The Crucial Power of 5 Key Financial Literacy Skills

Related Articles: The Crucial Power of 5 Key Financial Literacy Skills

- The Ultimate Guide To 5 Essential Cryptocurrency Concepts

- 5 Powerful Budgeting Tips To Conquer Student Debt And Achieve Financial Freedom

- 5 Powerful Strategies For A Worry-Free Retirement

- Financial projections projection

- Unlock Your Dream Home: 5 Powerful Strategies To Conquer The 20% Down Payment Hurdle

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Crucial Power of 5 Key Financial Literacy Skills. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Crucial Power of 5 Key Financial Literacy Skills

In the intricate tapestry of modern life, financial literacy stands as an indispensable thread, weaving together individual well-being, economic stability, and societal progress. Sadly, the reality is that a significant portion of the population lacks the fundamental knowledge and skills to navigate the complexities of personal finance, leading to a cascade of negative consequences. This article delves into the crucial power of financial literacy, highlighting the importance of five key skills that empower individuals to achieve financial security and prosperity.

The Alarming Reality of Financial Illiteracy

The lack of financial literacy is a global phenomenon, with staggering statistics painting a stark picture of the problem. A 2022 survey by the National Endowment for Financial Education (NEFE) revealed that only 37% of Americans can confidently answer basic financial questions. This alarming figure underscores the widespread need for financial education and the potential for positive change.

The consequences of financial illiteracy are far-reaching and deeply impact individuals, families, and communities.

1. Debt and Financial Instability:

Without a solid understanding of budgeting, saving, and borrowing, individuals are more susceptible to falling into debt traps. High-interest credit card debt, payday loans, and other forms of predatory lending can quickly spiral out of control, leading to financial instability and stress.

2. Limited Investment Opportunities:

Financial literacy empowers individuals to make informed investment decisions, maximizing their potential for wealth creation. Lacking this knowledge, individuals may miss out on opportunities to build a diversified portfolio, grow their savings, and achieve long-term financial goals.

3. Economic Inequality:

Financial literacy plays a crucial role in bridging the gap between the wealthy and the less fortunate. Individuals with a strong financial foundation are better equipped to navigate the complexities of the financial system, access opportunities, and build generational wealth. Conversely, financial illiteracy perpetuates cycles of poverty and inequality.

4. Vulnerability to Scams and Fraud:

Financial literacy equips individuals with the knowledge and skills to identify and avoid financial scams and fraud. Without this understanding, they become vulnerable targets for deceptive schemes that can result in significant financial losses.

5. Reduced Economic Growth:

Financial literacy is essential for a healthy and thriving economy. When individuals make informed financial decisions, they contribute to a more stable and sustainable economic environment. Conversely, widespread financial illiteracy can lead to instability, financial crises, and stunted economic growth.

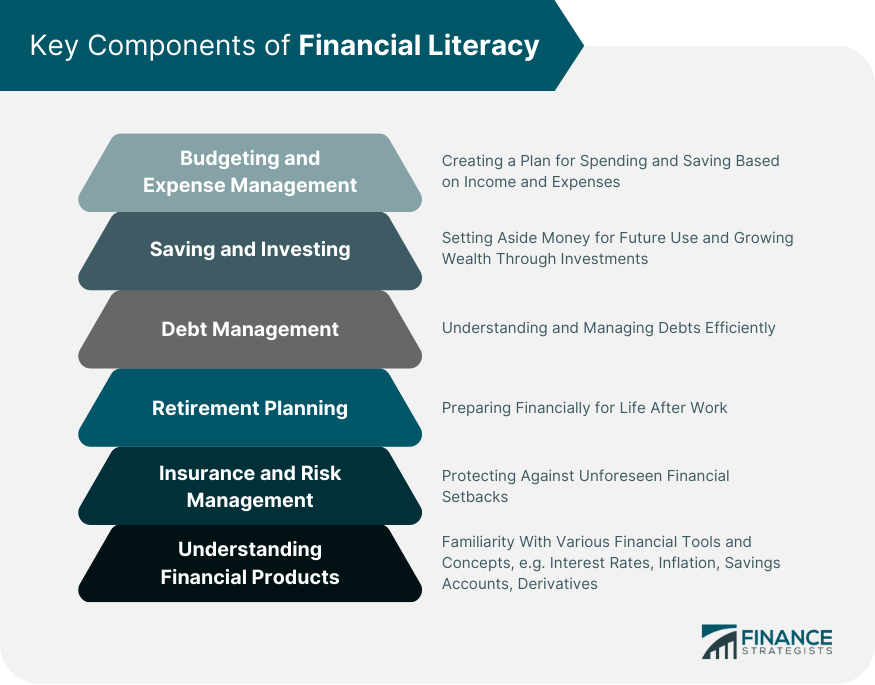

The 5 Pillars of Financial Literacy

Financial literacy encompasses a wide range of skills and knowledge, but five key pillars form the foundation for achieving financial security and prosperity:

