, your financial planner helps you create a detailed action plan to achieve them. This plan outlines specific steps you need to take, timelines for achieving each step, and strategies for overcoming potential obstacles.

Progress Tracking: Regularly reviewing your progress and making adjustments to your plan as needed is crucial. Your financial planner will help you monitor your progress towards your goals and make adjustments to your strategies if necessary.

By setting clear goals, creating a detailed action plan, and tracking your progress, financial planning provides the structure and support you need to achieve your financial aspirations. It transforms your dreams from mere aspirations into tangible plans with achievable timelines and actionable steps.

5. A Lifetime of Financial Confidence: Building a Secure Future

Financial planning is not a one-time event; it’s an ongoing process that evolves with your life. As your circumstances change, your financial plan should adapt to meet your evolving needs and goals.

Ongoing Support: A financial planner provides ongoing support and guidance throughout your financial journey. They will meet with you regularly to review your plan, make adjustments as needed, and address any concerns you may have.

Proactive Planning: Financial planning is about proactively managing your finances, anticipating future needs, and making informed decisions to secure your financial future. By working with a financial planner, you’ll be able to navigate life’s financial challenges with confidence and make informed decisions that protect your financial well-being.

Empowerment: Perhaps the most powerful benefit of comprehensive financial planning is the empowerment it provides. By understanding your finances, setting clear goals, and taking control of your financial future, you gain a sense of confidence and security that extends beyond your financial life. This empowerment can translate into greater peace of mind, improved decision-making, and a more fulfilling life.

Conclusion: Embracing the Power of Financial Planning

Comprehensive financial planning is not just about managing money; it’s about taking control of your future. It’s about creating a roadmap for financial security, navigating uncertainty with confidence, maximizing your potential, achieving your goals, and building a legacy of financial well-being. By embracing the power of financial planning, you can unlock a sense of peace, freedom, and control that will transform your life.

The journey to financial security begins with a single step: seeking the guidance of a qualified financial planner. They can help you create a customized plan that meets your unique needs and aspirations, empowering you to take control of your financial future and live a life free from financial worry. Don’t wait for life’s uncertainties to catch you off guard. Take charge of your financial well-being today and embrace the transformative power of comprehensive financial planning.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Reasons Why Transformative Financial Planning is Essential for Your Future. We hope you find this article informative and beneficial. See you in our next article!

google.com