Unleash Your Tax Savings: 10 Powerful Deductions and Credits You Need to Know

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unleash Your Tax Savings: 10 Powerful Deductions and Credits You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash Your Tax Savings: 10 Powerful Deductions and Credits You Need to Know

Tax season can be a stressful time, but it doesn’t have to be. Armed with the right knowledge, you can unlock significant savings and maximize your refund. While the thought of navigating complex tax laws might seem daunting, understanding the power of deductions and credits can transform your tax experience. This article will empower you with the knowledge to identify 10 powerful deductions and credits that can dramatically reduce your tax liability.

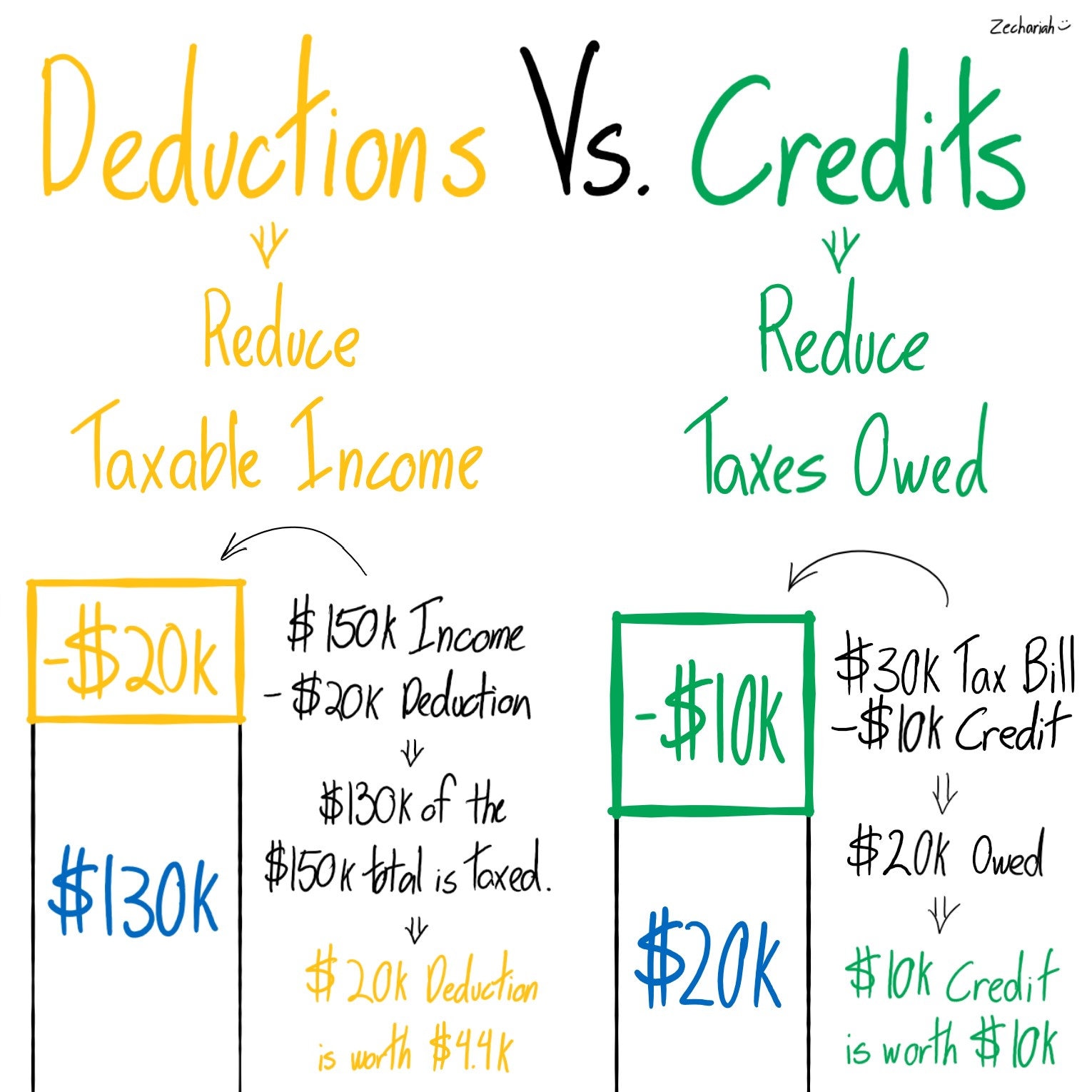

Understanding the Difference: Deductions vs. Credits

Before diving into specific deductions and credits, it’s essential to grasp the fundamental difference between the two.

