Unleash Your Financial Freedom: 5 Powerful Budgeting Strategies for Beginners

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleash Your Financial Freedom: 5 Powerful Budgeting Strategies for Beginners. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Financial Freedom: 5 Powerful Budgeting Strategies for Beginners

Feeling overwhelmed by finances? You’re not alone. Many people struggle with managing their money, often feeling trapped in a cycle of debt and financial stress. But it doesn’t have to be this way. Budgeting, while it may sound daunting, is a powerful tool that can empower you to take control of your finances and build a brighter financial future.

This guide will equip you with five effective budgeting strategies designed specifically for beginners. By implementing these strategies, you can transform your relationship with money, move towards financial stability, and achieve your financial goals.

1. Track Your Spending: The Foundation of Effective Budgeting

The first step towards building a successful budget is understanding where your money is going. This means tracking your spending, which can be done through various methods.

- Manual Tracking: The traditional method involves keeping a notebook or spreadsheet and recording every expense manually. While this requires discipline, it offers a detailed understanding of your spending habits.

- Budgeting Apps: Numerous apps like Mint, YNAB (You Need a Budget), and Personal Capital automate the process of tracking your spending by connecting to your bank accounts. These apps provide insights into your spending patterns and offer helpful tools for managing your budget.

- Cash Envelope System: This method involves allocating a specific amount of cash for each spending category (e.g., groceries, entertainment, etc.) and placing it in labeled envelopes. Once the money is gone, you stop spending in that category until the next budgeting period. This encourages mindful spending and helps avoid overspending.

2. Create a Realistic Budget: Setting Financial Goals

Once you understand your spending patterns, it’s time to create a budget that reflects your financial goals. This involves allocating your income to different spending categories based on your priorities.

