Unleash Your Financial Power: The Ultimate Beginner’s Guide to Stock Investing

Related Articles: Unleash Your Financial Power: The Ultimate Beginner’s Guide to Stock Investing

- 7 Powerful Strategies To Transform Your Financial Health

- Amazing! 5 Powerful Steps to Start Investing and Secure Your Financial Future

- Unleash Your Potential: 7 Powerful Strategies To Slash Education Costs

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

- Unleash Your Financial Freedom: 5 Powerful Strategies For Creating A Winning Monthly Budget

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleash Your Financial Power: The Ultimate Beginner’s Guide to Stock Investing. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unleash Your Financial Power: The Ultimate Beginner’s Guide to Stock Investing

The allure of the stock market is undeniable. The promise of wealth, the thrill of the chase, and the potential to build a secure financial future are just some of the reasons why millions of people around the world choose to invest in stocks. However, venturing into the world of stocks can seem daunting, especially for beginners. With a vast sea of information, complex jargon, and volatile market fluctuations, it’s easy to feel overwhelmed. But fear not! This comprehensive guide will equip you with the knowledge and tools you need to embark on your stock investing journey with confidence.

Understanding the Basics: What are Stocks and How Do They Work?

Imagine a company, let’s say a popular coffee shop chain. To grow and expand, the company needs money. One way to raise this money is by selling shares of ownership, called stocks. Each stock represents a tiny slice of the company’s ownership, and by purchasing a stock, you become a shareholder, owning a part of the company’s future.

Think of it like owning a piece of a pizza. The whole pizza represents the entire company, and each slice represents a share. The more slices you own, the more “ownership” you have in the company.

Why Invest in Stocks?

Now that you understand what stocks are, let’s explore why investing in them is a popular choice for many:

- Potential for Growth: The value of stocks can rise over time, allowing you to potentially earn significant returns on your investment. As the company grows and profits increase, the value of its shares can go up.

- Dividend Income: Some companies pay dividends to their shareholders, which are regular payments based on the company’s profits. This can provide you with a consistent stream of passive income.

- Long-Term Wealth Building: Stocks are considered a long-term investment, and by investing consistently over time, you can build wealth and secure your financial future.

- Diversification: Investing in different stocks across various industries can help to reduce risk by spreading your investments across different sectors.

The Two Main Types of Stocks:

- Common Stock: This is the most common type of stock, offering voting rights in the company and the potential to receive dividends.

- Preferred Stock: These stocks offer a fixed dividend payment and priority over common stockholders in case of company liquidation. However, they typically don’t have voting rights.

Key Terminology You Need to Know:

- Bull Market: A period of sustained economic growth and rising stock prices.

- Bear Market: A period of economic decline and falling stock prices.

- Volatility: The degree of price fluctuations in a stock or the market as a whole.

- Market Capitalization (Market Cap): The total value of a company’s outstanding shares.

- Dividend Yield: The annual dividend payment divided by the stock’s current price, expressed as a percentage.

- Price-to-Earnings Ratio (P/E Ratio): A measure of a company’s stock price relative to its earnings per share.

- Return on Equity (ROE): A measure of a company’s profitability, calculated by dividing net income by shareholders’ equity.

Getting Started: Choosing the Right Approach

Before diving headfirst into the stock market, it’s essential to understand the different approaches to investing:

- Active Investing: This involves actively researching, selecting, and managing your own portfolio of stocks. It requires significant time, effort, and knowledge of the market.

- Passive Investing: This involves investing in index funds or exchange-traded funds (ETFs) that track a specific market index, like the S&P 500. This approach is generally considered less risky and requires less active management.

