The Ultimate Guide to 5 Key Differences Between Mutual Funds and ETFs: Which is Best for You?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Ultimate Guide to 5 Key Differences Between Mutual Funds and ETFs: Which is Best for You?. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to 5 Key Differences Between Mutual Funds and ETFs: Which is Best for You?

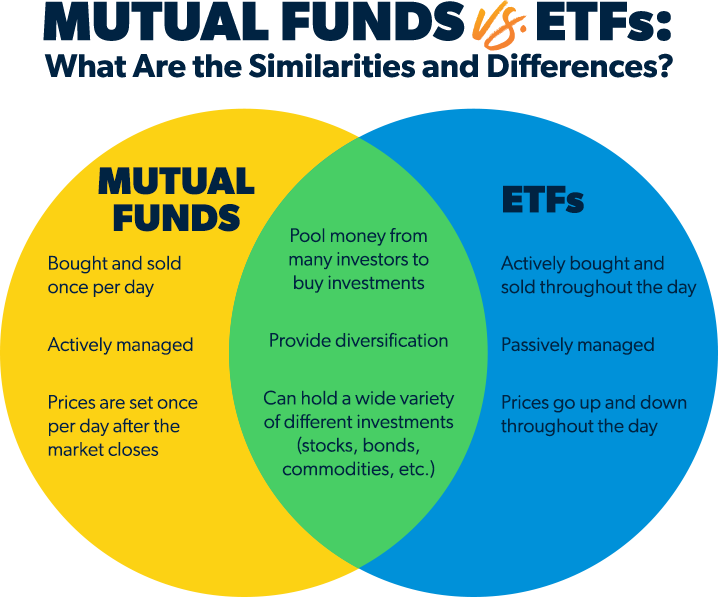

Investing can feel daunting, especially when faced with a plethora of options. Two popular choices, mutual funds and exchange-traded funds (ETFs), often leave investors scratching their heads. Both offer diversification and professional management, but they operate in distinct ways. This comprehensive guide will dissect the five key differences between these investment vehicles, empowering you to make the most informed decision for your portfolio.

1. Trading and Pricing:

- Mutual Funds: These are bought and sold directly from the fund company at the end of each trading day, based on the Net Asset Value (NAV) calculated at that time. This means you can only buy or sell shares after the market closes.

- ETFs: Traded on stock exchanges just like individual stocks, ETFs offer intraday trading throughout the market day. Their prices fluctuate continuously, reflecting supply and demand forces.

The Bottom Line: ETFs offer greater flexibility for active traders who want to capitalize on intraday price movements. For those who prefer a buy-and-hold approach, the difference in trading mechanics may not be a significant factor.

2. Expense Ratios:

- Mutual Funds: Typically have higher expense ratios, which are annual fees charged to cover management and operating costs. These fees are often expressed as a percentage of the fund’s assets.

- ETFs: Generally have lower expense ratios compared to mutual funds. This is primarily due to their passive investment strategy, which often involves tracking a specific index.

The Bottom Line: Lower expense ratios in ETFs translate to higher returns over the long term. However, it’s crucial to compare expense ratios across different funds and ETFs before making a decision.

3. Tax Efficiency:

- Mutual Funds: Can be less tax-efficient due to frequent trading activity, especially for actively managed funds. This can result in higher capital gains taxes for investors.

- ETFs: Generally more tax-efficient than mutual funds, especially those tracking indexes. Their passive nature minimizes trading activity, reducing the frequency of taxable events.

The Bottom Line: ETFs can be a better choice for long-term investors seeking to minimize tax liabilities. However, it’s essential to consider the specific tax implications of both mutual funds and ETFs based on your individual circumstances.

4. Minimum Investment:

- Mutual Funds: Often have higher minimum investment requirements, making them less accessible for smaller investors.

- ETFs: Typically have lower minimum investment requirements, allowing investors with limited capital to participate in the market.

The Bottom Line: ETFs provide a more accessible entry point for those with smaller investment amounts. However, it’s essential to note that minimum investment requirements can vary significantly across different funds and ETFs.

5. Transparency:

- Mutual Funds: Provide detailed information about their portfolio holdings in their prospectus, which is usually updated quarterly.

- ETFs: Offer greater transparency as their portfolio holdings are disclosed daily, providing investors with a more up-to-date view of their investments.

The Bottom Line: ETFs offer greater transparency for investors seeking real-time information about their holdings. However, both mutual funds and ETFs provide adequate information for investors to make informed decisions.

Choosing the Right Investment Vehicle:

The choice between mutual funds and ETFs ultimately depends on your individual investment goals, risk tolerance, and time horizon. Here’s a breakdown to help you decide:

Mutual Funds:

- Ideal for: Investors seeking professional management, diversification, and a hands-off approach.

- Suitable for: Long-term investors who prefer active management and are comfortable with higher expense ratios.

ETFs:

- Ideal for: Investors who value low costs, tax efficiency, and transparency.

- Suitable for: Active traders, investors with limited capital, and those seeking to track specific market indices.

Beyond the Basics:

While this guide has outlined the key differences between mutual funds and ETFs, it’s important to remember that these are just two components of a diverse investment portfolio. Other factors to consider include:

- Investment Objective: Define your investment goals, whether it’s growth, income, or preservation of capital.

- Risk Tolerance: Assess your comfort level with market fluctuations and volatility.

- Time Horizon: Determine how long you plan to invest, as long-term investments often benefit from a more passive approach.

- Financial Advisor: Consider seeking advice from a qualified financial advisor who can help you develop a personalized investment strategy tailored to your specific needs.

Conclusion:

The decision between mutual funds and ETFs is not a one-size-fits-all approach. Both offer unique advantages and disadvantages, making it crucial to carefully evaluate your investment objectives and risk tolerance. By understanding the key differences between these investment vehicles, you can make a well-informed choice that aligns with your financial goals and sets you on the path to achieving your investment aspirations. Remember, research is key. Explore the specific funds and ETFs available to you, compare their performance, and make an informed decision that aligns with your investment journey.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to 5 Key Differences Between Mutual Funds and ETFs: Which is Best for You?. We hope you find this article informative and beneficial. See you in our next article!

google.com