Masterful Tax Planning: 5 Strategies to Conquer Your Tax Burden

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Masterful Tax Planning: 5 Strategies to Conquer Your Tax Burden. Let’s weave interesting information and offer fresh perspectives to the readers.

Masterful Tax Planning: 5 Strategies to Conquer Your Tax Burden

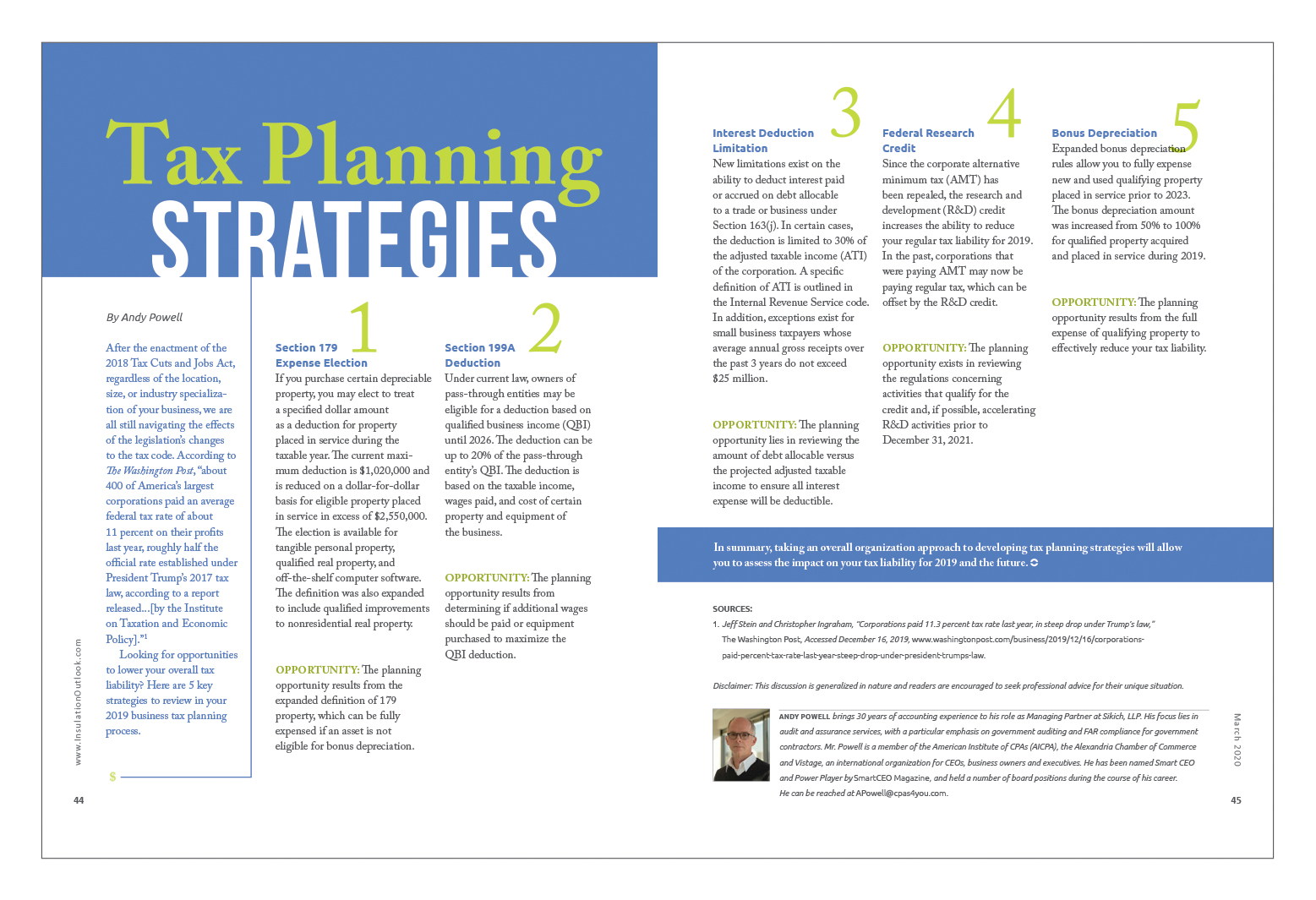

Tax season can be a stressful time for anyone, but it doesn’t have to be. By taking a proactive approach and implementing strategic tax planning techniques, you can significantly reduce your tax liability and ensure a smoother, more financially rewarding experience. This article will explore five powerful strategies that can empower you to master your taxes and achieve greater financial freedom.

