Unlocking Financial Freedom: 7 Powerful Strategies for a Thriving Future

Related Articles: Unlocking Financial Freedom: 7 Powerful Strategies for a Thriving Future

- The Crucial Role Of Financial Advisors: 5 Ways They Can Transform Your Financial Future

- Unlocking Your Financial Freedom: 5 Powerful Strategies To Maximize Your 401(k)

- Unbreakable: 5 Steps To Craft A Powerful Financial Plan For Your Business

- Mastering The Unexpected: 5 Powerful Strategies For Conquering Financial Surprises

- 7 Genius Hacks To Crush Your Travel Budget And Experience The World On A Dime

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking Financial Freedom: 7 Powerful Strategies for a Thriving Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking Financial Freedom: 7 Powerful Strategies for a Thriving Future

Financial literacy is a crucial skill, yet it’s often overlooked in our education system. We’re taught how to read, write, and solve equations, but rarely equipped with the knowledge to manage our money effectively. This can lead to a lifetime of financial struggles, from accumulating debt to missing out on potential wealth-building opportunities.

The good news is that financial literacy is not a predetermined path. It’s a skill you can learn and cultivate, just like any other. By investing in your financial education, you unlock the potential for a brighter, more secure future.

This article outlines seven powerful strategies to empower you on your financial journey:

1. Embrace the Power of Free Resources:

The internet has revolutionized access to information, and financial literacy is no exception. Countless free resources are available at your fingertips, providing a wealth of knowledge to jumpstart your journey.

-

- Websites: Websites like Investopedia, NerdWallet, and The Balance offer comprehensive articles, guides, and tools covering everything from budgeting to investing.

- Blogs: Financial bloggers often share their personal experiences, insights, and practical advice on various financial topics.

- YouTube Channels: YouTube is a treasure trove of financial education content, with channels like The Financial Diet, Ramit Sethi, and Financial Samurai offering engaging videos on topics like saving, investing, and debt management.

- Podcasts: Financial podcasts, such as “Planet Money” and “The Tim Ferriss Show,” offer insightful interviews with experts and practical tips for navigating the financial world.

2. Dive into Books and E-books:

Books have long been a cornerstone of education, and financial literacy is no exception. There are countless books written by renowned financial experts, offering detailed guidance on various aspects of personal finance.

-

- Investing: “The Intelligent Investor” by Benjamin Graham, “The Little Book of Common Sense Investing” by John C. Bogle, and “The Psychology of Money” by Morgan Housel offer timeless wisdom on investing principles.

- Budgeting and Saving: “The Total Money Makeover” by Dave Ramsey, “Your Money or Your Life” by Vicki Robin and Joe Dominguez, and “Rich Dad Poor Dad” by Robert Kiyosaki provide practical strategies for managing your money effectively.

- Debt Management: “The Automatic Millionaire” by David Bach, “Broke Millennial Takes on Investing” by Erin Lowry, and “The Total Money Makeover” by Dave Ramsey offer insights on tackling debt and building wealth.

3. Enroll in Online Courses:

Online courses offer a structured and interactive learning experience, providing in-depth knowledge on specific financial topics. Platforms like Coursera, edX, and Udemy host a wide range of courses taught by industry experts.

- Investing: “Financial Markets” by Yale University on Coursera, “Introduction to Finance” by Wharton School of the University of Pennsylvania on Coursera, and “Investing: From Zero to Hero” by Udemy offer comprehensive insights into the world of investing.

- Budgeting and Saving: “Personal Finance Essentials” by edX, “Financial Literacy for Beginners” by Udemy, and “Building Wealth Through Budgeting” by Coursera provide practical strategies for managing your finances effectively.

- Debt Management: “Debt Management and Credit Repair” by Udemy, “Managing Personal Debt” by Coursera, and “Financial Planning for Debt Reduction” by edX offer strategies for tackling debt and building a solid financial foundation.

4. Attend Financial Workshops and Seminars:

Attending financial workshops and seminars provides an opportunity to learn from experts, network with like-minded individuals, and gain practical knowledge through interactive sessions.

- Local Community Centers: Many community centers offer free or low-cost workshops on budgeting, investing, and other financial topics.

- Financial Institutions: Banks and credit unions often host seminars on financial planning, retirement planning, and other relevant topics.

- Professional Organizations: Organizations like the National Endowment for Financial Education (NEFE) and the Financial Planning Association (FPA) offer workshops and seminars led by certified financial professionals.

5. Seek Guidance from a Financial Advisor:

For complex financial situations or when you need personalized advice, a financial advisor can be a valuable resource. They can provide expert guidance on investing, retirement planning, and other financial goals.

- Certified Financial Planners (CFPs): CFPs are required to adhere to a strict code of ethics and have extensive knowledge in financial planning.

- Registered Investment Advisors (RIAs): RIAs are fiduciaries, meaning they are legally obligated to act in your best interest.

- Fee-Only Advisors: Fee-only advisors charge a flat fee for their services, eliminating potential conflicts of interest associated with commission-based advisors.

6. Leverage the Power of Peer Learning:

Learning from others who have already embarked on their financial journey can be incredibly valuable.

- Online Communities: Join online forums and social media groups dedicated to personal finance, where you can connect with other individuals, share experiences, and learn from their insights.

