Master Your Finances: 7 Powerful Steps to Conquer Your Budget

Introduction

With great pleasure, we will explore the intriguing topic related to Master Your Finances: 7 Powerful Steps to Conquer Your Budget. Let’s weave interesting information and offer fresh perspectives to the readers.

Master Your Finances: 7 Powerful Steps to Conquer Your Budget

The feeling of financial freedom is a powerful one. It’s the ability to make choices without the shackles of debt or worry, to pursue your dreams without the constant fear of running out of money. But achieving this freedom requires discipline and a solid plan. That plan is your budget.

A budget isn’t about restriction; it’s about empowerment. It’s about taking control of your money and making it work for you. It’s about understanding where your money goes and making conscious decisions about how to allocate it.

This article will equip you with the tools and strategies to create a budget that works for you, helping you achieve financial peace of mind and unlock the potential for a brighter financial future.

Step 1: Track Your Spending – The Foundation of Financial Awareness

The first step to mastering your finances is understanding where your money is going. This might seem daunting, but it’s essential for building a budget that reflects your actual spending habits.

Here’s how to track your spending:

- Utilize a budgeting app: Numerous apps like Mint, Personal Capital, and YNAB (You Need a Budget) can automatically track your transactions, categorize them, and provide insightful reports.

- Maintain a spreadsheet: If you prefer a more hands-on approach, create a simple spreadsheet to log your income and expenses.

- Use the envelope system: This classic method involves allocating cash for specific categories (e.g., groceries, entertainment) and placing it in labeled envelopes.

Step 2: Identify Your Income – The Source of Your Financial Power

Knowing your income is as crucial as tracking your expenses. It’s the foundation upon which your budget is built.

- List all income sources: This includes your salary, wages, freelance income, investments, and any other regular sources of money.

- Calculate your net income: Subtract taxes and other deductions from your gross income to determine your take-home pay.

- Be realistic about your income: Don’t base your budget on potential income or bonuses; stick to what you know you’ll reliably receive.

Step 3: Define Your Financial Goals – The Compass for Your Financial Journey

Having clear financial goals provides direction and motivation. They are the destinations you want to reach with your budget.

- Set SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound goals are more likely to be successful.

- Prioritize your goals: Rank your goals based on importance and urgency.

- Break down large goals: Large goals can seem overwhelming. Divide them into smaller, more manageable steps.

Step 4: Create Your Budget – The Blueprint for Financial Success

Now that you have a clear understanding of your income, expenses, and goals, you can create your budget.

- Categorize your expenses: Group your spending into categories like housing, transportation, food, entertainment, and savings.

- Allocate your income: Assign a specific amount of money to each category based on your priorities and goals.