1. Understanding Your Tax Bracket and Deductions

The first step in effective tax planning is to understand your tax bracket and the deductions you are eligible for. This requires careful analysis of your income, expenses, and tax obligations.

- Tax Bracket: Your tax bracket determines the percentage of your income that is taxed. Knowing your bracket allows you to make informed financial decisions that can minimize your tax burden. For example, if you are nearing the threshold for a higher tax bracket, you might consider adjusting your income to stay within the lower bracket.

- Deductions: Deductions are expenses that you can subtract from your taxable income, reducing your overall tax liability. Common deductions include:

- Standard Deduction: A fixed amount that most taxpayers can claim.

- Itemized Deductions: Specific expenses like medical expenses, mortgage interest, and charitable donations.

- Tax Credits: Direct reductions to your tax liability, often offering greater savings than deductions.

2. Maximize Your Retirement Savings

Retirement savings plans offer significant tax advantages, making them a powerful tool for tax planning.

- Traditional IRA: Contributions to a traditional IRA are tax-deductible, reducing your taxable income in the current year. You’ll pay taxes on the withdrawals during retirement.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, but withdrawals in retirement are tax-free. This can be beneficial if you expect to be in a higher tax bracket during retirement.

- 401(k) and 403(b): Employer-sponsored retirement plans that offer tax advantages similar to IRAs. Many employers offer matching contributions, effectively boosting your savings.

3. Harness the Power of Tax-Advantaged Accounts

Beyond retirement accounts, there are other tax-advantaged accounts that can help you save money and reduce your tax liability.

- Health Savings Account (HSA): HSAs are available to those enrolled in high-deductible health plans. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Flexible Spending Account (FSA): FSAs allow you to set aside pre-tax dollars for healthcare and dependent care expenses. This can significantly reduce your taxable income.

- 529 Plan: 529 plans are designed for education savings. Contributions are not tax-deductible, but earnings grow tax-free and withdrawals for qualified education expenses are tax-free.

4. Optimize Your Investment Strategies

Your investment portfolio can play a significant role in your tax planning. By understanding the tax implications of different investment types, you can optimize your returns and minimize your tax burden.

- Tax-Loss Harvesting: Selling losing investments can create a tax deduction, offsetting capital gains from other investments. This strategy can be particularly beneficial during market downturns.

- Dividend-Paying Stocks: Dividends are taxed as ordinary income, but certain types of dividends, such as qualified dividends, receive a preferential tax rate.

- Municipal Bonds: Interest income from municipal bonds is typically exempt from federal income tax and often state and local taxes, making them attractive for investors seeking tax-free income.

5. Consult a Tax Professional

While there are numerous resources available for DIY tax planning, consulting a qualified tax professional can be invaluable. A tax advisor can:

- Provide personalized guidance: They can assess your unique financial situation and recommend strategies tailored to your needs.

- Identify potential tax savings: Tax professionals are well-versed in tax laws and can identify deductions and credits you may be overlooking.

- Help you navigate complex situations: Tax laws can be complex, and a tax advisor can help you understand and navigate challenging situations, such as business ownership, estate planning, or international tax issues.

Conclusion: Taking Control of Your Taxes

Tax planning is not a one-time event but an ongoing process. By actively managing your finances and implementing these strategies, you can gain control over your tax burden and achieve greater financial security. Remember, knowledge is power, and understanding the intricacies of tax laws can empower you to make informed decisions that benefit your financial well-being.

Beyond the Basics: Additional Tax Planning Tips

- Track Your Expenses: Keep detailed records of all your income and expenses throughout the year. This will make it easier to prepare your taxes and identify potential deductions.

- Consider a Home Office Deduction: If you work from home, you may be eligible for a home office deduction.

- Stay Informed: Tax laws are constantly evolving, so it’s important to stay updated on any changes that could affect your tax situation.

- Plan for Future Events: Anticipate major life events, such as marriage, divorce, or the birth of a child, as these can impact your tax liability.

Final Thoughts

Tax planning is not about avoiding taxes altogether, but rather about minimizing your tax burden legally and ethically. By taking a proactive approach and implementing the strategies outlined in this article, you can navigate tax season with confidence and achieve greater financial freedom.

Closure

Thus, we hope this article has provided valuable insights into Masterful Tax Planning: 5 Strategies to Conquer Your Tax Burden. We thank you for taking the time to read this article. See you in our next article!

google.com