Unleash Your Financial Power: 5 Reasons Why a Financial Planner is Your Secret Weapon

Related Articles: Unleash Your Financial Power: 5 Reasons Why a Financial Planner is Your Secret Weapon

- Unleashing The Power Of 5: The Crucial Importance Of Financial Discipline

- I have earned my highest income on teachers pay teachers after 6 months

- Finance financial company financials traditional training capital venture business approach modern management non stock funds blocks reasons properly deal money

- Unleash Your Financial Freedom: A 5-Step Roadmap To Achieve Your Dreams

- The Unstoppable Power Of Bonds: 5 Reasons They Deserve A Place In Your Portfolio

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unleash Your Financial Power: 5 Reasons Why a Financial Planner is Your Secret Weapon. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unleash Your Financial Power: 5 Reasons Why a Financial Planner is Your Secret Weapon

Navigating the complex world of personal finance can be daunting. From managing debt to investing for the future, it’s easy to feel overwhelmed and unsure of where to start. This is where a financial planner can become your secret weapon, empowering you to achieve your financial goals with confidence.

While some may view financial planning as a luxury reserved for the wealthy, the truth is, everyone can benefit from the expertise and guidance of a qualified professional. This article will explore five compelling reasons why partnering with a financial planner can be a transformative decision for your financial well-being, regardless of your income level or investment experience.

1. A Personalized Roadmap to Financial Success:

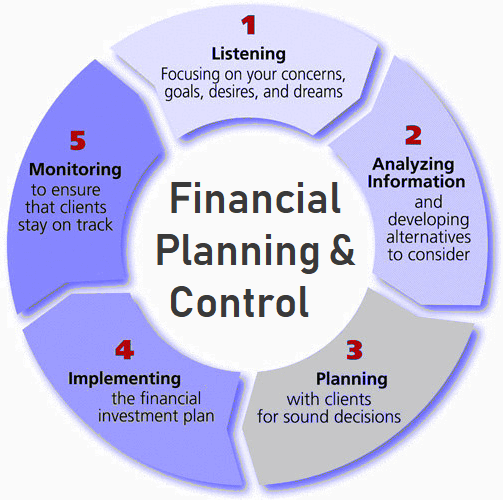

Imagine having a personalized roadmap that guides you through the intricate maze of your financial journey. A financial planner acts as your trusted navigator, helping you develop a comprehensive financial plan tailored to your unique circumstances, goals, and risk tolerance. This roadmap includes:

-

- Goal Setting and Prioritization: A financial planner helps you define your short-term and long-term financial goals, whether it’s buying a home, funding your children’s education, retiring comfortably, or simply achieving financial peace of mind.

- Budgeting and Cash Flow Management: They assist you in creating a realistic budget that aligns with your income and expenses, ensuring you stay on track and avoid unnecessary debt.

- Investment Strategy Development: Based on your risk tolerance, time horizon, and financial goals, a financial planner can recommend a diversified investment portfolio that aims to maximize returns while minimizing risk.

- Debt Management and Reduction: They can help you develop a plan to manage and reduce existing debt, such as credit card debt, student loans, or mortgages, freeing up more cash flow for your goals.

- Retirement Planning: A financial planner can help you determine how much you need to save for retirement, guide you through investment options, and ensure you’re on track to achieve your desired lifestyle.

2. Objectivity and Expert Advice:

When it comes to your finances, emotions can often cloud judgment. It’s easy to get swayed by market trends or succumb to impulsive spending habits. This is where a financial planner’s objectivity and expertise prove invaluable.

-

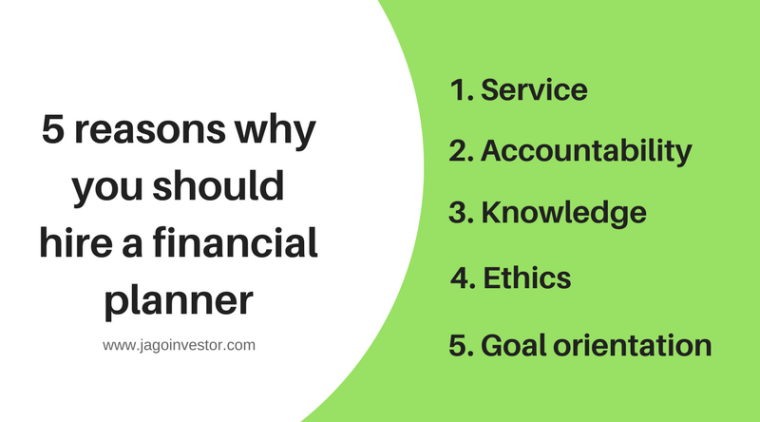

- Unbiased Perspective: Financial planners are trained to provide unbiased advice, free from the influence of personal biases or sales pressure. They prioritize your best interests, offering recommendations based on data, research, and proven financial strategies.

- Specialized Knowledge: Financial planners possess extensive knowledge of financial markets, investment products, tax laws, and other relevant areas. They can navigate complex financial concepts and provide informed advice on making the right decisions for your specific situation.

- Market Insights: They stay updated on current market trends and economic conditions, allowing them to adjust your financial plan accordingly and make informed investment decisions.

3. Time and Stress Reduction:

Managing your finances can be a time-consuming and stressful endeavor. A financial planner can take the burden off your shoulders, freeing up valuable time and reducing stress.

- Time Savings: By delegating the management of your finances, you can free up precious time to focus on other priorities, like your career, family, or personal hobbies.

