Master Your Finances: A 5-Step Guide to Creating a Powerful Spending Plan

Related Articles: Master Your Finances: A 5-Step Guide to Creating a Powerful Spending Plan

- 5 Powerful Strategies For Effortless Real Estate Investing: A Beginner’s Guide

- Essential: 5 Crucial Steps To Secure Your Legacy With Estate Planning

- 5 Powerful Reasons Why Multiple Income Streams Are A Game-Changer For Financial Freedom

- Unlocking Your Financial Freedom: 5 Powerful Strategies To Maximize Your 401(k)

- Unleash Financial Freedom: 7 Powerful Steps To Master Your Monthly Budget

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Master Your Finances: A 5-Step Guide to Creating a Powerful Spending Plan. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Master Your Finances: A 5-Step Guide to Creating a Powerful Spending Plan

In today’s world, it’s easy to feel overwhelmed by the constant barrage of expenses. From rent and bills to groceries and entertainment, money seems to disappear faster than we can keep track of it. But what if there was a way to take control of your finances and achieve financial freedom? The answer lies in creating a powerful spending plan.

A spending plan, often called a budget, is more than just a list of your income and expenses. It’s a strategic roadmap that guides your financial decisions, helps you prioritize your needs, and ultimately empowers you to achieve your financial goals. Whether you dream of buying a house, traveling the world, or simply having a comfortable retirement, a well-crafted spending plan is the key to unlocking your financial potential.

