5 Powerful Strategies for Dominating the Dividend Stock Market

Related Articles: 5 Powerful Strategies for Dominating the Dividend Stock Market

- I have earned my highest income on teachers pay teachers after 6 months

- Conquer Financial Chaos: 5 Powerful Strategies To Track Your Spending Like A Pro

- Conquer The Stock Market: 5 Powerful Strategies For Success

- Unbreakable: 5 Reasons Why A Strong Financial Safety Net Is Your Ultimate Power Move

- The Essential 5-Point Framework For Unleashing Financial Accountability

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Powerful Strategies for Dominating the Dividend Stock Market. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Strategies for Dominating the Dividend Stock Market

Dividend stocks are a popular investment choice for many reasons. They offer the potential for both capital appreciation and regular income, making them attractive to both growth-oriented and income-seeking investors. While the concept of investing in dividend stocks might seem simple, navigating this market effectively requires a strategic approach. This article will delve into 5 powerful strategies that can help you dominate the dividend stock market and achieve your financial goals.

Understanding the Basics of Dividend Stocks

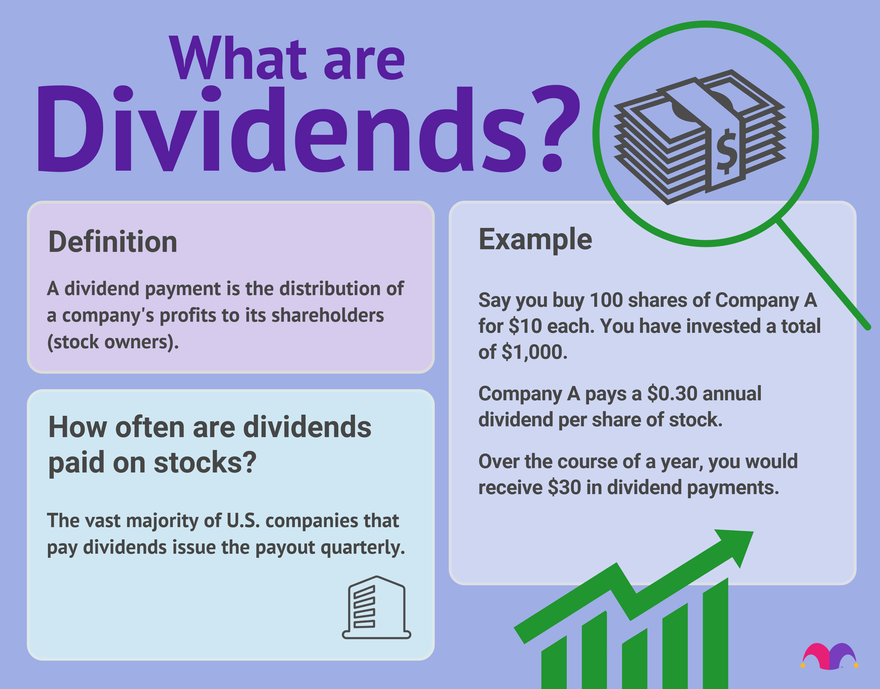

Before diving into strategies, it’s crucial to understand the fundamentals of dividend stocks. Essentially, these are stocks issued by companies that distribute a portion of their profits to shareholders in the form of regular cash payments. These payments, known as dividends, are typically paid quarterly or annually, providing investors with a steady stream of income.

Why Invest in Dividend Stocks?

The appeal of dividend stocks lies in their dual nature. They offer:

- Income Generation: Dividends provide a regular source of income, which can be particularly beneficial for retirees or those seeking to supplement their income.

- Potential for Capital Appreciation: Like any stock, dividend stocks can appreciate in value over time, offering the potential for capital gains.

5 Powerful Strategies for Dominating the Dividend Stock Market

1. Focus on Quality and Sustainability:

The first step to success in the dividend stock market is to prioritize quality over quantity. Instead of chasing high dividend yields, focus on companies with a proven track record of profitability, strong financial health, and a history of consistently paying dividends. Look for companies with:

-

- Stable Earnings: Choose companies with consistent earnings growth, indicating their ability to generate profits and sustain dividend payments.

- Low Debt Levels: A low debt-to-equity ratio signifies financial stability and the ability to weather economic downturns without jeopardizing dividend payouts.

- Strong Management: Seek companies with experienced and competent management teams who prioritize shareholder value and long-term growth.

- Sustainable Dividend Growth: Look for companies that have a history of increasing their dividend payments over time, signaling a commitment to rewarding shareholders.

2. Diversify Your Portfolio:

Diversification is crucial for mitigating risk in any investment portfolio. Don’t put all your eggs in one basket by investing in only a few dividend stocks. Instead, create a diversified portfolio that includes stocks from various sectors and industries. This helps reduce the impact of any single company’s performance on your overall portfolio returns.

3. Consider Dividend Growth Stocks:

While high-yield stocks can be tempting, focusing on dividend growth stocks can lead to greater long-term returns. These companies prioritize reinvesting profits into their business, leading to sustainable growth and potential for higher future dividend payments. Look for companies with:

- Strong Growth Prospects: Seek companies operating in industries with favorable growth potential, allowing them to expand their operations and increase dividends.

- A History of Dividend Increases: Companies that have consistently increased their dividends over time demonstrate a commitment to shareholder value and long-term growth.

- A Strong Financial Position: Ensure the company has a solid financial foundation to support future dividend increases and growth initiatives.

4. Utilize Dividend Reinvestment Plans (DRIPs):

Dividend reinvestment plans allow you to automatically reinvest your dividends into more shares of the same company. This strategy can be highly beneficial for long-term growth, as it allows you to compound your returns by buying more shares at a discounted price. DRIPs offer several advantages:

- Compounding Growth: Reinvesting dividends automatically allows you to buy more shares, accelerating your portfolio growth through compounding.

- Cost-Effective Investing: DRIPs often waive transaction fees, making it a cost-effective way to invest.

- Dollar-Cost Averaging: DRIPs help you average your investment cost over time, mitigating the impact of market fluctuations.

5. Don’t Neglect Valuation:

While focusing on quality and growth is important, it’s equally crucial to consider valuation when investing in dividend stocks. Ensure that the price you pay for a stock is justified by its fundamentals, including its earnings, dividend yield, and growth prospects. Several valuation metrics can be helpful:

- Dividend Yield: This metric compares the annual dividend payment to the stock price, providing an indication of the income generated from the investment.

- Payout Ratio: This ratio measures the percentage of earnings paid out as dividends. A sustainable payout ratio should be below 100%, indicating that the company has retained enough earnings to fund future growth.

- Price-to-Earnings (P/E) Ratio: This ratio compares the stock price to its earnings per share, providing a measure of how much investors are willing to pay for each dollar of earnings.

Important Considerations

While investing in dividend stocks can be a rewarding strategy, it’s essential to be aware of potential risks:

- Dividend Cuts: Companies can reduce or eliminate dividends due to financial difficulties or changing business conditions.

- Market Volatility: Like any stock, dividend stocks can experience price fluctuations due to market volatility.

- Tax Implications: Dividend income is generally subject to taxation, which can impact your overall returns.

Conclusion

Investing in dividend stocks can be a powerful strategy for achieving your financial goals, providing both income and potential for capital appreciation. By focusing on quality, diversifying your portfolio, considering dividend growth stocks, utilizing DRIPs, and paying attention to valuation, you can position yourself for success in the dividend stock market. Remember, thorough research, patience, and a long-term perspective are key to navigating this market effectively and achieving your investment objectives.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for Dominating the Dividend Stock Market. We thank you for taking the time to read this article. See you in our next article!

google.com