- Financial Literacy Groups: Many communities offer financial literacy groups where individuals can gather to discuss financial topics, share strategies, and support each other’s progress.

- Mentorship Programs: Seek out mentorship programs that connect individuals with experienced financial professionals who can provide guidance and support.

7. Embrace Continuous Learning:

Financial education is an ongoing journey. The financial landscape is constantly evolving, so it’s essential to stay updated on the latest trends and information.

- Subscribe to Financial Newsletters: Subscribe to newsletters from reputable financial institutions, organizations, and experts to receive regular updates on financial news, market trends, and investment strategies.

- Follow Financial Experts on Social Media: Follow financial experts on platforms like Twitter and LinkedIn to stay informed about current events, market analysis, and investment opportunities.

- Attend Financial Conferences and Events: Attending financial conferences and events allows you to hear from industry leaders, gain insights into emerging trends, and network with other professionals.

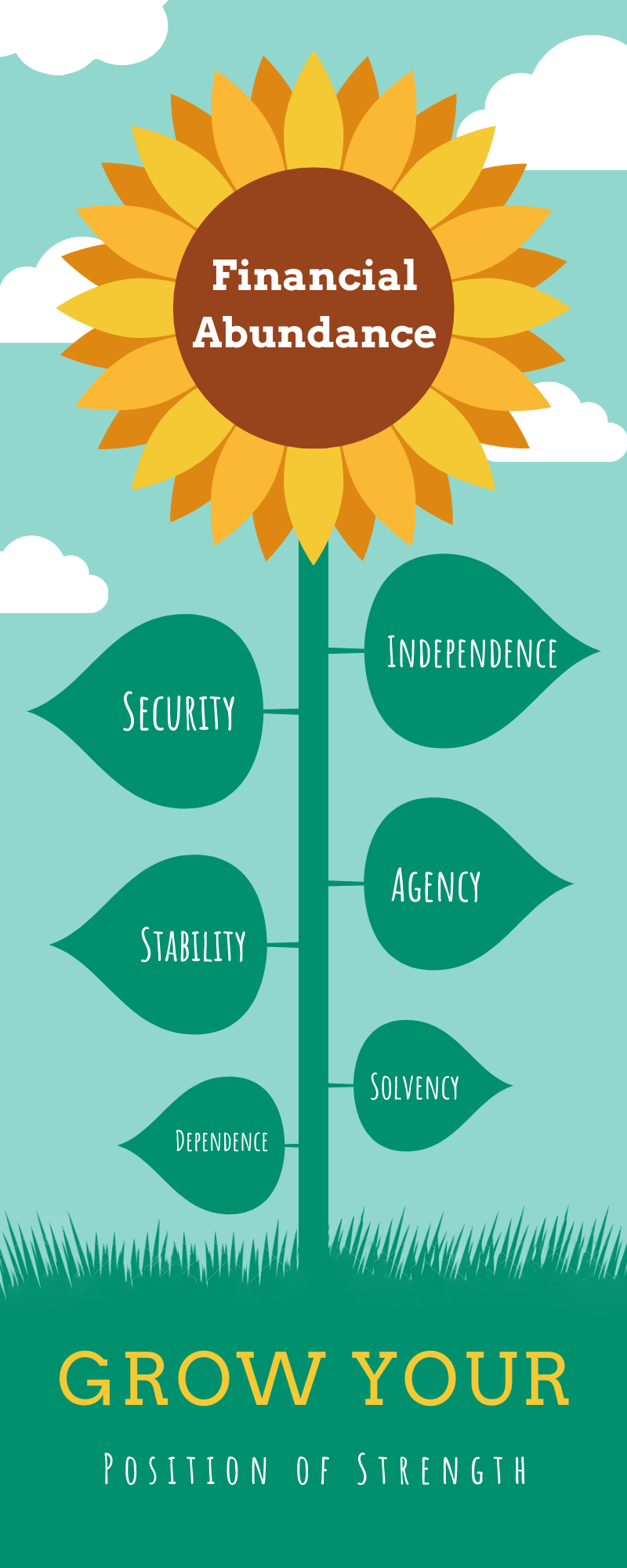

The Power of Financial Literacy: A Path to a Secure Future

Investing in your financial education is not just about acquiring knowledge; it’s about empowering yourself to make informed decisions about your money. By embracing the strategies outlined above, you can cultivate financial literacy and unlock the potential for a brighter, more secure future.

- Financial literacy empowers you to make informed decisions: From budgeting to investing, financial knowledge helps you make informed choices that align with your financial goals.

- Financial literacy helps you avoid financial pitfalls: Understanding financial concepts like debt, interest rates, and investment risks can help you avoid costly mistakes.

- Financial literacy builds confidence and control: Having a firm grasp of your finances empowers you to take control of your financial future and achieve your goals.

- Financial literacy opens doors to opportunities: By understanding financial concepts, you can access opportunities for wealth building, investing, and securing your future.

Conclusion:

Investing in your financial education is an investment in yourself. It’s a journey of continuous learning, but the rewards are immeasurable. By embracing the strategies outlined above, you can embark on a path towards financial freedom, security, and a brighter future. Remember, financial literacy is not just about managing your money; it’s about empowering yourself to live a life on your own terms.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Financial Freedom: 7 Powerful Strategies for a Thriving Future. We hope you find this article informative and beneficial. See you in our next article!

google.com