Unleash Your Financial Power: Building a 5-Asset Diversified Portfolio

Introduction

With great pleasure, we will explore the intriguing topic related to Unleash Your Financial Power: Building a 5-Asset Diversified Portfolio. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Financial Power: Building a 5-Asset Diversified Portfolio

The pursuit of financial security is a journey, not a destination. It requires careful planning, strategic investment, and a healthy dose of patience. One of the most crucial aspects of this journey is building a diversified portfolio, a strategy that can help mitigate risk and maximize returns over the long term.

While the idea of diversification might seem daunting, it’s actually quite simple. It’s about spreading your investment capital across various asset classes, each with its unique characteristics and potential for growth. This strategy helps to smooth out volatility, ensuring that a downturn in one asset class is offset by gains in another.

The Power of 5: A Simple Yet Effective Framework

For a beginner investor, the concept of "asset classes" might seem overwhelming. But don’t worry, it’s not as complicated as it sounds. Here’s a simple framework for building a diversified portfolio using just five key asset classes:

- Equities (Stocks): Stocks represent ownership in companies. They offer the potential for high returns, but also carry higher risk.

- Types: You can choose from various types of stocks, including large-cap (large companies), small-cap (small companies), and growth stocks (companies with high growth potential).

- Benefits: Stocks have historically outperformed other asset classes over the long term, providing potential for significant capital appreciation.

- Risks: Stocks are volatile and can experience significant price fluctuations, especially in the short term.

- Fixed Income (Bonds): Bonds are debt securities that represent loans to companies or governments. They generally offer lower returns than stocks but are considered less risky.

- Types: Bonds come in various forms, including government bonds, corporate bonds, and high-yield bonds (also known as junk bonds).

- Benefits: Bonds provide a steady stream of income in the form of interest payments and can act as a ballast to a portfolio during market downturns.

- Risks: Bonds can lose value if interest rates rise, and there’s a risk of default, where the issuer fails to repay the principal or interest.

- Real Estate: This asset class includes residential and commercial properties.

- Types: You can invest in real estate directly by purchasing a property or indirectly through REITs (Real Estate Investment Trusts).

- Benefits: Real estate can offer potential for capital appreciation and rental income. It also acts as a hedge against inflation.

- Risks: Real estate is illiquid, meaning it can be difficult to sell quickly. Property values can fluctuate, and there are ongoing costs associated with ownership, such as maintenance and property taxes.

- Commodities: These are raw materials, such as oil, gold, and agricultural products.

- Types: You can invest in commodities through futures contracts, ETFs (Exchange Traded Funds), or physical ownership (like gold bullion).

- Benefits: Commodities can provide a hedge against inflation and offer diversification benefits.

- Risks: Commodity prices can be volatile, and there’s a risk of storage costs and potential for theft or damage.

- Cash and Equivalents: This includes savings accounts, money market accounts, and short-term bonds.

- Benefits: Cash provides liquidity and serves as a safe haven during market downturns.

- Risks: Cash typically earns low returns, especially in periods of high inflation.

Building Your Portfolio: A Step-by-Step Guide

- Define Your Investment Goals: Before you start investing, it’s crucial to determine your financial goals. What are you saving for? How much do you need to achieve your goals? How long do you have to invest?

- Assess Your Risk Tolerance: Everyone has a different level of comfort with risk. Are you a conservative investor who prefers low-risk investments, or are you more aggressive and willing to take on more risk for potentially higher returns?

