The Essential 5-Step Guide to Thriving Long-Term Financial Planning

Related Articles: The Essential 5-Step Guide to Thriving Long-Term Financial Planning

- The Unleashing Power Of 5 Crucial Financial Education Benefits

- Conquer Student Loan Debt: 5 Powerful Strategies For Financial Freedom

- Conquer The 5-Year Spending Trap: How To Avoid Lifestyle Inflation And Secure Your Financial Future

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

- Worried about being abducted by aliens?

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Essential 5-Step Guide to Thriving Long-Term Financial Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essential 5-Step Guide to Thriving Long-Term Financial Planning

The journey to financial freedom is often paved with good intentions, but without a clear roadmap, it can easily become a winding and uncertain path. Many of us dream of achieving financial security, retiring comfortably, or leaving a legacy for future generations, yet these aspirations often remain just that – dreams – without a well-defined plan. This is where the power of long-term financial planning comes in. It’s not just about saving money; it’s about taking control of your financial destiny and crafting a future that aligns with your goals and aspirations.

Why is Long-Term Financial Planning Crucial?

The importance of long-term financial planning cannot be overstated. It provides a framework for making informed financial decisions, ensuring you stay on track to achieve your goals, and safeguarding your future against unforeseen circumstances. Here’s a breakdown of its key benefits:

1. Clarity and Direction: Long-term financial planning helps you define your financial goals, both short-term and long-term. It provides a clear roadmap, outlining the steps you need to take to achieve these goals. Whether it’s buying a home, starting a business, funding your children’s education, or securing a comfortable retirement, having a plan gives you a sense of direction and purpose.

2. Financial Discipline and Control: A well-structured plan encourages financial discipline and control. It helps you prioritize spending, track expenses, and make conscious decisions about your money. This can lead to increased savings, reduced debt, and a more secure financial future.

3. Risk Management and Mitigation: Life is full of uncertainties. Unexpected events, such as job loss, illness, or market fluctuations, can significantly impact your financial stability. Long-term financial planning helps you identify and assess potential risks, developing strategies to mitigate their impact. This includes building an emergency fund, diversifying your investments, and securing appropriate insurance coverage.

4. Maximizing Returns and Minimizing Losses: Financial planning helps you make informed investment decisions based on your risk tolerance, time horizon, and financial goals. By understanding the potential returns and risks associated with different investment options, you can optimize your portfolio for long-term growth and minimize losses.

5. Peace of Mind and Stress Reduction: Knowing you have a plan in place for your financial future can provide immense peace of mind. It reduces stress and anxiety associated with financial uncertainties, allowing you to focus on other aspects of your life with confidence.