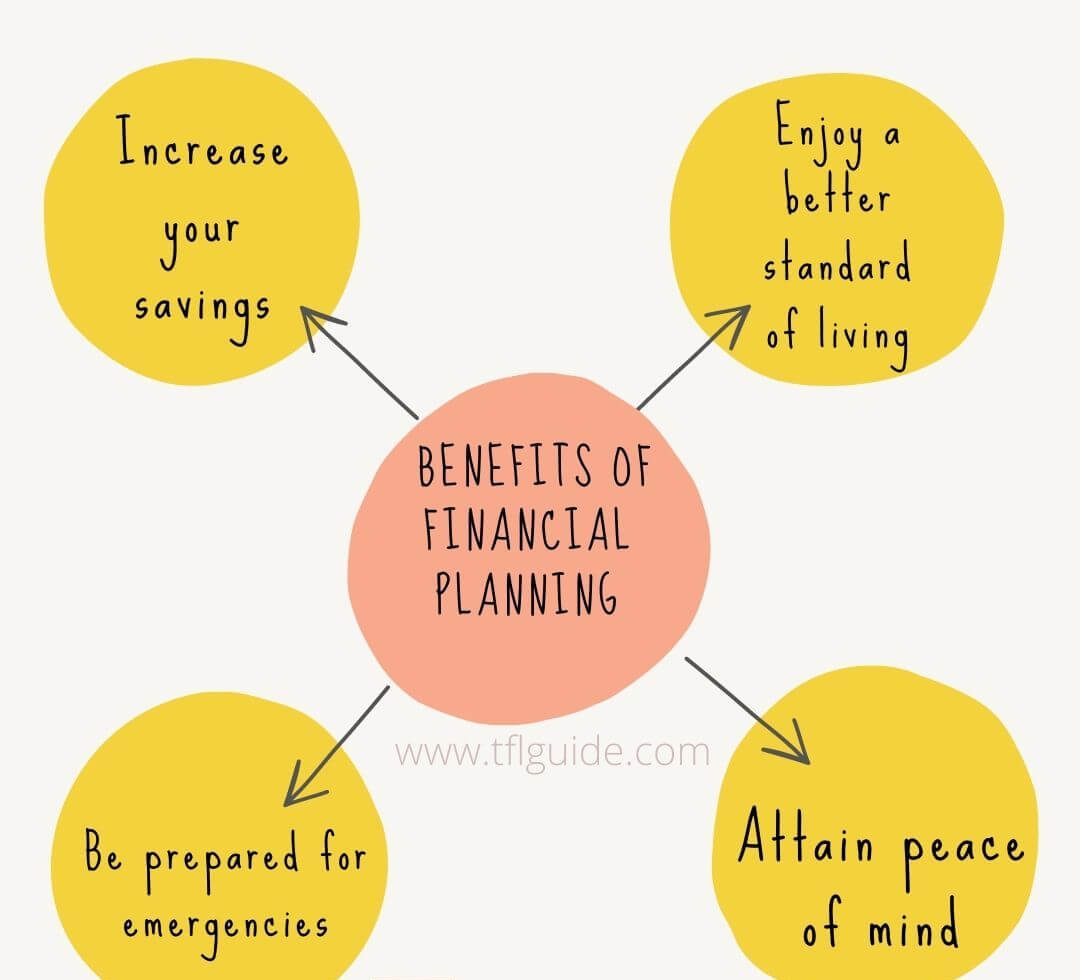

- Stress Relief: The complexity and uncertainty surrounding finances can be a significant source of stress. A financial planner can provide peace of mind by taking the reins and guiding you through the process.

- Reduced Errors: Financial planning involves a multitude of details and calculations. A financial planner can help minimize errors and ensure you’re making the most informed decisions.

4. Accountability and Motivation:

Having a financial planner on your side can provide the accountability and motivation you need to stay committed to your financial goals.

- Regular Check-Ins: Financial planners typically schedule regular meetings to review your progress, discuss any changes in your financial situation, and make adjustments to your plan as needed.

- Accountability: Knowing that you’re accountable to a professional can help you stay on track with your financial goals and avoid impulsive spending habits.

- Motivation: A financial planner can provide encouragement and support, keeping you motivated and focused on achieving your financial aspirations.

5. Increased Financial Confidence:

One of the most significant benefits of working with a financial planner is the increased financial confidence you gain.

- Empowerment: By understanding your finances and having a plan in place, you feel empowered to make informed decisions about your money.

- Reduced Anxiety: Knowing that your finances are in good hands can reduce anxiety and stress, allowing you to live a more fulfilling life.

- Financial Security: A well-crafted financial plan provides a sense of security and peace of mind, knowing you’re on the right path to achieving your financial goals.

Finding the Right Financial Planner:

While the benefits of working with a financial planner are numerous, it’s crucial to find the right professional for your needs. Here are some tips for choosing a financial planner:

- Look for a Certified Financial Planner (CFP): CFPs have met rigorous education and experience requirements and adhere to a strict code of ethics.

- Check Credentials and Experience: Look for a planner with experience in areas relevant to your financial goals, such as investment management, retirement planning, or estate planning.

- Consider Your Values: Find a planner whose values align with yours, ensuring you feel comfortable and confident working with them.

- Schedule a Consultation: Before committing to a financial planner, schedule a free consultation to discuss your needs and ensure they’re a good fit.

Conclusion:

The decision to engage a financial planner is a significant step towards achieving your financial goals and securing your future. By providing personalized guidance, objective advice, and ongoing support, a financial planner can empower you to take control of your finances, reduce stress, and gain the confidence you need to make informed decisions. While the initial investment may seem daunting, the long-term benefits of having a financial planner on your team are immeasurable.

Remember, your financial journey is unique. Partnering with a qualified financial planner can be the key to unlocking your financial power and achieving the financial freedom you deserve.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Power: 5 Reasons Why a Financial Planner is Your Secret Weapon. We hope you find this article informative and beneficial. See you in our next article!

google.com