Unleash the Power of 5: Deciphering Financial Statements for Ultimate Financial Freedom

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleash the Power of 5: Deciphering Financial Statements for Ultimate Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash the Power of 5: Deciphering Financial Statements for Ultimate Financial Freedom

The world of finance can seem like a labyrinth of jargon and complex numbers, leaving many feeling overwhelmed and lost. But understanding financial statements, those crucial documents that reveal the financial health of a company, is a crucial step towards achieving financial literacy and making informed decisions about your investments, career, or even your own personal finances. This article will equip you with the essential knowledge to unleash the power of 5 key financial statements, empowering you to navigate the financial landscape with confidence.

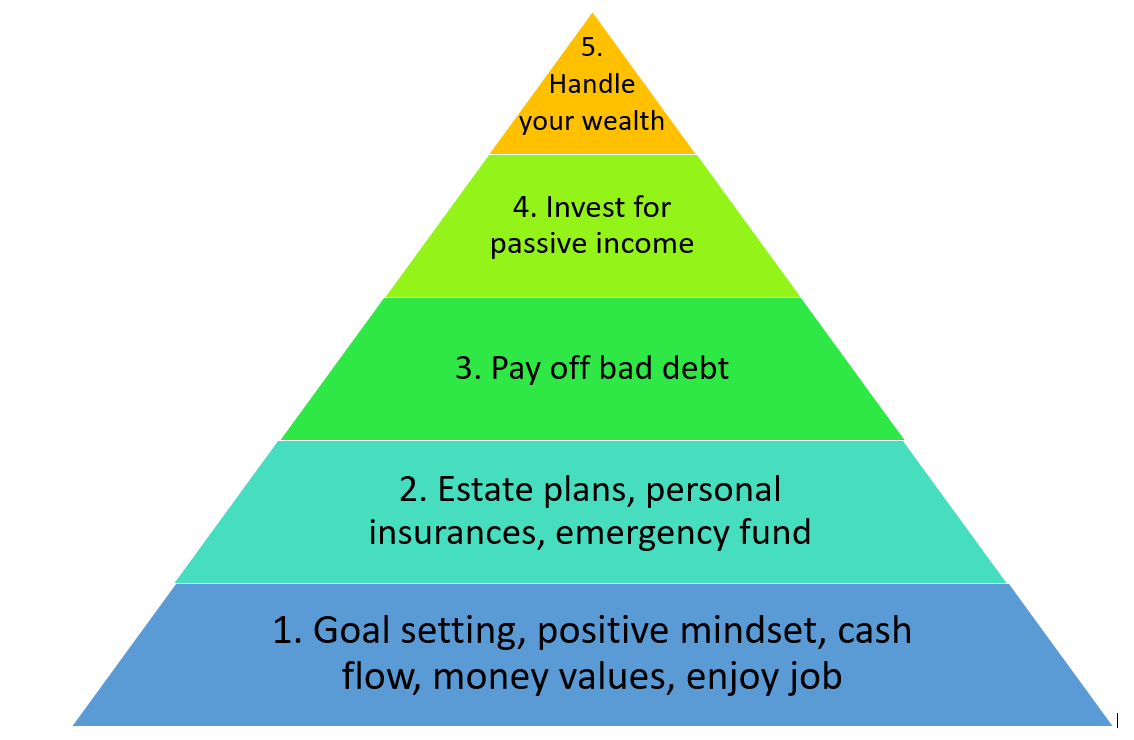

The Five Pillars of Financial Understanding

Imagine financial statements as the blueprints of a company’s financial journey. They reveal the company’s performance, its financial position, and its ability to generate cash flow, providing valuable insights into its past, present, and future. Here are the five key statements you need to understand:

1. The Income Statement: Unveiling the Profit Picture

The income statement, also known as the profit and loss (P&L) statement, is your first stop in understanding a company’s financial health. It paints a clear picture of the company’s revenues, expenses, and ultimately, its profitability over a specific period.

- Revenue: This represents the total amount of money a company earns from its core operations. Think of it as the company’s sales receipts.

- Expenses: These are the costs incurred by the company to generate revenue. Think of them as the company’s bills and operating costs.

- Net Income (Profit): This is the bottom line of the income statement, representing the company’s profit after deducting all expenses from its revenue. A positive net income indicates profitability, while a negative net income signifies a loss.

Example:

Imagine a bakery that sells cakes and pastries. Its income statement might look like this:

- Revenue: $10,000 (from cake and pastry sales)

- Expenses: $6,000 (cost of ingredients, rent, utilities, salaries)

- Net Income: $4,000 (Revenue – Expenses)

This income statement shows that the bakery generated a profit of $4,000 during the period.