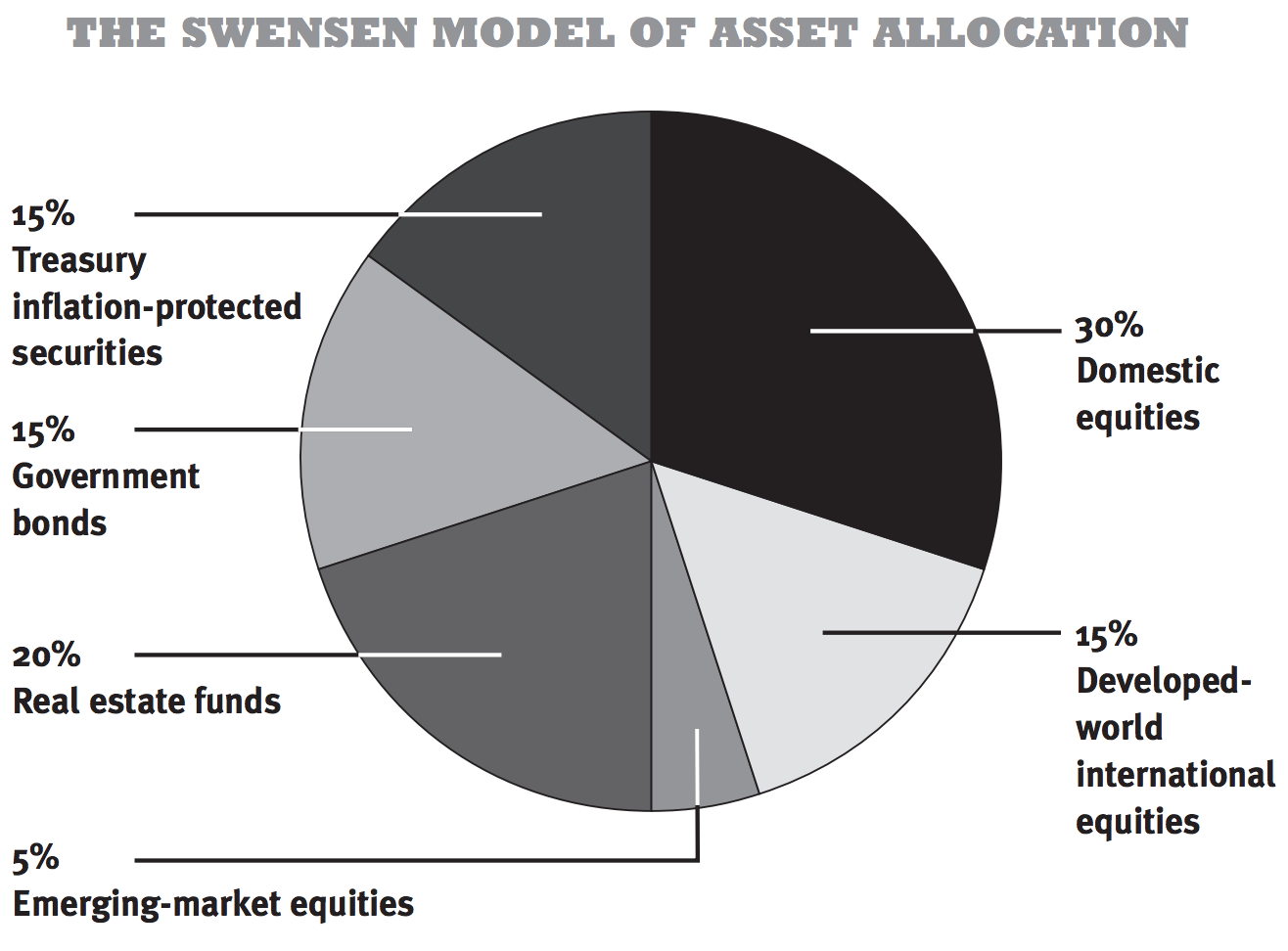

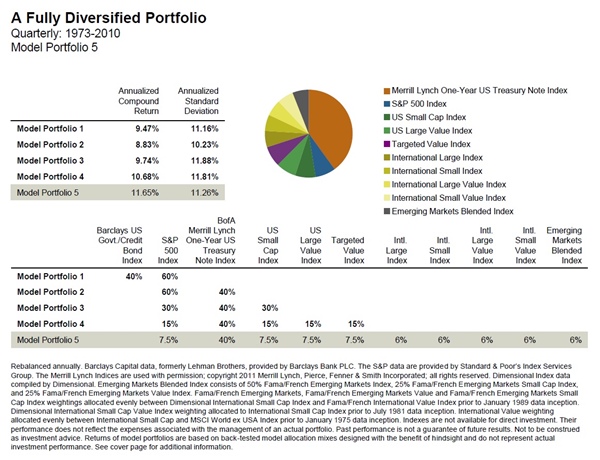

- Allocate Your Assets: Based on your goals and risk tolerance, you can determine the percentage of your portfolio you want to allocate to each asset class. This is known as asset allocation.

- Conservative: A conservative investor might allocate a larger percentage of their portfolio to fixed income and cash, with a smaller allocation to equities and commodities.

- Moderate: A moderate investor might split their portfolio more evenly between equities, fixed income, and real estate, with a smaller allocation to cash and commodities.

- Aggressive: An aggressive investor might allocate a larger percentage of their portfolio to equities and commodities, with a smaller allocation to fixed income and cash.

- Choose Your Investments: Once you have determined your asset allocation, you can start choosing specific investments within each asset class.

- Monitor and Rebalance: Your portfolio needs to be regularly monitored and rebalanced to ensure that it remains aligned with your investment goals and risk tolerance. Rebalancing involves adjusting your asset allocation as needed to bring it back in line with your original plan.

Benefits of Diversification

- Reduced Risk: Diversification helps to mitigate risk by spreading your investments across different asset classes. This means that if one asset class performs poorly, the others can help to offset those losses.

- Improved Returns: While diversification doesn’t guarantee higher returns, it can help to improve returns over the long term by ensuring that you’re not putting all your eggs in one basket.

- Enhanced Stability: A diversified portfolio is generally more stable than a portfolio concentrated in a single asset class. This can help to reduce stress and anxiety during market downturns.

- Increased Flexibility: A diversified portfolio provides greater flexibility to adjust your investment strategy as your needs and goals change.

Conclusion: A Journey Towards Financial Security

Building a diversified portfolio is not a one-time event, but an ongoing process that requires ongoing monitoring and adjustments. It’s a journey that demands patience, discipline, and a commitment to long-term financial goals. By embracing diversification, you can unleash your financial power and embark on a path towards greater financial security.

Remember, investing involves risk, and there are no guarantees of returns. It’s essential to consult with a qualified financial advisor to create a personalized investment plan that meets your specific needs and goals.

By understanding the basics of diversification and following a structured approach, you can build a portfolio that can weather market storms and help you achieve your financial dreams. So, embrace the power of diversification and embark on your journey towards a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Power: Building a 5-Asset Diversified Portfolio. We hope you find this article informative and beneficial. See you in our next article!

google.com