Mastering the 5 Key Strategies for Powerful Tax Planning

Related Articles: Mastering the 5 Key Strategies for Powerful Tax Planning

- Unleash Your Inner Entrepreneur: 5 Powerful Steps To Launching A Thriving Side Hustle

- 5 Unstoppable Financial Goals To Crush In Your 20s

- The Ultimate Guide To Conquering The Stock Market: 5 Steps To Smart Investing For Beginners

- Unlocking The 5 Crucial Keys To Mastering Insurance: A Comprehensive Guide

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Mastering the 5 Key Strategies for Powerful Tax Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

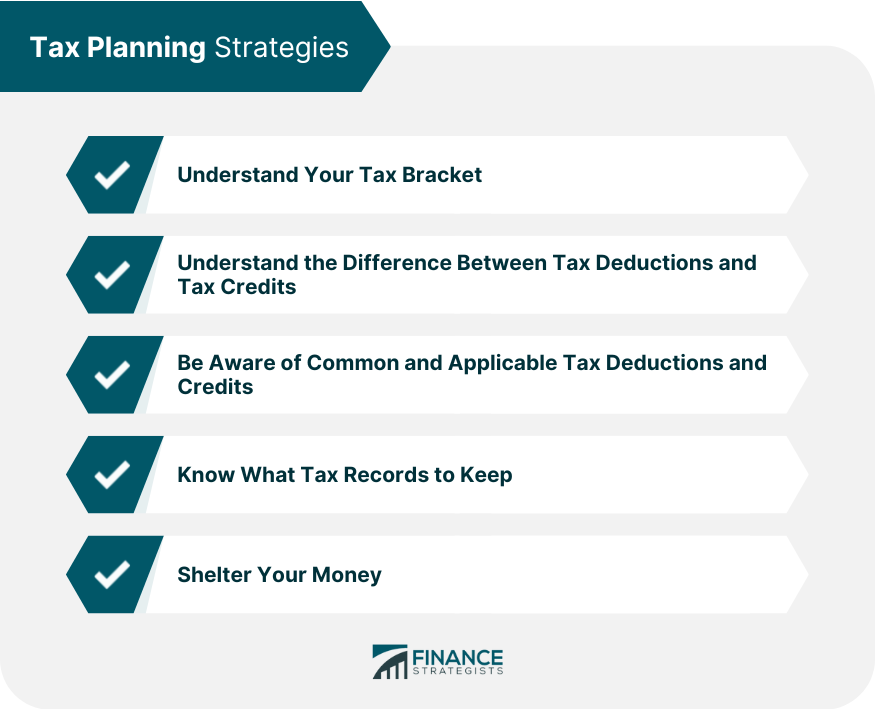

Mastering the 5 Key Strategies for Powerful Tax Planning

The tax system, with its labyrinthine rules and regulations, can feel like an impenetrable fortress. But understanding the fundamentals of tax planning can be the key to unlocking significant financial benefits. This article will guide you through five powerful strategies that can empower you to navigate the tax landscape with confidence, minimizing your tax burden and maximizing your financial well-being.

1. Understanding Your Tax Bracket: The Foundation of Effective Planning

Tax planning starts with a solid understanding of your current tax bracket. Your tax bracket, determined by your taxable income, dictates the percentage of taxes you pay on each additional dollar earned. Knowing your bracket allows you to make informed decisions about your income and expenses, potentially reducing your overall tax liability.

- Example: Let’s say you earn $70,000 annually and fall within the 22% tax bracket. If you receive a $5,000 bonus, you’ll pay 22% of that bonus in taxes. However, if you can strategically defer that bonus income to the following year, you might be able to avoid paying taxes at the 22% rate if your overall income for that year falls into a lower tax bracket.

2. Harnessing Deductions and Credits: Your Tax-Saving Arsenal

Deductions and credits are powerful tools in your tax planning arsenal. Deductions reduce your taxable income, while credits directly reduce the amount of taxes you owe. Understanding the various deductions and credits available to you can significantly decrease your tax bill.

Common Deductions:

Common Deductions:

-

- Standard deduction: This fixed amount is a simpler alternative to itemizing deductions.