2. The Balance Sheet: A Snapshot of Assets, Liabilities, and Equity

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It essentially shows what the company owns (assets), what it owes (liabilities), and the value of its ownership (equity).

- Assets: These are the company’s resources that have economic value and are expected to provide future benefits. Think of them as the company’s possessions. Examples include cash, inventory, equipment, and buildings.

- Liabilities: These are the company’s financial obligations to others. Think of them as the company’s debts. Examples include loans, accounts payable, and deferred revenue.

- Equity: This represents the value of the ownership stake in the company. Think of it as the company’s net worth. It is calculated as assets minus liabilities.

Example:

Let’s continue with our bakery example. Its balance sheet might look like this:

- Assets: $15,000 (cash, inventory, equipment, building)

- Liabilities: $5,000 (bank loan, accounts payable)

- Equity: $10,000 (Assets – Liabilities)

This balance sheet shows that the bakery owns assets worth $15,000, owes $5,000, and has an equity value of $10,000.

3. The Statement of Cash Flows: Tracking the Flow of Cash

The statement of cash flows tracks the movement of cash in and out of a company over a specific period. It provides insights into how the company generates cash, how it uses cash, and how its cash position changes over time.

- Operating Activities: This section reflects cash flows from the company’s core business operations, such as selling goods or services.

- Investing Activities: This section reflects cash flows from investments, such as purchasing or selling assets.

- Financing Activities: This section reflects cash flows from financing activities, such as borrowing money or issuing stock.

Example:

Our bakery’s statement of cash flows might show the following:

- Operating Activities: $5,000 (cash generated from selling cakes and pastries)

- Investing Activities: -$2,000 (cash spent on purchasing new equipment)

- Financing Activities: $1,000 (cash received from a bank loan)

This statement shows that the bakery generated $5,000 from its operations, spent $2,000 on investments, and received $1,000 from financing activities.

4. The Statement of Changes in Equity: Tracking Ownership Changes

The statement of changes in equity tracks the changes in the company’s ownership value over a specific period. It shows how the company’s equity has been affected by factors such as profits, losses, dividends, and share issuance or buybacks.

Example:

Our bakery’s statement of changes in equity might show the following:

- Beginning Equity: $8,000

- Net Income: $4,000

- Dividends Paid: -$1,000

- Ending Equity: $11,000

This statement shows that the bakery’s equity increased from $8,000 to $11,000 during the period, driven by the $4,000 net income and partially offset by the $1,000 dividends paid.

5. The Statement of Comprehensive Income: A Broader View of Income

The statement of comprehensive income provides a broader view of a company’s income than the income statement. It includes items that are not included in the income statement, such as unrealized gains and losses on investments.

Example:

Our bakery might have investments in other businesses. The statement of comprehensive income would include any gains or losses from those investments, even if they haven’t been realized yet.

Beyond the Basics: Analyzing Financial Statements

Understanding the individual components of financial statements is just the first step. The real power lies in analyzing these statements to gain insights into a company’s performance and financial health. Here are some key areas to focus on:

- Trend Analysis: Comparing financial statements over time can reveal important trends in a company’s performance. For example, a consistent increase in net income over several years indicates strong growth, while a decline in revenue might signal a potential problem.

- Ratio Analysis: Ratios provide a more comprehensive picture of a company’s financial health by comparing different elements of its financial statements. Common ratios include profitability ratios (like gross profit margin and net profit margin), liquidity ratios (like current ratio and quick ratio), and solvency ratios (like debt-to-equity ratio and times interest earned).

- Comparative Analysis: Comparing a company’s financial statements to those of its competitors or industry averages can provide valuable insights into its relative performance and competitive position.

The Power of Financial Literacy

Understanding financial statements is not just for investors and financial professionals. It empowers individuals to make informed decisions about their own finances. Whether you’re planning for retirement, buying a home, or managing your personal budget, understanding the language of finance can help you make smarter choices and achieve your financial goals.

Key Takeaways

- Financial statements are essential for understanding a company’s financial health.

- The five key statements are the income statement, balance sheet, statement of cash flows, statement of changes in equity, and statement of comprehensive income.

- Analyzing financial statements involves trend analysis, ratio analysis, and comparative analysis.

- Financial literacy is crucial for individuals to make informed financial decisions.

By mastering the power of 5 key financial statements, you can unlock a world of financial understanding, empowering you to make confident decisions and achieve your financial aspirations. Remember, knowledge is power, and in the world of finance, understanding the language of numbers is the key to unlocking your financial freedom.

Closure

Thus, we hope this article has provided valuable insights into Unleash the Power of 5: Deciphering Financial Statements for Ultimate Financial Freedom. We thank you for taking the time to read this article. See you in our next article!

google.com