5 Powerful Steps to Craft a Resilient Financial Plan for a Sustainable Future

Related Articles: 5 Powerful Steps to Craft a Resilient Financial Plan for a Sustainable Future

- The Crucial 5-Step Financial Plan For Couples: Unlocking Your Shared Dreams

- 5 Powerful Strategies To Crush Your Major Life Event Savings Goals

- Unleashing The Power Of 5: The Crucial Importance Of Financial Discipline

- Unlocking Financial Freedom: 7 Steps To Building A Powerful Diversified Investment Portfolio

- Mastering The Unexpected: 5 Powerful Strategies For Conquering Financial Surprises

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Steps to Craft a Resilient Financial Plan for a Sustainable Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Steps to Craft a Resilient Financial Plan for a Sustainable Future

In an era marked by economic uncertainty, climate change, and the ever-present shadow of global crises, creating a financial plan that can withstand the storms of life is more crucial than ever. Gone are the days of simply investing in the stock market and hoping for the best. Today, true financial security demands a resilient approach, one that considers not just short-term gains but also long-term sustainability and the well-being of our planet.

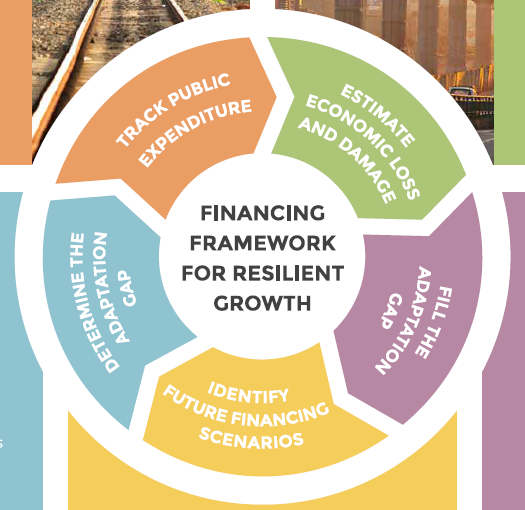

This article will delve into the five essential pillars of crafting a resilient financial plan that empowers you to navigate the complexities of the modern world with confidence and peace of mind.

1. Define Your Values and Goals: The Compass of Your Financial Journey

At the heart of any successful financial plan lies a clear understanding of your values and goals. What truly matters to you? What do you aspire to achieve, both personally and financially? This foundational step is often overlooked but is absolutely crucial for staying on track and making informed decisions.

a) Personal Values:

-

- Sustainability: Do you prioritize environmental responsibility and ethical investments?

- Family: Do you prioritize financial security for your family, ensuring their future well-being?

- Community: Are you passionate about making a positive impact on your community through philanthropy or social enterprises?

- Freedom: Do you value financial independence and the freedom to pursue your passions?

- Health and Well-being: Do you prioritize your physical and mental health, and are you willing to invest in preventative measures?

b) Financial Goals:

-

- Short-term: These goals are achievable within a year or two, such as paying off debt, saving for a vacation, or building an emergency fund.

- Mid-term: These goals typically span 3-5 years and may include purchasing a home, funding a child’s education, or starting a business.

- Long-term: These goals are often ambitious and extend beyond 5 years, such as retiring comfortably, leaving a legacy, or achieving financial independence.

2. Assess Your Current Financial Situation: A Clear Picture of Your Starting Point

Once you have a grasp of your values and goals, it’s time to take stock of your current financial situation. This involves a comprehensive analysis of your income, expenses, assets, and liabilities.

a) Income:

- Regular Income: This includes your salary, wages, and any other consistent sources of income.

- Variable Income: This encompasses income that fluctuates, such as bonuses, commissions, or freelance work.

- Passive Income: This refers to income generated from investments or other sources without active involvement.

b) Expenses:

- Fixed Expenses: These are recurring costs that remain relatively stable, such as rent, mortgage payments, and utilities.

- Variable Expenses: These are expenses that fluctuate depending on your usage, such as groceries, entertainment, and travel.