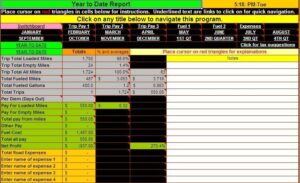

1. Budgeting and Money Management:

The ability to track income and expenses, create a realistic budget, and manage money effectively is fundamental to financial literacy. Budgeting empowers individuals to prioritize spending, save for future goals, and avoid unnecessary debt.

2. Saving and Investing:

Understanding the importance of saving and investing is crucial for building wealth and achieving long-term financial goals. This pillar encompasses knowledge of different saving and investment options, risk tolerance, and the power of compounding.

3. Debt Management:

Effective debt management involves understanding the different types of debt, managing credit responsibly, and developing strategies for paying off debt efficiently. This pillar is essential for avoiding financial pitfalls and building a healthy credit score.

4. Insurance and Risk Management:

Financial literacy includes understanding the importance of insurance and risk management. Individuals should be able to identify potential risks, assess their need for insurance coverage, and choose appropriate policies to protect themselves and their families.

5. Financial Planning and Goal Setting:

Financial literacy empowers individuals to set financial goals, create a plan to achieve those goals, and make informed decisions that align with their financial aspirations. This pillar encompasses long-term planning, retirement planning, and estate planning.

Empowering Individuals and Communities

The path to financial literacy begins with education, awareness, and access to resources. Governments, schools, communities, and financial institutions all have a role to play in promoting financial literacy and empowering individuals to make informed financial decisions.

1. Educational Initiatives:

Integrating financial literacy into school curriculums from an early age is crucial. This can be achieved through dedicated financial literacy courses, incorporating financial concepts into other subjects, and creating interactive learning experiences.

2. Community Outreach Programs:

Community organizations and financial institutions can play a vital role in providing financial education to underserved populations. This can include workshops, seminars, and online resources tailored to specific needs and circumstances.

3. Government Policies:

Governments can implement policies that promote financial literacy, such as mandatory financial education requirements, tax incentives for financial literacy programs, and regulations that protect consumers from predatory lending practices.

4. Financial Technology (FinTech):

FinTech advancements have created innovative tools and platforms that can enhance financial literacy and access to financial services. This includes budgeting apps, investment platforms, and financial literacy resources available online.

5. Media Literacy:

Individuals need to be equipped to critically evaluate financial information presented in the media. This includes understanding the potential biases, identifying misleading claims, and seeking credible sources of information.

The Ripple Effect of Financial Literacy

Investing in financial literacy is not just about individual empowerment; it’s about building a stronger and more resilient society. When individuals are financially literate, they are more likely to:

- Make informed financial decisions: This leads to better financial management, reduced debt, and increased savings.

- Contribute to economic growth: Financially literate individuals are more likely to invest, start businesses, and contribute to the overall economic well-being of their communities.

- Build a stronger social safety net: Financial literacy reduces the reliance on government assistance and empowers individuals to become self-sufficient.

- Promote social equity: Financial literacy helps bridge the gap between the wealthy and the less fortunate, creating a more equitable society.

Conclusion: A Call to Action

Financial literacy is not just a matter of personal responsibility; it’s a societal imperative. It’s time to move beyond the alarming statistics of financial illiteracy and embrace the crucial power of financial literacy to empower individuals, strengthen communities, and drive economic progress. By prioritizing financial education, providing access to resources, and fostering a culture of financial responsibility, we can create a brighter future for all. The journey to financial literacy begins with a single step, a commitment to learning, and a dedication to building a more financially secure and equitable world.

Closure

Thus, we hope this article has provided valuable insights into The Crucial Power of 5 Key Financial Literacy Skills. We hope you find this article informative and beneficial. See you in our next article!

google.com