5 Powerful Strategies for Transforming Your Financial Portfolio

Related Articles: 5 Powerful Strategies for Transforming Your Financial Portfolio

- The Crucial Importance Of Unveiling 5 Key Benefits Of Financial Transparency

- 5 Powerful Steps To Craft A Resilient Financial Plan For A Sustainable Future

- 5 Powerful Reasons Why Automatic Savings Plans Are A Game-Changer For Your Financial Future

- What is a preferred provider organization (ppo)?

- Finance financial company financials traditional training capital venture business approach modern management non stock funds blocks reasons properly deal money

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Powerful Strategies for Transforming Your Financial Portfolio. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Powerful Strategies for Transforming Your Financial Portfolio

In the ever-shifting landscape of finance, navigating the complexities of portfolio management can feel like an overwhelming task. The fear of missing out (FOMO) can lead to impulsive decisions, while uncertainty about market trends can foster a sense of paralysis. However, with a strategic approach and a clear understanding of your financial goals, you can transform your portfolio from a source of anxiety to a powerful engine for achieving your dreams. This article outlines five powerful strategies for managing your financial portfolio effectively, empowering you to take control of your financial future.

1. Define Your Financial Goals and Risk Tolerance

The foundation of any successful portfolio lies in a clear understanding of your financial goals and risk tolerance. Without this framework, your investment decisions will be driven by emotion rather than logic.

a. Defining Your Goals:

- Short-term goals: These goals are typically achieved within a year or two, such as saving for a down payment on a house, a vacation, or a new car.

- Mid-term goals: These goals might take several years to achieve, such as funding your child’s education or paying off debt.

- Long-term goals: These goals are typically achieved over a decade or more, such as securing a comfortable retirement or building generational wealth.

b. Assessing Your Risk Tolerance:

- Risk-averse investors: These investors prioritize safety and stability. They prefer low-risk investments like bonds and money market accounts.

- Moderate risk-takers: These investors are willing to accept some risk in exchange for potentially higher returns. They might invest in a mix of stocks, bonds, and real estate.

- Aggressive investors: These investors are comfortable with high risk in pursuit of significant returns. They might invest heavily in stocks, options, and other high-growth assets.

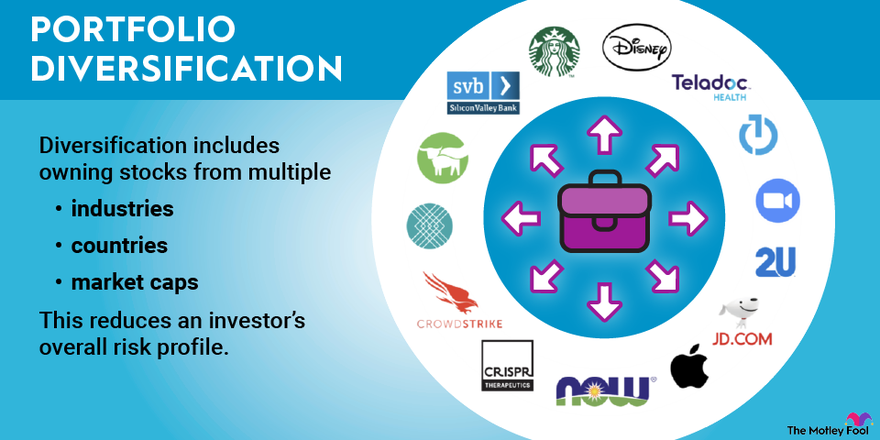

2. Diversify Your Portfolio

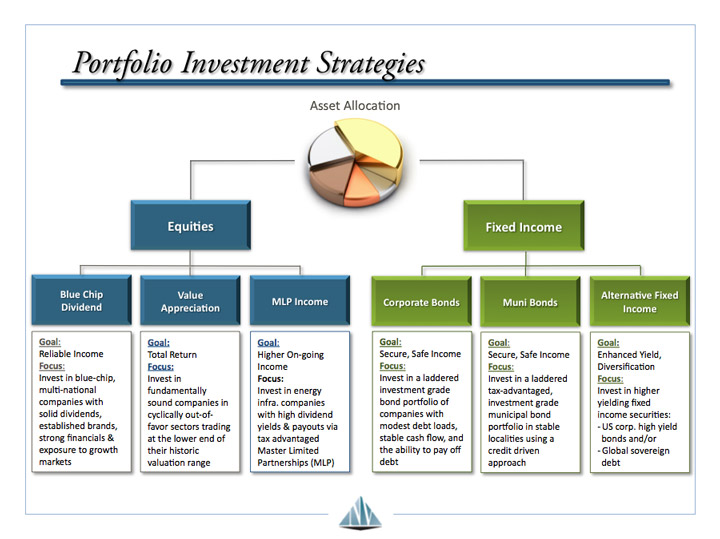

Diversification is a fundamental principle of investing that involves spreading your investments across different asset classes, industries, and geographic regions. By diversifying, you reduce your exposure to any single investment and minimize the impact of market fluctuations.