- Itemized deductions: This option allows you to deduct specific expenses, such as medical expenses, mortgage interest, and charitable donations, exceeding a certain threshold.

- Homeownership deductions: This category includes deductions for mortgage interest, property taxes, and real estate taxes.

- Business expenses: If you are self-employed or run a small business, you can deduct expenses directly related to your business operations.

-

- Common Credits:

- Child Tax Credit: This credit provides a tax break for families with children.

- Earned Income Tax Credit: This credit benefits low- and moderate-income working individuals and families.

- American Opportunity Tax Credit: This credit provides financial assistance for qualified college expenses.

- Retirement Savings Contributions Credit: This credit offers tax breaks for individuals who contribute to retirement accounts.

3. Retirement Planning: A Tax-Advantaged Path to Financial Security

Retirement planning is an integral part of long-term tax planning. By utilizing tax-advantaged retirement accounts, you can significantly reduce your current tax liability and build a substantial nest egg for the future.

- Traditional IRA: Contributions to a traditional IRA are tax-deductible, meaning you reduce your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions to a Roth IRA are not tax-deductible, but withdrawals in retirement are tax-free. This makes Roth IRAs particularly beneficial for individuals who anticipate being in a higher tax bracket in retirement.

- 401(k) and 403(b) Plans: These employer-sponsored retirement plans offer tax advantages similar to traditional IRAs.

4. Investing Strategically: Minimizing Capital Gains Taxes

Capital gains taxes apply to profits earned from selling investments like stocks, bonds, and real estate. Understanding how these taxes work can help you optimize your investment strategies.

- Long-term vs. Short-term Capital Gains: Capital gains held for more than one year are taxed at a lower rate than those held for less than a year.

- Tax-Loss Harvesting: This strategy involves selling losing investments to offset capital gains, reducing your overall tax liability.

- Capital Gains Exclusion: There are specific exemptions that allow you to exclude certain capital gains from taxation, such as those from the sale of your primary residence.

5. Estate Planning: Ensuring a Secure Legacy

Estate planning involves preparing for the distribution of your assets after your death. Proper estate planning can minimize estate taxes and ensure your assets are distributed according to your wishes.

- Will and Trust: These legal documents outline how your assets will be distributed after your passing.

- Gifting: You can reduce your taxable estate by gifting assets to beneficiaries during your lifetime.

- Estate Tax Planning: Understanding the estate tax rules and exemptions is crucial for minimizing your tax liability.

Beyond the Basics: Expert Guidance for Complex Situations

While this article provides a foundational understanding of tax planning, complex situations may require professional advice. Consulting a qualified tax advisor can help you:

- Develop a personalized tax plan: A tax advisor can tailor a plan to your specific circumstances, taking into account your income, expenses, and financial goals.

- Identify all available deductions and credits: A tax advisor can help you maximize your tax savings by ensuring you claim all eligible deductions and credits.

- Optimize your investment strategies: A tax advisor can help you make investment decisions that minimize your tax liability.

- Navigate estate planning complexities: A tax advisor can guide you through the intricacies of estate planning, ensuring your assets are distributed according to your wishes.

Tax Planning: An Ongoing Journey

Tax planning is not a one-time event; it’s an ongoing process that should be revisited regularly. As your financial situation evolves, so too should your tax planning strategies. By staying informed and proactively managing your tax affairs, you can ensure that you are taking full advantage of available tax benefits and maximizing your financial well-being.

Key Takeaways:

- Understanding your tax bracket is essential for making informed financial decisions.

- Deductions and credits can significantly reduce your tax liability.

- Retirement planning offers tax advantages that can enhance your financial security.

- Strategic investing can minimize capital gains taxes.

- Estate planning ensures your assets are distributed according to your wishes.

- Seeking professional advice can help you navigate complex tax situations.

By embracing these powerful tax planning strategies, you can navigate the complex tax landscape with confidence, maximizing your financial well-being and securing your future.

Closure

Thus, we hope this article has provided valuable insights into Mastering the 5 Key Strategies for Powerful Tax Planning. We thank you for taking the time to read this article. See you in our next article!

google.com