- Discretionary Expenses: These are non-essential expenses that you can choose to cut back on, such as eating out, subscriptions, and hobbies.

c) Assets:

- Liquid Assets: These are assets that can be easily converted into cash, such as savings accounts, checking accounts, and marketable securities.

- Non-Liquid Assets: These assets are less easily converted into cash, such as real estate, vehicles, and collectibles.

d) Liabilities:

- Debt: This includes any outstanding loans, credit card balances, and other financial obligations.

- Other Liabilities: This may include unpaid bills, taxes, or other financial commitments.

3. Develop a Budget: The Foundation for Financial Control

A budget is the cornerstone of a resilient financial plan, allowing you to track your income and expenses, identify areas for improvement, and allocate your resources effectively.

a) Zero-Based Budgeting: This method involves starting from scratch each month, allocating every dollar to a specific category. It promotes mindful spending and helps you prioritize your financial goals.

b) 50/30/20 Rule: This popular budgeting method allocates 50% of your income to needs (housing, utilities, transportation), 30% to wants (entertainment, dining out, travel), and 20% to savings and debt repayment.

c) Cash Envelope System: This method involves allocating cash to specific categories, such as groceries, entertainment, or personal care. It helps you stay accountable for your spending and avoid overspending.

4. Invest Wisely: Building Wealth for a Sustainable Future

Investing is essential for growing your wealth and securing your financial future. However, in today’s volatile markets, it’s crucial to adopt a long-term, sustainable approach.

a) Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities, to mitigate risk.

b) Consider ESG Investing: ESG (Environmental, Social, and Governance) investing takes into account the ethical and sustainable impact of companies. By investing in companies that prioritize environmental responsibility, social justice, and good governance, you can align your investments with your values.

c) Invest in Your Future: Don’t forget to invest in yourself through education, skills development, and personal growth. These investments can enhance your earning potential and provide a strong foundation for long-term financial security.

5. Plan for Retirement: Securing Your Financial Independence

Retirement planning is often overlooked, but it’s essential for ensuring financial security in your later years.

a) Start Early: The sooner you begin saving for retirement, the more time your money has to grow. Even small contributions can make a significant difference over the long term.

b) Maximize Your Retirement Contributions: Take advantage of employer-sponsored retirement plans, such as 401(k)s and 403(b)s, and maximize your contributions to receive the full employer match.

c) Consider a Roth IRA: This type of retirement account allows you to withdraw your contributions tax-free in retirement, making it an attractive option for those who expect to be in a higher tax bracket in retirement.

d) Plan for Healthcare Costs: Healthcare expenses can be significant in retirement. Factor in these costs when planning for your financial needs.

Building a Resilient Financial Plan: A Continuous Journey

Creating a resilient financial plan is an ongoing process. It’s not a one-time event but a journey that requires constant review, adaptation, and refinement. As your life circumstances change, so too will your financial needs.

Here are some tips for maintaining a resilient financial plan:

- Review your budget regularly: Make sure your budget aligns with your current income, expenses, and goals.

- Adjust your investment strategy: As your risk tolerance and financial goals evolve, you may need to adjust your investment portfolio.

- Stay informed about market trends: Keep abreast of economic and market conditions to make informed financial decisions.

- Seek professional guidance: A financial advisor can provide personalized advice and support to help you achieve your financial goals.

Conclusion: Embracing Resilience for a Sustainable Future

Creating a resilient financial plan is not just about accumulating wealth; it’s about building a foundation for a secure and sustainable future. By defining your values, assessing your current situation, developing a budget, investing wisely, and planning for retirement, you can empower yourself to navigate the complexities of the modern world with confidence and peace of mind. Remember, financial resilience is an ongoing journey, and by embracing a proactive approach, you can build a future that aligns with your values and aspirations.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Steps to Craft a Resilient Financial Plan for a Sustainable Future. We appreciate your attention to our article. See you in our next article!

google.com