The Crucial Role of Financial Advisors: 5 Ways They Can Transform Your Financial Future

Related Articles: The Crucial Role of Financial Advisors: 5 Ways They Can Transform Your Financial Future

- 5 Strategic Steps To Conquer Unexpected Expenses And Achieve Financial Peace

- Unleashing The Power Of 1000: A Comprehensive Guide To Understanding Mutual Funds

- Worried about being abducted by aliens?

- Student loan forgiveness loans if federal affect credit will repay struggling qualify might re program who

- Unlock Your Financial Potential: 5 Powerful Strategies To Boost Your Credit Score

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Crucial Role of Financial Advisors: 5 Ways They Can Transform Your Financial Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Crucial Role of Financial Advisors: 5 Ways They Can Transform Your Financial Future

Navigating the complex world of finances can be daunting, even for the most financially savvy individuals. From investment strategies to retirement planning, the sheer volume of information and decisions can leave many feeling overwhelmed and uncertain. This is where financial advisors step in, offering expert guidance and support to help individuals achieve their financial goals. While some may view financial advisors as an unnecessary expense, their role is far more crucial than many realize.

1. Personalized Financial Planning:

A key advantage of working with a financial advisor is the ability to receive personalized financial planning tailored to your specific needs and circumstances. This goes beyond generic investment advice or cookie-cutter solutions. A good advisor will take the time to understand your financial goals, risk tolerance, time horizon, and overall financial situation. They will then develop a comprehensive financial plan that addresses your unique needs, whether it’s saving for retirement, buying a home, paying off debt, or planning for your children’s education.

2. Expert Investment Management:

Investing your money can be a risky endeavor, especially for those lacking the knowledge and experience to make informed decisions. Financial advisors possess the expertise and resources to navigate the complex world of investments. They can help you diversify your portfolio, choose appropriate asset classes, and manage risk effectively. By leveraging their market knowledge and research capabilities, advisors can help you maximize your returns while minimizing your potential losses.

3. Objective Advice:

One of the biggest challenges of managing your own finances is the emotional aspect. Market fluctuations and economic uncertainties can easily cloud your judgment, leading to impulsive decisions that may not be in your best interest. Financial advisors offer a much-needed objective perspective. They can help you separate emotions from logic, providing unbiased advice based on your financial goals and risk tolerance. This objectivity is crucial for making sound financial decisions, especially during turbulent market conditions.

4. Ongoing Support and Monitoring:

The relationship with a financial advisor isn’t a one-time transaction. It’s an ongoing partnership that involves regular check-ins, adjustments to your financial plan, and ongoing monitoring of your investments. As your life changes, so too will your financial needs. A good advisor will stay abreast of these changes and adjust your financial plan accordingly. They will also monitor your investments and make necessary adjustments based on market conditions, ensuring your portfolio stays aligned with your goals.

5. Peace of Mind and Confidence:

Perhaps the most valuable benefit of working with a financial advisor is the peace of mind and confidence it provides. Knowing that you have a trusted professional guiding you through the complexities of finance can alleviate a significant amount of stress. This newfound confidence can empower you to make informed financial decisions and focus on achieving your goals without the constant worry of managing your finances alone.

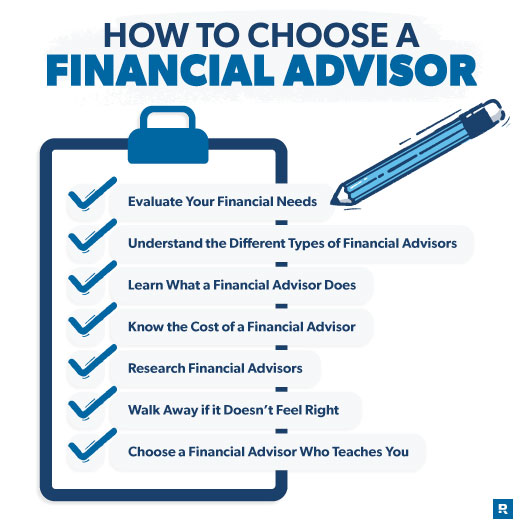

Choosing the Right Financial Advisor:

While the benefits of working with a financial advisor are undeniable, choosing the right one is crucial. Consider the following factors:

-

- Credentials and Experience: Look for a financial advisor with the appropriate credentials, such as a Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). Experience in the field is also important, as it indicates a track record of success and a deep understanding of financial markets.

- Fees and Compensation: Understand how the advisor is compensated. Some advisors charge a flat fee, while others work on a commission basis. Make sure you are comfortable with the fee structure and understand how it affects their advice.

- Investment Philosophy: Ensure the advisor’s investment philosophy aligns with your risk tolerance and goals. Do they focus on active or passive investing? What is their approach to portfolio diversification?

- Communication and Transparency: Choose an advisor who communicates clearly and transparently. They should be willing to explain their recommendations in detail and answer any questions you have.

Finding a Financial Advisor:

There are several ways to find a reputable financial advisor:

- Professional Organizations: The Financial Planning Association (FPA) and the Certified Financial Planner Board of Standards (CFP Board) are good resources for finding certified financial planners in your area.

- Referrals: Ask friends, family, or colleagues for recommendations.

- Online Resources: Websites like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) offer tools and resources to help you find financial advisors.

Conclusion:

Financial advisors play a crucial role in helping individuals achieve their financial goals. By providing personalized financial planning, expert investment management, objective advice, ongoing support, and peace of mind, advisors can transform your financial future. While choosing the right advisor is essential, the benefits of working with a trusted professional far outweigh the perceived costs. By taking the time to find the right advisor and establishing a strong partnership, you can confidently navigate the complex world of finance and achieve your financial aspirations.

Closure

Thus, we hope this article has provided valuable insights into The Crucial Role of Financial Advisors: 5 Ways They Can Transform Your Financial Future. We appreciate your attention to our article. See you in our next article!

google.com