The Essential 5-Point Framework for Unleashing Financial Accountability

Related Articles: The Essential 5-Point Framework for Unleashing Financial Accountability

- 5 Powerful Strategies To Crush Your Tax Bill And Maximize Your Savings

- 5 Brilliant Ways To Maximize Your Credit Card Rewards

- The Crucial Role Of Financial Advisors: 5 Ways They Can Transform Your Financial Future

- Finance financial company financials traditional training capital venture business approach modern management non stock funds blocks reasons properly deal money

- Conquer Student Loan Debt: 5 Powerful Strategies For Financial Freedom

Introduction

With great pleasure, we will explore the intriguing topic related to The Essential 5-Point Framework for Unleashing Financial Accountability. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essential 5-Point Framework for Unleashing Financial Accountability

Financial accountability – a concept often met with groans and sighs, conjuring images of tedious spreadsheets and restrictive budgets. Yet, the truth is far more empowering. Financial accountability isn’t about limitations; it’s about unleashing the potential for a secure, fulfilling, and prosperous future. It’s about taking control of your financial destiny, ensuring your hard-earned money works for you, not against you.

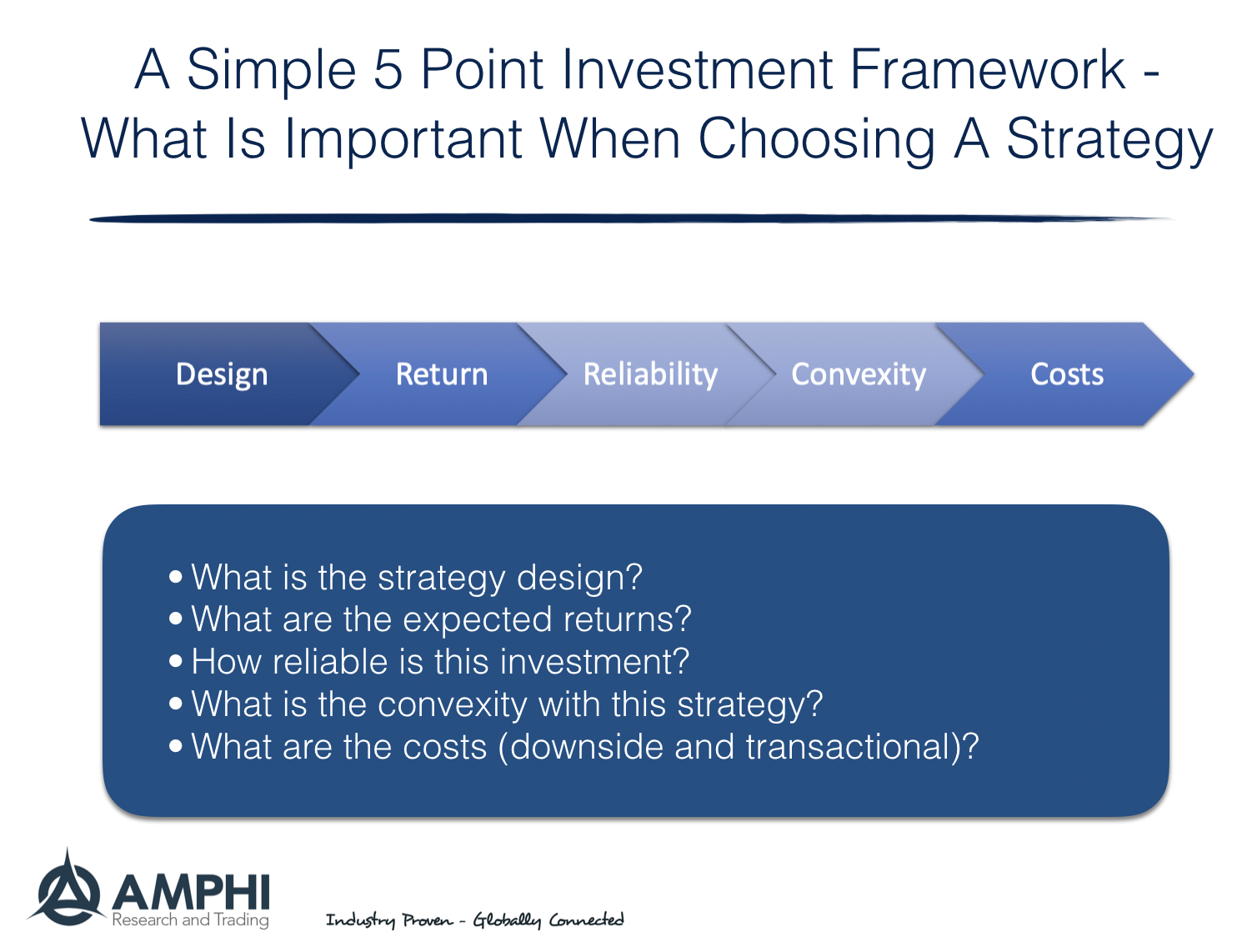

This article will delve into the crucial importance of financial accountability, outlining a 5-point framework to guide you on your journey towards financial freedom. By embracing these principles, you’ll not only gain control of your finances but also cultivate a mindset that fosters responsible and sustainable financial habits.

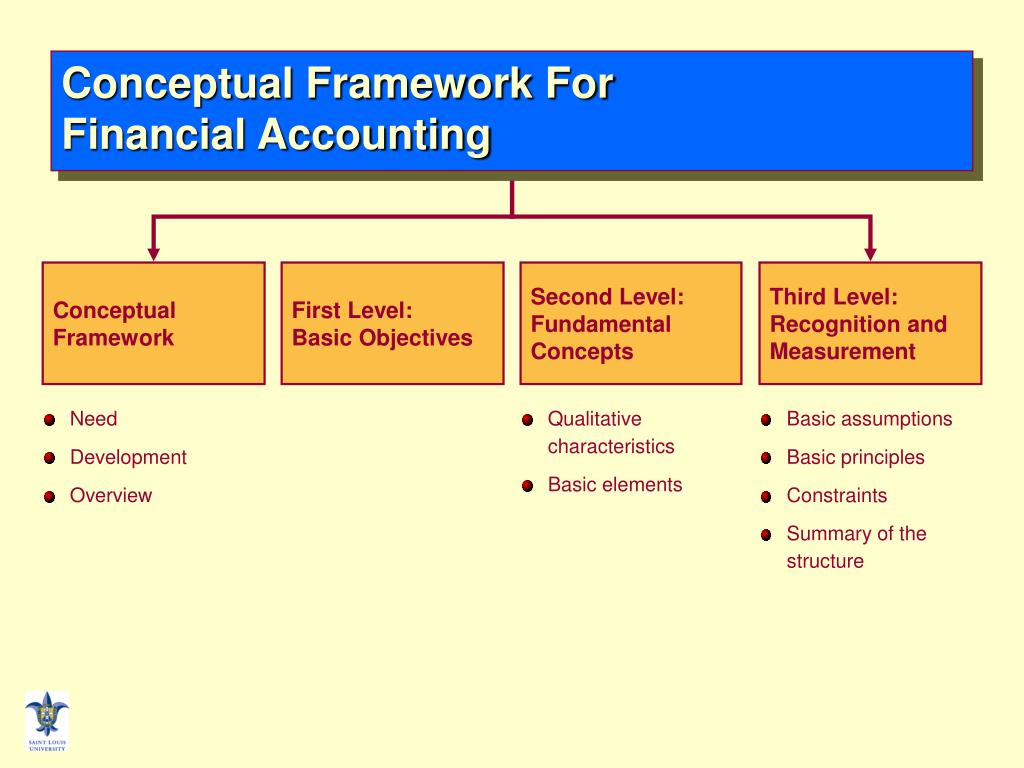

1. The Power of Transparency: Unveiling the Truth

Financial accountability starts with honesty. It means acknowledging your current financial position, good or bad, without sugarcoating or denial. This requires a clear understanding of your income, expenses, debts, and assets.

