Secure Your Future: 5 Powerful Steps to a Thriving Retirement

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Secure Your Future: 5 Powerful Steps to a Thriving Retirement. Let’s weave interesting information and offer fresh perspectives to the readers.

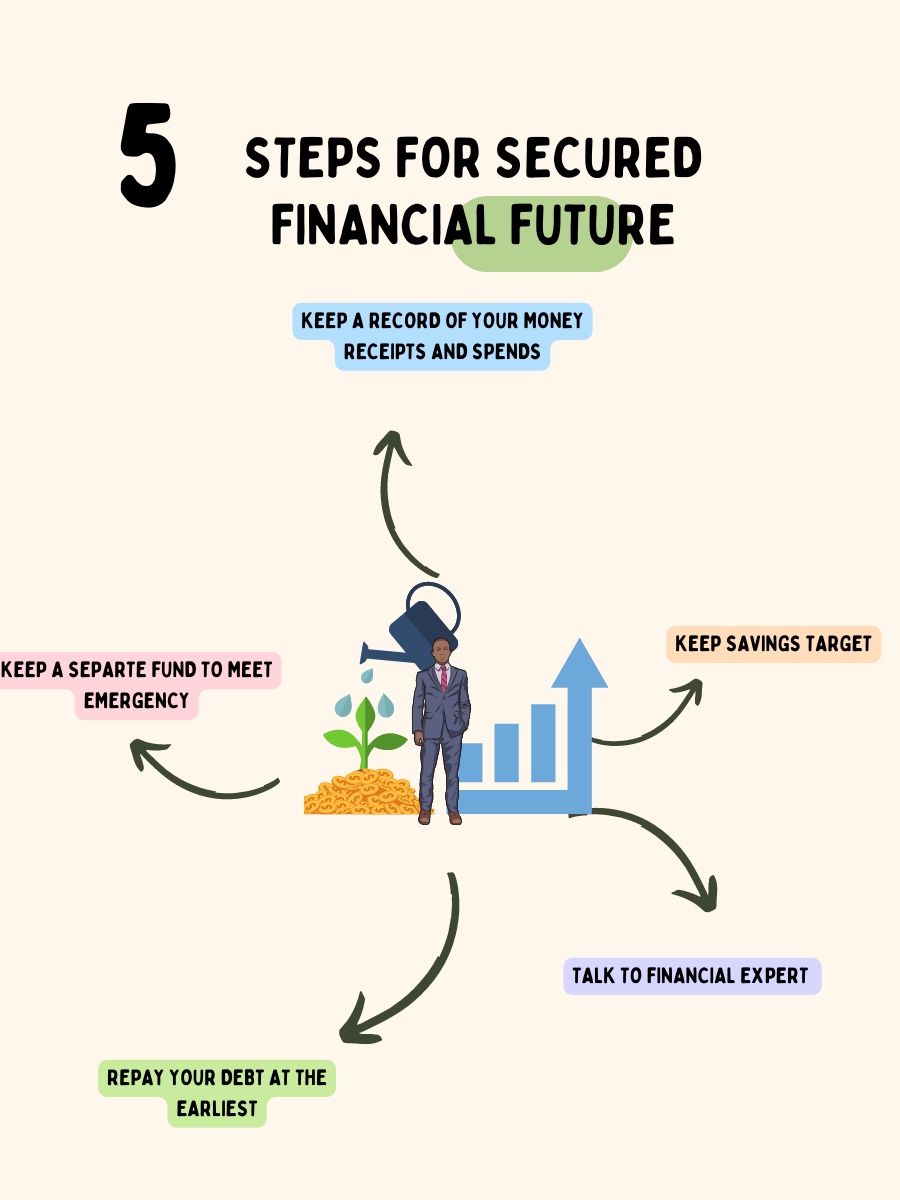

Secure Your Future: 5 Powerful Steps to a Thriving Retirement

Retirement. The word conjures up images of leisurely pursuits, travel adventures, and time spent with loved ones. However, the reality for many is far from idyllic. Financial insecurity can cast a long shadow over these golden years, turning dreams of relaxation into anxieties about making ends meet. This article outlines five powerful steps to help you plan for a secure and thriving retirement, ensuring you can enjoy the fruits of your labor without the constant worry of financial strain.

1. Assess Your Current Financial Situation: The Foundation of a Strong Plan

Before embarking on any retirement planning, you need a clear understanding of your current financial landscape. This involves a thorough assessment of your assets and liabilities. List all your assets, including:

- Retirement savings: This encompasses 401(k)s, IRAs (Traditional and Roth), pensions, and any other employer-sponsored retirement plans. Note the current balances and projected growth based on the plan’s investment strategy.