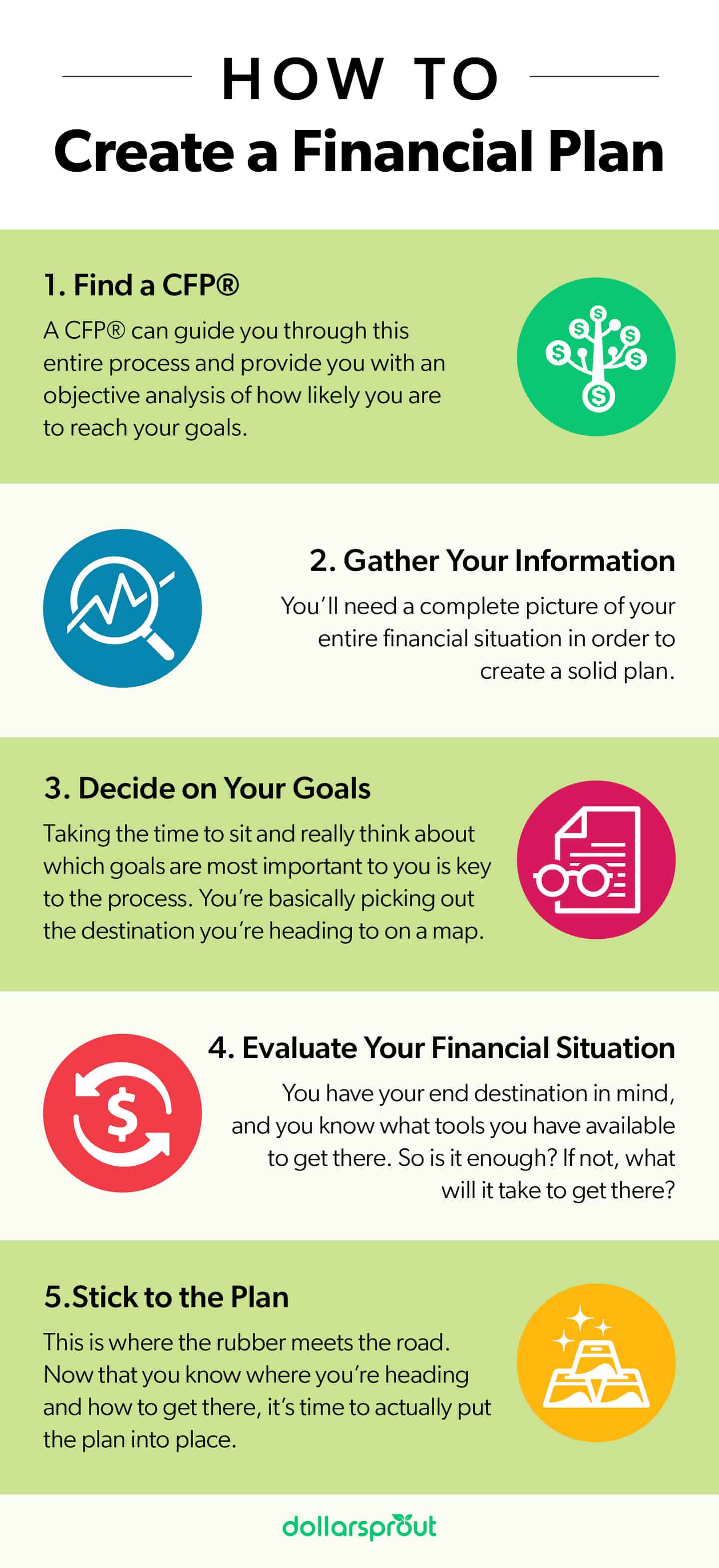

This article will guide you through a 5-step process to create a powerful spending plan that works for you. We’ll cover everything from tracking your spending to setting financial goals, and provide practical tips to help you stay on track.

Step 1: Track Your Spending

The first step to creating a spending plan is to understand where your money is going. This involves tracking your expenses for a period of time, typically one to three months. There are several ways to do this:

- Use a Spreadsheet: A simple spreadsheet can be a great way to track your spending. You can create columns for date, category, and amount, and then record your expenses as you go.

- Use a Budgeting App: There are many budgeting apps available that can automate the tracking process. These apps can connect to your bank accounts and automatically categorize your transactions.

- Use the Envelope Method: This old-fashioned method involves dividing your cash into envelopes labeled with different categories, such as groceries, entertainment, and gas. You can only spend the money in each envelope for the designated category.

Regardless of the method you choose, the key is to be consistent and accurate. Don’t forget to track even the smallest expenses, such as coffee, snacks, or public transportation fares.

Step 2: Analyze Your Spending

Once you have tracked your spending for a period of time, it’s time to analyze it. Look for patterns and identify areas where you might be overspending.

Here are some questions to ask yourself:

- Where is the majority of your money going? Are you spending more on housing, food, or entertainment?

- Are there any unnecessary expenses you can cut back on? Do you subscribe to streaming services you don’t use, or do you eat out too often?

- Are you spending more than you earn? This is a sign that you need to make adjustments to your spending habits.

Step 3: Set Financial Goals

Before you can create a spending plan, you need to define what you want to achieve with your money. What are your financial goals?

Here are some examples of common financial goals:

- Pay off debt: This could include credit card debt, student loans, or personal loans.

- Save for retirement: This is essential for ensuring financial security in your later years.

- Save for a down payment on a house: Owning a home is a major financial goal for many people.

- Save for a vacation: This could be a dream vacation to a far-off destination or a weekend getaway closer to home.

- Invest in your education: This could include taking online courses, attending workshops, or pursuing a higher degree.

Step 4: Create Your Spending Plan

Now that you understand your spending habits and have set your financial goals, it’s time to create your spending plan. There are different approaches you can take, but the key is to create a plan that works for you and your lifestyle.

Here are some popular budgeting methods:

- The 50/30/20 Method: This method divides your after-tax income into three categories: 50% for needs (housing, utilities, groceries), 30% for wants (entertainment, dining out, hobbies), and 20% for savings and debt repayment.

- The Zero-Based Budget: This method involves allocating every dollar of your income to a specific category, leaving no room for overspending.

- The Envelope Method: This method, described earlier, is a great way to stay on track with your spending by physically limiting the amount of cash you can spend in each category.