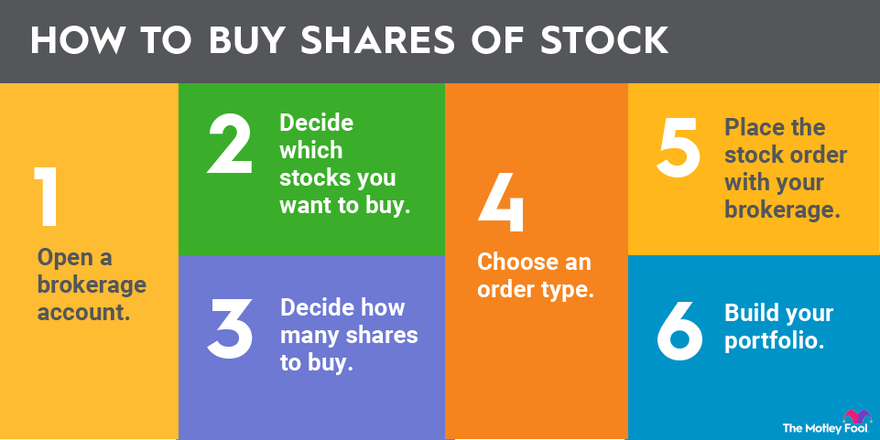

Steps to Start Investing in Stocks:

- Open a Brokerage Account: This is your gateway to the stock market. Choose a reputable online brokerage that offers a user-friendly platform, research tools, and low fees.

- Fund Your Account: Deposit money into your brokerage account to start buying stocks.

- Research and Select Stocks: This is the heart of stock investing. You need to carefully research companies and industries that align with your investment goals and risk tolerance.

- Place Your Order: Once you’ve chosen a stock, you can place an order to buy it through your brokerage platform.

- Monitor Your Investments: Regularly review your portfolio, adjust your holdings as needed, and stay informed about market trends.

Essential Tips for Beginner Investors:

- Start Small: Don’t invest more than you can afford to lose. It’s better to start small and gradually increase your investment amount as you gain experience.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in a variety of stocks across different sectors to reduce risk.

- Invest for the Long Term: The stock market is volatile, and prices can fluctuate in the short term. Don’t panic sell if your investments decline. Instead, focus on long-term growth.

- Stay Informed: Read financial news, research companies, and keep up-to-date on market trends.

- Seek Professional Advice: If you’re unsure about where to start, consider consulting with a financial advisor.

Understanding Risk and Reward:

Investing in stocks inherently involves risk. There’s no guarantee that you’ll make money, and you could even lose some or all of your investment. However, the potential for reward is also significant. By carefully researching and diversifying your portfolio, you can mitigate risk and increase your chances of success.

Common Investment Strategies:

- Value Investing: This strategy involves identifying undervalued stocks with the potential to appreciate in value.

- Growth Investing: This strategy focuses on companies with strong growth potential and high earnings potential.

- Dividend Investing: This strategy focuses on companies that pay regular dividends, providing a stream of passive income.

- Index Investing: This strategy involves investing in index funds or ETFs that track a specific market index, offering diversification and low costs.

The Importance of Patience and Discipline:

Successful stock investing requires patience and discipline. It’s not a get-rich-quick scheme. Building wealth takes time, and you need to be prepared to weather market fluctuations and stay committed to your investment strategy.

Avoiding Common Mistakes:

- Panicking and Selling During Market Downturns: Don’t let fear dictate your investment decisions. Remember that market downturns are temporary, and staying invested for the long term is crucial for growth.

- Chasing Hot Stocks: Don’t get caught up in hype or chasing the latest “hot” stock. Do your own research and invest in companies with a solid foundation and long-term potential.

- Overtrading: Avoid making frequent trades, as this can lead to higher transaction fees and potentially lower returns.

- Ignoring Your Investment Goals: Always keep your investment goals in mind and make sure your investment strategy aligns with them.

Conclusion: Embracing the Journey of Stock Investing

Investing in stocks can be an exciting and rewarding journey, but it’s important to approach it with knowledge, discipline, and a long-term perspective. By understanding the basics, choosing the right approach, and following the tips outlined in this guide, you can navigate the stock market with confidence and build a secure financial future. Remember, the key to success is to start early, stay informed, and stay patient. The power of the stock market is waiting to be unleashed, and with the right knowledge and strategy, you can unlock its potential and achieve your financial goals.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Financial Power: The Ultimate Beginner’s Guide to Stock Investing. We hope you find this article informative and beneficial. See you in our next article!

google.com