- Investments: Include stocks, bonds, mutual funds, real estate, and any other investments you hold. Determine their current market value.

- Savings accounts: List the balances in your checking, savings, and money market accounts.

- Other assets: This might include the value of your home, vehicles, or other valuable possessions.

Next, meticulously list your liabilities:

- Mortgages: Note the outstanding balance and monthly payments.

- Loans: Include student loans, auto loans, credit card debt, and any other outstanding loans.

- Other debts: This could encompass medical bills, taxes owed, or other outstanding debts.

Once you have a comprehensive list of your assets and liabilities, calculate your net worth (assets minus liabilities). This figure provides a crucial baseline for your retirement planning. Consider using budgeting software or spreadsheets to organize this information effectively. If you find this process overwhelming, consider consulting a financial advisor who can guide you through this critical first step.

2. Determine Your Retirement Needs and Lifestyle: Imagining Your Future Self

This step involves projecting your future expenses and determining the lifestyle you envision for retirement. Consider the following factors:

- Housing: Will you continue living in your current home, downsize, or relocate? Factor in mortgage payments, property taxes, insurance, and potential maintenance costs.

- Healthcare: Healthcare expenses can be significant in retirement. Consider Medicare costs, supplemental insurance premiums, and potential out-of-pocket medical expenses. Research average healthcare costs for your age group and location.

- Travel and leisure: Do you plan to travel extensively, pursue hobbies, or engage in other leisure activities? Estimate the costs associated with these activities.

- Everyday expenses: Consider your daily expenses, such as groceries, utilities, transportation, and entertainment. These costs may fluctuate, so it’s wise to account for inflation.

- Unexpected expenses: Life throws curveballs. Build a buffer into your retirement plan to account for unexpected expenses, such as home repairs, medical emergencies, or family support.

To determine your retirement income needs, you can use online retirement calculators or consult a financial advisor. These tools can help you estimate the amount of money you’ll need to maintain your desired lifestyle in retirement. Remember to adjust your calculations for inflation, as the cost of living will likely increase over time.

3. Develop a Savings and Investment Strategy: Building Your Retirement Nest Egg

Once you understand your retirement needs, you can develop a savings and investment strategy to reach your goals. This involves:

- Maximize contributions to retirement accounts: Contribute the maximum amount allowed to your 401(k) and IRA accounts. Take advantage of employer matching contributions in your 401(k) plan, as this is essentially free money.

- Diversify your investments: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk. Consider your risk tolerance and time horizon when choosing investments.

- Invest early and often: The power of compounding is crucial for long-term growth. Start saving early and contribute regularly to your retirement accounts. Even small contributions can make a significant difference over time.

- Consider a Roth IRA: A Roth IRA offers tax-free withdrawals in retirement, which can be advantageous for those expecting to be in a higher tax bracket in retirement.

- Rebalance your portfolio: Regularly review and rebalance your investment portfolio to maintain your desired asset allocation. This helps ensure you’re not overly exposed to any single asset class.

4. Plan for Healthcare Costs: A Significant Retirement Expense

Healthcare costs are a significant and often underestimated expense in retirement. Medicare covers some healthcare costs, but it doesn’t cover everything. Consider supplemental insurance, such as Medigap or Medicare Advantage plans, to help cover the gaps in Medicare coverage. Also, explore long-term care insurance to protect yourself against the potentially high costs of nursing home care. Research the various options available and choose the plan that best suits your needs and budget. Understanding the complexities of Medicare and supplemental insurance is crucial for a secure retirement.

5. Seek Professional Advice: Navigating the Complexities of Retirement Planning

Retirement planning can be complex, and seeking professional advice can be invaluable. A financial advisor can help you develop a personalized retirement plan, manage your investments, and navigate the complexities of taxes and estate planning. They can also provide guidance on Social Security benefits and other retirement income sources. While professional advice comes at a cost, the benefits of having a well-structured plan can significantly outweigh the expense. Consider scheduling a consultation with a qualified financial advisor to discuss your individual needs and circumstances.

Conclusion:

Securing a thriving retirement requires careful planning and proactive steps. By assessing your financial situation, determining your retirement needs, developing a sound savings and investment strategy, planning for healthcare costs, and seeking professional advice, you can significantly increase your chances of enjoying a comfortable and fulfilling retirement. Don’t delay – start planning today to secure your future and enjoy the retirement you deserve.

Closure

Thus, we hope this article has provided valuable insights into Secure Your Future: 5 Powerful Steps to a Thriving Retirement. We hope you find this article informative and beneficial. See you in our next article!

google.com