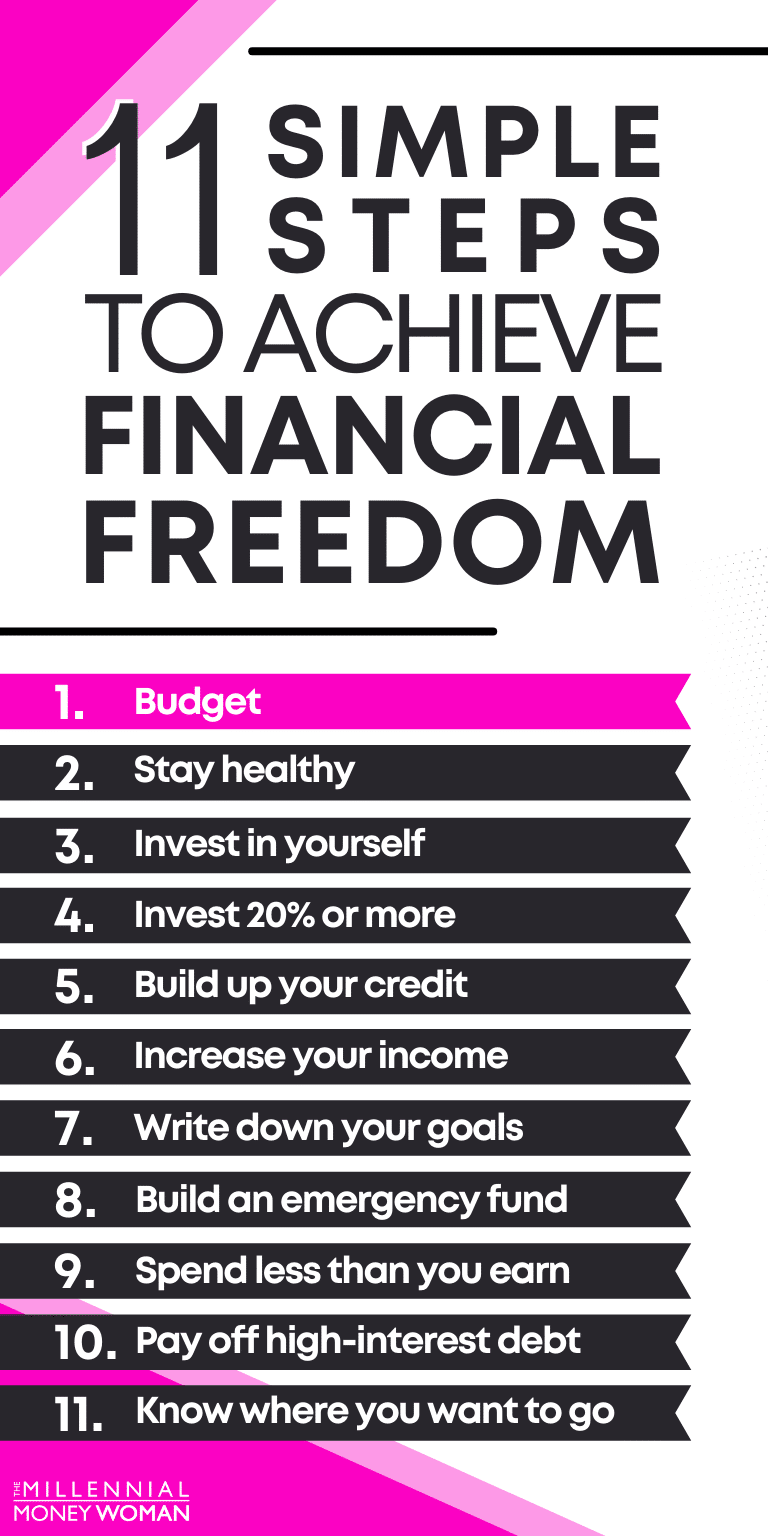

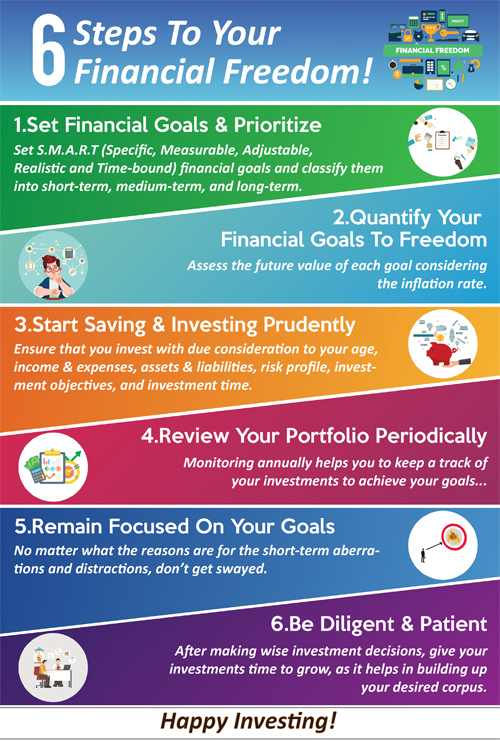

- Identify Your Financial Goals: What do you want to achieve with your money? Do you want to save for a down payment on a house, pay off debt, or invest for retirement? Defining your goals will help you prioritize your spending and allocate funds accordingly.

- Categorize Your Expenses: Divide your spending into essential categories like housing, utilities, groceries, and transportation. You can also include discretionary categories like entertainment, dining out, and shopping.

- Allocate Your Income: Based on your financial goals and spending categories, allocate a specific amount of money to each category. Be realistic and ensure your budget is sustainable in the long term.

3. The 50/30/20 Rule: A Simple Yet Effective Framework

The 50/30/20 rule is a popular budgeting guideline that provides a straightforward approach to allocating your income. It suggests dividing your after-tax income as follows:

- 50% Needs: This includes essential expenses like housing, utilities, groceries, transportation, and healthcare.

- 30% Wants: This category covers discretionary spending, including entertainment, dining out, travel, and hobbies.

- 20% Savings and Debt Repayment: This portion is allocated towards building an emergency fund, paying off debt, and investing for the future.

While this rule provides a starting point, it’s essential to adjust it based on your individual circumstances and financial goals.

4. Embrace the Power of Automation: Setting Up Automatic Transfers

Automation is a powerful tool for simplifying budgeting and achieving financial goals. Setting up automatic transfers can help you:

- Save Regularly: Schedule automatic transfers from your checking account to your savings account. This ensures consistent savings, even when you’re busy or forget.

- Pay Bills on Time: Automate bill payments to avoid late fees and maintain a good credit score.

- Contribute to Retirement: Set up automatic contributions to your retirement account to ensure you’re saving for the future.

5. Review and Adjust: A Continuous Process

Budgeting is not a one-time event but an ongoing process. It’s essential to regularly review your budget and make adjustments as needed.

- Track Your Progress: Monitor your spending and compare it to your budget. This helps you identify areas where you may be overspending or underspending.

- Adjust as Needed: If you find yourself consistently overspending in certain categories, consider reducing your spending in those areas or increasing your income.

- Re-evaluate Your Goals: As your financial situation changes, your goals may evolve. Regularly re-evaluate your goals and adjust your budget accordingly.

Beyond the Basics: Tips for Success

- Start Small: Don’t try to overhaul your entire budget overnight. Start with small changes and gradually incorporate more complex strategies.

- Set Realistic Goals: Avoid setting unrealistic goals that are likely to lead to frustration and discouragement.

- Find a Budgeting Buddy: Having someone to hold you accountable and share tips with can be motivating and helpful.

- Don’t Be Afraid to Ask for Help: If you’re struggling with budgeting, don’t hesitate to seek professional guidance from a financial advisor.

Conclusion: Empowering Yourself with Financial Control

Budgeting is a powerful tool that can empower you to take control of your finances and achieve your financial goals. By following these strategies, you can create a realistic budget, track your spending, and make informed financial decisions. Remember, it’s a journey, not a destination. Be patient, persistent, and celebrate your successes along the way.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Freedom: 5 Powerful Budgeting Strategies for Beginners. We thank you for taking the time to read this article. See you in our next article!

google.com