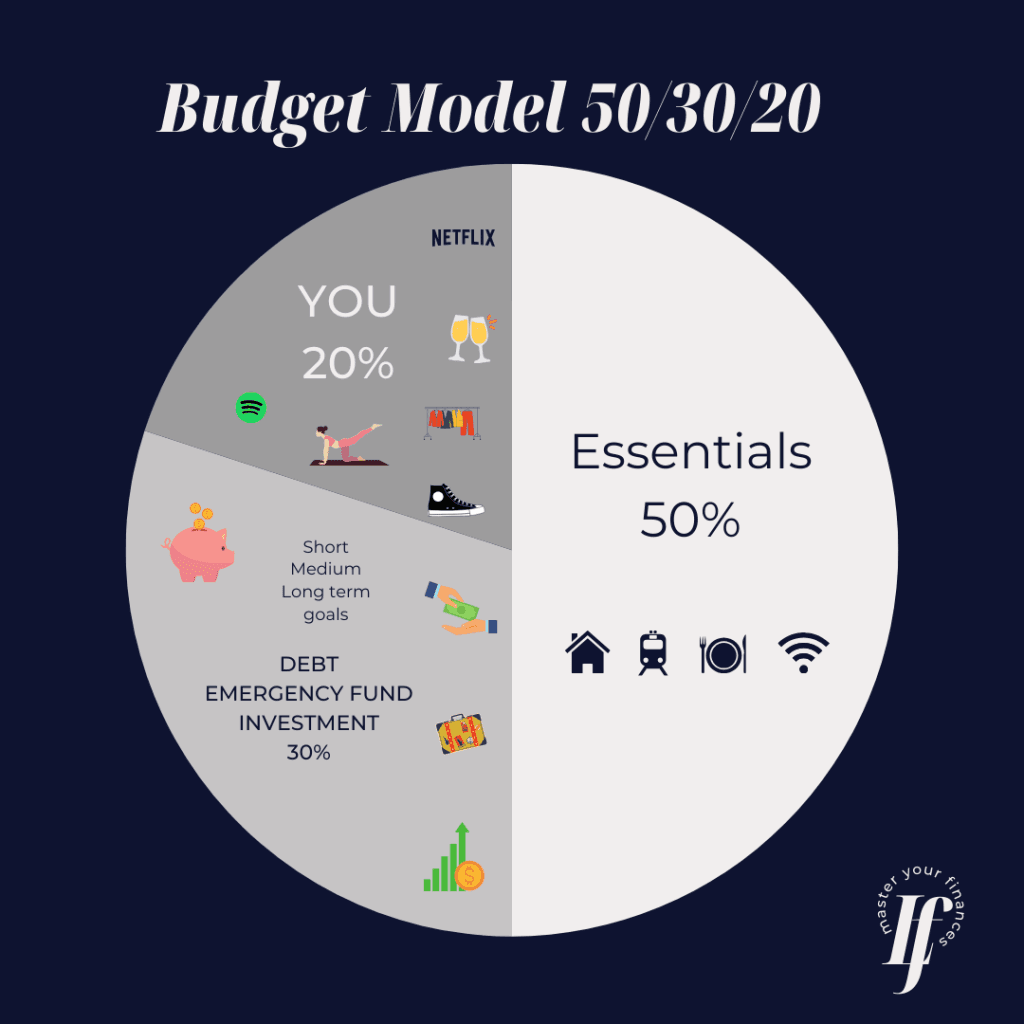

- Use the 50/30/20 rule: A popular budgeting guideline suggests allocating 50% of your income to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

Step 5: Adjust and Review – The Key to Constant Improvement

Your budget isn’t set in stone. Life happens, and your financial situation can change. Regular adjustments are essential for keeping your budget aligned with your goals.

- Review your budget monthly: Analyze your spending patterns and identify areas where you can cut back or reallocate funds.

- Make necessary adjustments: If your income changes, adjust your budget accordingly.

- Celebrate your successes: Acknowledge your progress and reward yourself for sticking to your budget.

Step 6: Automate Your Savings – The Foundation of Financial Security

Saving is crucial for achieving financial freedom. Automating your savings ensures you’re consistently building wealth.

- Set up automatic transfers: Schedule regular transfers from your checking account to your savings account.

- Consider a high-yield savings account: Earn more interest on your savings by choosing a high-yield savings account.

- Utilize a robo-advisor: These automated investment platforms can manage your savings and investments based on your risk tolerance and goals.

Step 7: Pay Down Debt – The Path to Financial Liberation

Debt can be a significant burden on your finances. Paying it down should be a priority.

- Create a debt repayment plan: Prioritize debts with the highest interest rates.

- Consider debt consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Negotiate with creditors: Contact your creditors to explore options for lowering your interest rates or monthly payments.

Tips for Successful Budgeting

- Be realistic and flexible: Don’t set unrealistic expectations or be too rigid with your budget. Allow for some flexibility.

- Track your progress: Monitor your spending and savings regularly to stay on track.

- Don’t be afraid to ask for help: Seek guidance from a financial advisor or a trusted friend or family member.

Conclusion: Embrace the Power of Budgeting

Mastering your finances is a journey, not a destination. It’s about continuous learning, adaptation, and commitment. By embracing the principles outlined in this article, you can create a budget that empowers you to achieve your financial goals, secure your future, and unlock the freedom to live life on your own terms. Remember, a budget isn’t about deprivation; it’s about conscious choices and strategic planning that pave the way for a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Master Your Finances: 7 Powerful Steps to Conquer Your Budget. We thank you for taking the time to read this article. See you in our next article!

google.com