- Deductions: Deductions reduce your taxable income, which in turn lowers your tax bill. Think of them as a discount on your income.

- Credits: Credits are direct reductions in your tax liability. They are more valuable than deductions because they directly lower the amount of taxes you owe.

10 Powerful Deductions and Credits to Claim:

1. The Standard Deduction:

This is a fixed amount that you can deduct from your taxable income. The standard deduction is adjusted annually, and for 2023, it is $13,850 for single filers, $27,700 for married couples filing jointly, and $20,800 for heads of household.

2. Itemized Deductions:

Instead of claiming the standard deduction, you can choose to itemize your deductions. This allows you to deduct specific expenses, such as:

-

- Home Mortgage Interest: This is the interest you pay on your primary residence mortgage.

- Property Taxes: Deductible up to $10,000 per household.

- State and Local Taxes (SALT): Deductible up to $10,000 per household.

- Medical Expenses: You can deduct medical expenses exceeding 7.5% of your Adjusted Gross Income (AGI).

- Charitable Contributions: You can deduct cash contributions up to 60% of your AGI and non-cash contributions up to 30% of your AGI.

3. Child Tax Credit:

This credit can significantly reduce your tax liability if you have children under 17. For 2023, the credit is worth up to $2,000 per child.

4. Earned Income Tax Credit (EITC):

This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income and the number of qualifying children you have.

5. Education Credits:

If you are pursuing higher education, you might be eligible for education credits, such as:

- American Opportunity Tax Credit: This credit is worth up to $2,500 per eligible student and is available for the first four years of post-secondary education.

- Lifetime Learning Credit: This credit is worth up to $2,000 per eligible student and can be used for undergraduate, graduate, and vocational courses.

6. Child and Dependent Care Credit:

This credit can help offset the costs of childcare if you are working or looking for work and have a dependent under 13 years old. The credit is worth up to 35% of your qualifying expenses, with a maximum credit amount of $3,000 for one qualifying individual and $6,000 for two or more qualifying individuals.

7. Retirement Contributions:

Contributions to traditional and Roth IRAs, as well as 401(k) plans, are often tax-deductible. This can lower your taxable income and potentially save you money on taxes in the present and future.

8. Health Savings Account (HSA):

If you have a high-deductible health insurance plan, you can contribute to an HSA. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

9. Home Energy Credits:

If you’ve made energy-efficient improvements to your home, you might be eligible for tax credits. These credits can cover a portion of the cost of upgrades like solar panels, energy-efficient windows, and insulation.

10. Adoption Tax Credit:

This credit is available to taxpayers who adopt a child. It can help offset the costs associated with adoption, such as legal fees, travel expenses, and court costs.

Tips for Maximizing Your Tax Savings:

- Keep Detailed Records: Maintain organized records of all your income and expenses throughout the year. This will make it easier to claim all eligible deductions and credits.

- Consult a Tax Professional: If you’re unsure about which deductions and credits you qualify for, seek advice from a qualified tax professional. They can help you navigate the complexities of the tax code and ensure you’re taking advantage of all available savings.

- Stay Informed: Tax laws are constantly evolving, so it’s essential to stay updated on any changes that might affect your tax situation.

Conclusion:

The tax system can seem daunting, but it doesn’t have to be. By understanding the power of deductions and credits, you can significantly reduce your tax liability and maximize your refund. This article has provided you with a roadmap to 10 powerful deductions and credits that can make a real difference in your financial well-being. Remember to keep detailed records, seek professional advice when needed, and stay informed about any changes in tax laws. With the right knowledge and preparation, you can confidently navigate tax season and unleash your tax savings.

Closure

Thus, we hope this article has provided valuable insights into Unleash Your Tax Savings: 10 Powerful Deductions and Credits You Need to Know. We hope you find this article informative and beneficial. See you in our next article!

google.com