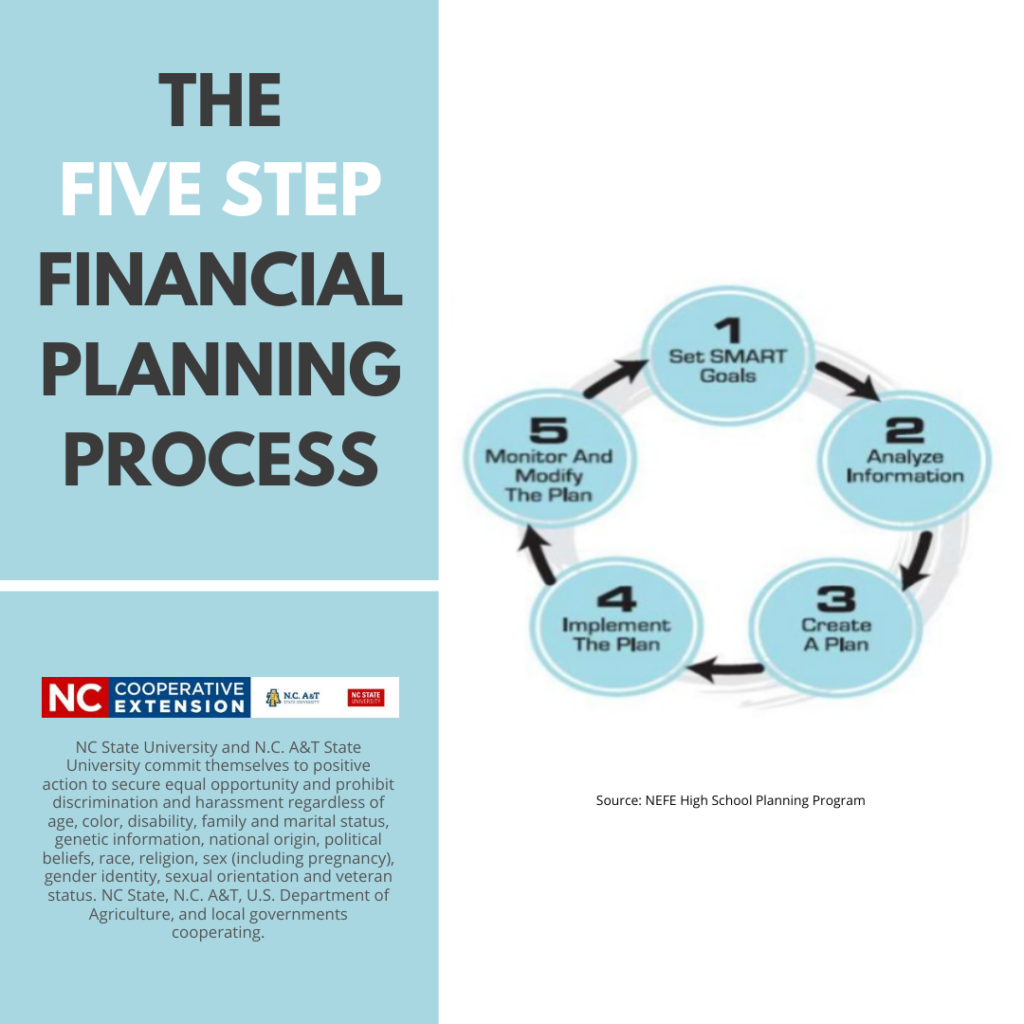

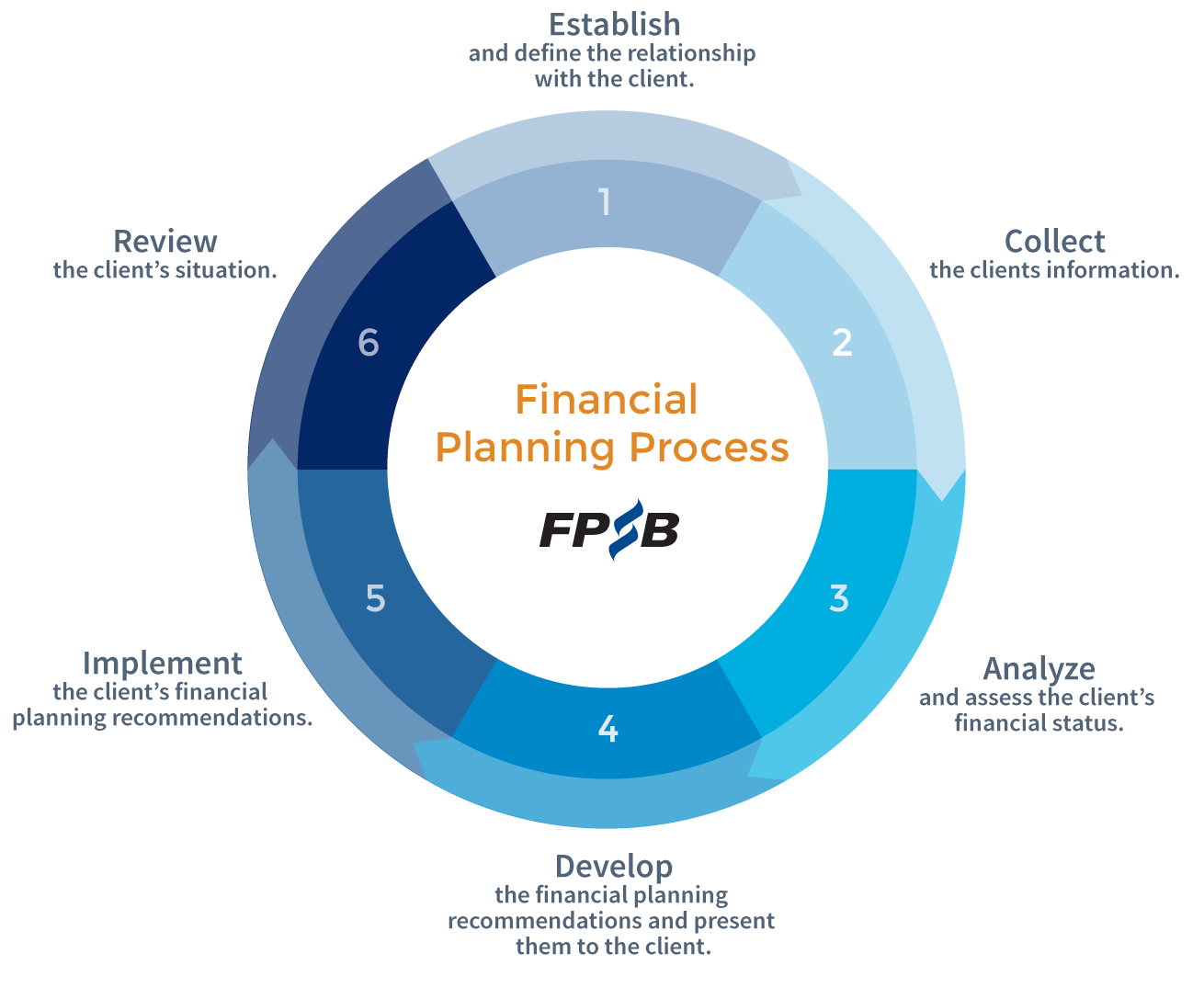

The 5 Essential Steps to Long-Term Financial Planning:

1. Define Your Goals and Values: The first step is to identify your financial goals, both short-term and long-term. This might include saving for a down payment on a house, funding your children’s education, starting a business, or ensuring a comfortable retirement. It’s also important to consider your values and priorities. What are your financial aspirations? What kind of lifestyle do you envision for yourself and your family?

2. Assess Your Current Financial Situation: Once you’ve defined your goals, it’s time to take stock of your current financial situation. This involves assessing your income, expenses, assets, and liabilities. Create a detailed budget to track your spending habits and identify areas where you can save money.

3. Develop a Spending Plan and Budget: A budget is a crucial tool for managing your money effectively. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds to reach your financial goals.

4. Create a Savings and Investment Strategy: Develop a savings and investment strategy that aligns with your goals and risk tolerance. This involves determining how much you need to save each month, choosing appropriate investment vehicles, and managing your portfolio effectively.

5. Regularly Review and Adjust: Financial planning is an ongoing process. It’s essential to regularly review your plan and make adjustments as your circumstances change. This includes reviewing your goals, assessing your progress, and making necessary adjustments to your budget, savings, and investment strategies.

Tips for Successful Long-Term Financial Planning:

- Seek Professional Advice: Don’t be afraid to seek professional guidance from a financial advisor. A qualified advisor can provide personalized advice, develop a tailored plan, and help you navigate complex financial matters.

Start Early: The earlier you start planning, the more time you have to compound your savings and reach your financial goals.

Start Early: The earlier you start planning, the more time you have to compound your savings and reach your financial goals.- Be Consistent: Consistency is key to financial success. Stick to your budget, save regularly, and make consistent investment contributions.

- Educate Yourself: Take the time to learn about financial concepts, investment strategies, and different financial products.

- Stay Informed: Keep up-to-date on market trends, economic conditions, and changes in tax laws that may impact your financial planning.

Conclusion:

Long-term financial planning is not a one-time event; it’s a continuous journey that requires commitment, discipline, and a willingness to adapt to changing circumstances. By taking the time to define your goals, assess your situation, create a plan, and review it regularly, you can set yourself on a path toward financial security and achieve your financial dreams. Remember, the power of long-term financial planning lies in its ability to provide clarity, control, and a sense of confidence in your financial future. Embrace the journey, and watch your financial well-being flourish.

Closure

Thus, we hope this article has provided valuable insights into The Essential 5-Step Guide to Thriving Long-Term Financial Planning. We hope you find this article informative and beneficial. See you in our next article!

google.com