a. Asset Allocation:

-

- Stocks: Stocks represent ownership in companies and offer the potential for high returns over the long term. However, they also carry higher risk.

- Bonds: Bonds are debt securities that represent loans to governments or corporations. They offer lower returns than stocks but are generally considered less risky.

- Real estate: Real estate can provide income through rental properties or appreciation in value. However, it is illiquid and can be subject to market fluctuations.

- Commodities: Commodities are raw materials, such as gold, oil, and agricultural products. They can serve as a hedge against inflation.

- Alternative investments: These investments include hedge funds, private equity, and venture capital. They offer the potential for higher returns but also come with higher risk.

b. Rebalancing Your Portfolio:

As your investments grow and market conditions change, your asset allocation can become unbalanced. Rebalancing involves periodically adjusting your portfolio to maintain your desired asset allocation. This helps ensure that your portfolio remains aligned with your risk tolerance and financial goals.

3. Invest for the Long Term

The stock market is cyclical, meaning it experiences periods of growth and decline. Short-term market fluctuations can be unsettling, but it’s crucial to remember that investing is a long-term game. By staying focused on your long-term goals and avoiding emotional reactions to market volatility, you can ride out the ups and downs and reap the rewards of compounding.

a. Dollar-Cost Averaging:

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps to smooth out the impact of market fluctuations and reduces the risk of buying high and selling low.

b. Reinvesting Dividends and Capital Gains:

When your investments generate dividends or capital gains, reinvesting these earnings allows you to buy more shares and accelerate your wealth growth. This compounding effect is a powerful force for wealth creation over time.

4. Seek Professional Advice

While you can certainly manage your own portfolio, seeking professional advice from a qualified financial advisor can be invaluable. A financial advisor can help you develop a personalized financial plan, diversify your portfolio, and make informed investment decisions.

a. Choosing a Financial Advisor:

- Credentials: Look for advisors with the appropriate licenses and certifications, such as a Certified Financial Planner (CFP) or a Chartered Financial Analyst (CFA).

- Experience: Consider an advisor with experience in managing portfolios similar to yours.

- Fees: Understand the advisor’s fee structure and ensure it aligns with your budget.

b. Asking the Right Questions:

- What is your investment philosophy?

- What is your experience managing portfolios similar to mine?

- How do you handle conflicts of interest?

- What are your fees?

5. Stay Informed and Adaptable

The financial landscape is constantly evolving, so it’s essential to stay informed about market trends, economic conditions, and investment opportunities. This includes staying updated on news and research, attending financial seminars, and reading books and articles on investing.

a. Monitoring Your Portfolio:

- Regularly review your portfolio’s performance: Compare your returns to your benchmarks and make adjustments as needed.

- Stay abreast of market news: Be aware of economic indicators, geopolitical events, and industry trends that could impact your investments.

- Re-evaluate your risk tolerance and goals: As your life circumstances change, so too may your investment goals and risk appetite.

b. Embracing Adaptability:

- Be prepared to adjust your strategy: Market conditions can change rapidly, and it’s essential to be flexible and adaptable in your investment approach.

- Don’t be afraid to seek second opinions: If you’re unsure about a particular investment, seek advice from a trusted financial professional.

- Avoid emotional decision-making: Market fluctuations can be unsettling, but it’s crucial to make investment decisions based on logic and your long-term goals.

Conclusion:

Transforming your financial portfolio into a powerful engine for achieving your dreams requires a strategic approach, a clear understanding of your financial goals, and a commitment to continuous learning. By following these five powerful strategies, you can navigate the complexities of portfolio management with confidence and build a solid foundation for a secure financial future. Remember, investing is a marathon, not a sprint. Stay focused on your long-term goals, make informed decisions, and embrace the power of compounding to unlock your financial potential.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for Transforming Your Financial Portfolio. We thank you for taking the time to read this article. See you in our next article!

google.com