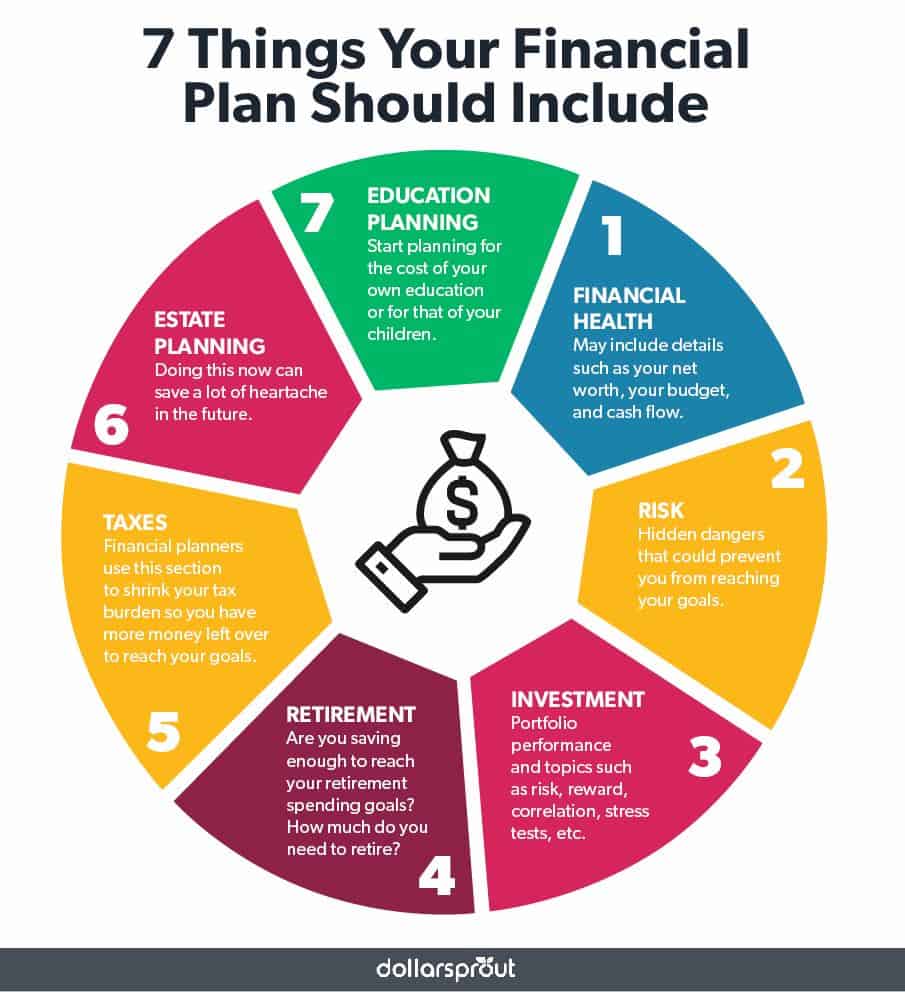

Regardless of the method you choose, your spending plan should include the following elements:

- Income: This includes all sources of income, such as your salary, investments, and any side hustles.

- Expenses: This includes all of your necessary expenses, such as rent, utilities, groceries, transportation, and debt payments.

- Savings: This includes any money you are setting aside for your financial goals, such as retirement, a down payment on a house, or an emergency fund.

Step 5: Track and Adjust

Creating a spending plan is only the first step. The next step is to track your progress and make adjustments as needed. This involves regularly reviewing your spending, comparing it to your budget, and identifying areas where you can improve.

Here are some tips for staying on track:

- Review your spending plan monthly: This will help you identify any areas where you are overspending and make necessary adjustments.

- Use a budgeting app or spreadsheet: This can help you track your spending automatically and make it easier to see where your money is going.

- Set reminders: Set reminders on your phone or calendar to remind yourself to review your spending plan and make adjustments.

- Don’t be afraid to make changes: Your spending plan is a living document, and it’s okay to make changes as your circumstances change.

Tips for Creating a Powerful Spending Plan

- Be realistic: Don’t try to cut back on too much too quickly. Start with small changes and gradually work your way up to bigger goals.

- Prioritize your needs: Make sure you are covering all of your essential expenses before allocating money to wants.

- Set clear financial goals: Having clear goals will give you motivation to stick to your spending plan.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month.

- Don’t be afraid to ask for help: If you are struggling to create a spending plan or stick to it, don’t hesitate to seek professional financial advice.

Conclusion

Creating a powerful spending plan is essential for achieving financial freedom and reaching your financial goals. It requires discipline, commitment, and a willingness to make adjustments along the way. By following these five steps and incorporating the tips provided, you can take control of your finances and build a brighter financial future. Remember, it’s not about restricting yourself, but rather about making informed decisions about your money and ensuring that it works for you, not against you.

Closure

Thus, we hope this article has provided valuable insights into Master Your Finances: A 5-Step Guide to Creating a Powerful Spending Plan. We appreciate your attention to our article. See you in our next article!

google.com