Unleash Your Financial Freedom: A 5-Step Retirement Savings Plan by Age

Introduction

With great pleasure, we will explore the intriguing topic related to Unleash Your Financial Freedom: A 5-Step Retirement Savings Plan by Age. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Financial Freedom: A 5-Step Retirement Savings Plan by Age

Retirement. The word itself conjures up images of sun-drenched beaches, leisurely walks, and the freedom to pursue passions long neglected. But achieving this idyllic picture requires a strategic approach, one that starts early and prioritizes consistent saving.

The journey to retirement financial security is not a one-size-fits-all endeavor. Your age, income, lifestyle, and risk tolerance all play a crucial role in shaping your savings strategy. This article will guide you through a 5-step plan, tailored to specific age groups, to ensure you’re on the right track to a financially secure and fulfilling retirement.

Step 1: Assess Your Current Financial Situation

Before embarking on any savings journey, it’s essential to understand your starting point. This involves taking a comprehensive look at your current financial situation, including:

- Income: Calculate your annual income, factoring in any bonuses, commissions, or side hustles.

- Expenses: Track your monthly expenses, categorizing them into necessities (housing, utilities, groceries), discretionary spending (entertainment, dining out), and debt payments.

- Assets: List your assets, including savings accounts, investments, property, and any other valuable possessions.

- Liabilities: Identify your outstanding debts, such as student loans, mortgages, credit card balances, and personal loans.

Once you have a clear picture of your income, expenses, assets, and liabilities, you can calculate your net worth (assets minus liabilities). This will give you a baseline understanding of your financial health and help you determine how much you can realistically save for retirement.

Step 2: Define Your Retirement Goals

Now that you have a grasp of your current financial standing, it’s time to envision your future. Ask yourself:

- When do you plan to retire? This will influence the length of time you have to save and the amount you need to accumulate.

- What lifestyle do you envision in retirement? Do you dream of traveling the world, buying a vacation home, or simply enjoying a comfortable life?

- What are your anticipated retirement expenses? Factor in housing costs, healthcare expenses, travel, hobbies, and any other anticipated expenses.

By defining your retirement goals, you create a clear target to strive for. This will help you stay motivated and make informed decisions about your savings strategy.

Step 3: Determine Your Savings Target

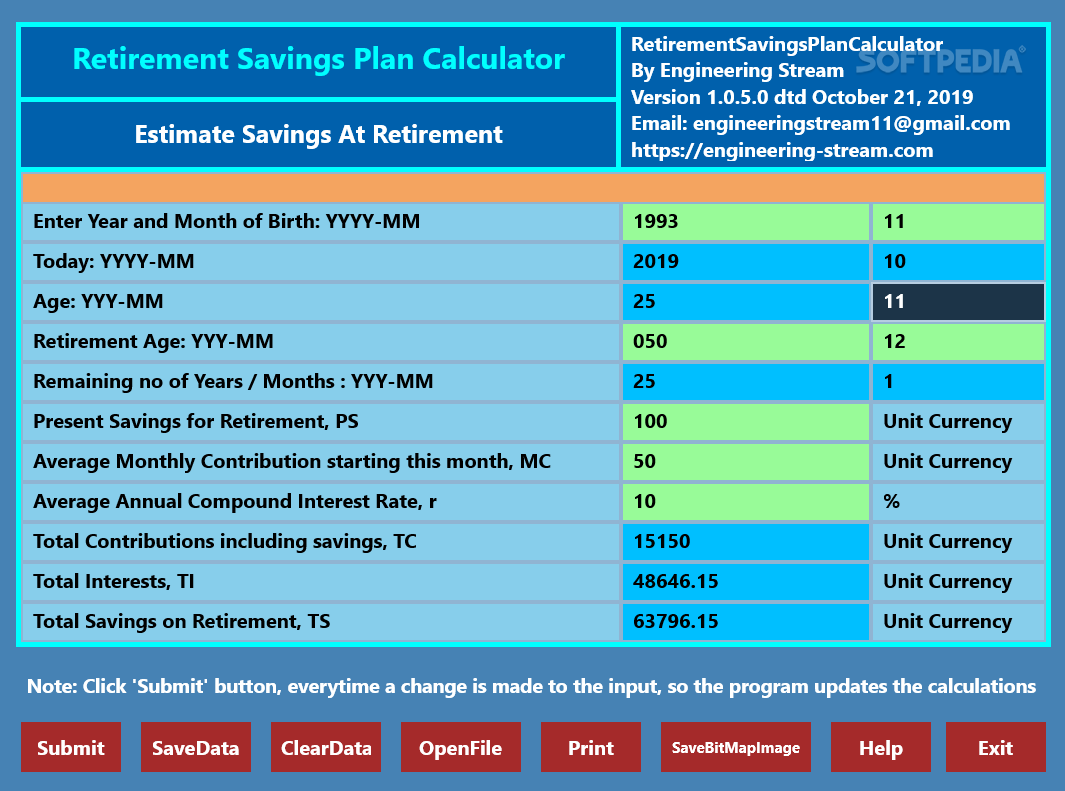

With your retirement goals in mind, you can now estimate the amount you need to save. Several online calculators and financial advisors can assist you in determining your retirement savings target. Factors that influence this target include:

- Age: The younger you are, the more time you have to accumulate wealth, so you may need to save less each year.

- Expected rate of return: The average historical return on investments is around 7-8% per year. However, your actual returns may vary.

- Inflation: Inflation erodes the purchasing power of your money over time. You need to account for inflation when estimating your retirement expenses.

- Social Security benefits: While Social Security benefits can provide a valuable source of income in retirement, they are unlikely to cover all your expenses.

It’s important to note that these are just estimates. Your actual retirement savings needs may vary based on your individual circumstances.

Step 4: Develop a Savings Plan by Age

Now comes the crucial part: creating a tailored savings plan based on your age. Here’s a breakdown of recommended savings strategies for different age groups:

20s:

- Focus on building a solid foundation: Start saving early and consistently, even if it’s just a small amount.

- Maximize your employer-sponsored retirement plan: Take advantage of any employer matching contributions, as this is free money.

- Consider investing in a Roth IRA: This allows you to contribute after-tax dollars and withdraw your earnings tax-free in retirement.

- Pay down high-interest debt: Prioritize paying down debt with high interest rates, such as credit card debt, to reduce your financial burden.

30s:

- Increase your savings contributions: As your income grows, increase your savings contributions to accelerate your wealth accumulation.

- Consider diversifying your investments: Invest in a mix of stocks, bonds, and real estate to mitigate risk and maximize potential returns.

- Start planning for major life events: Consider saving for a down payment on a house, your children’s education, or other significant life events.

- Review your insurance coverage: Ensure you have adequate life insurance, health insurance, and disability insurance to protect your family and finances.

40s:

- Prioritize retirement savings: With less time to accumulate wealth, focus on maximizing your retirement contributions.

- Rebalance your portfolio: Review your investment portfolio regularly and adjust your asset allocation as needed.

- Explore other savings options: Consider investing in a 401(k) or a traditional IRA if you haven’t already.

- Start planning for your retirement transition: Begin thinking about your retirement lifestyle and how you’ll transition into this new phase of life.

50s:

- Maximize retirement contributions: Take advantage of any catch-up contributions allowed for individuals over 50.

- Review your retirement plan: Ensure your retirement plan aligns with your current goals and financial situation.

- Consider downsizing your home: If you have a large mortgage, downsizing to a smaller home can free up cash flow for retirement savings.

- Start thinking about healthcare costs: Healthcare expenses can be significant in retirement. Consider exploring health savings accounts (HSAs) or other options to help manage these costs.

60s:

- Focus on preserving your wealth: Avoid taking unnecessary risks with your investments.

- Start drawing down your retirement savings: Begin withdrawing funds from your retirement accounts to cover your expenses.

- Consider working part-time: If you’re healthy and enjoy working, consider taking on a part-time job to supplement your retirement income.

- Prepare for potential long-term care expenses: Explore long-term care insurance options or consider setting aside funds to cover potential long-term care costs.

Step 5: Seek Professional Guidance

Navigating the complex world of retirement savings can be overwhelming. Don’t hesitate to seek professional guidance from a financial advisor. A qualified advisor can:

- Develop a personalized retirement plan: They can help you set realistic goals, create a tailored savings strategy, and choose appropriate investments.

- Provide ongoing support and advice: They can monitor your progress, adjust your plan as needed, and answer any questions you may have.

- Help you manage your retirement assets: They can provide guidance on asset allocation, diversification, and tax planning.

Conclusion

Retirement is a significant milestone, and achieving financial security during this phase of life requires careful planning and consistent effort. By following these five steps and starting early, you can unleash your financial freedom and enjoy a comfortable and fulfilling retirement. Remember, it’s never too late to start saving for retirement, and even small contributions can make a big difference over time.

Take control of your financial future and start planning for a retirement that reflects your dreams and aspirations.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Freedom: A 5-Step Retirement Savings Plan by Age. We appreciate your attention to our article. See you in our next article!

google.com