- Track Your Income: Begin by meticulously recording all your sources of income, including salary, investments, and any additional income streams.

- Map Your Expenses: Identify and categorize your expenses. This can be done through budgeting apps, spreadsheets, or even simply using a notebook.

- Face Your Debts: Don’t shy away from your debts. List them out, including the amount owed, interest rates, and minimum payments.

- Inventory Your Assets: Take stock of your assets, including savings, investments, real estate, and any valuable possessions.

This process may feel daunting, but it’s the foundation of financial accountability. By understanding your current financial landscape, you gain the clarity needed to make informed decisions and chart a path forward.

2. Setting SMART Goals: Navigating Your Financial Journey

Once you’ve gained a comprehensive understanding of your financial situation, it’s time to set goals. But setting goals isn’t enough; they need to be SMART – Specific, Measurable, Achievable, Relevant, and Time-bound.

-

- Specific: Instead of vague goals like “save more,” aim for “save $500 per month for a down payment on a house.”

- Measurable: Quantify your goals. Instead of “reduce debt,” aim for “reduce credit card debt by $1,000 in the next six months.”

- Achievable: Set realistic goals you can reasonably achieve. Don’t aim for the moon if you’re just starting your financial journey.

- Relevant: Ensure your goals align with your values and priorities. Don’t chase wealth if it means sacrificing your well-being.

- Time-bound: Set deadlines for achieving your goals. This creates a sense of urgency and keeps you accountable.

By setting SMART goals, you give your financial journey a clear direction. Each goal becomes a stepping stone, guiding you towards your ultimate financial aspirations.

3. Budgeting: The Blueprint for Financial Control

Budgeting is the cornerstone of financial accountability. It’s the roadmap that helps you allocate your income strategically, ensuring your money is working for you, not against you.

- The Zero-Based Budget: This method requires you to allocate every dollar of your income to a specific category, leaving no room for unplanned spending.

- The 50/30/20 Rule: This simple rule allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- The Envelope System: This method involves dividing your cash into envelopes for different categories, ensuring you don’t overspend in any one area.

The best budgeting method depends on your personal preferences and financial situation. Experiment with different methods until you find one that works for you.

4. Saving and Investing: Building Your Financial Future

Saving and investing are crucial for long-term financial security. They allow you to grow your wealth and achieve your financial goals, from retirement planning to buying a home.

- Emergency Fund: A well-stocked emergency fund acts as a safety net, providing a buffer during unexpected financial emergencies. Aim for 3-6 months of living expenses.

- Retirement Savings: Start saving for retirement early, even if it’s just a small amount. Take advantage of employer-sponsored retirement plans like 401(k)s.

- Investing: Consider investing in stocks, bonds, mutual funds, or real estate. Remember that investment involves risk, so diversify your portfolio to mitigate potential losses.

The earlier you start saving and investing, the more time your money has to grow. Compound interest, the eighth wonder of the world, will work its magic, turning small amounts into substantial wealth over time.

5. Debt Management: Breaking Free from the Shackles

Debt can be a crippling burden, hindering your financial progress. Effective debt management is essential for achieving financial accountability.

- Prioritize High-Interest Debt: Focus on paying down high-interest debt first, like credit card debt, as it can quickly snowball.

- Debt Consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate.

- Debt Snowball Method: This method involves paying off your smallest debt first, gaining momentum and motivation as you go.

- Debt Avalanche Method: This method focuses on paying down debts with the highest interest rates first, saving the most on interest charges.

By taking proactive steps to manage your debt, you free yourself from the shackles of interest payments and pave the way for financial freedom.

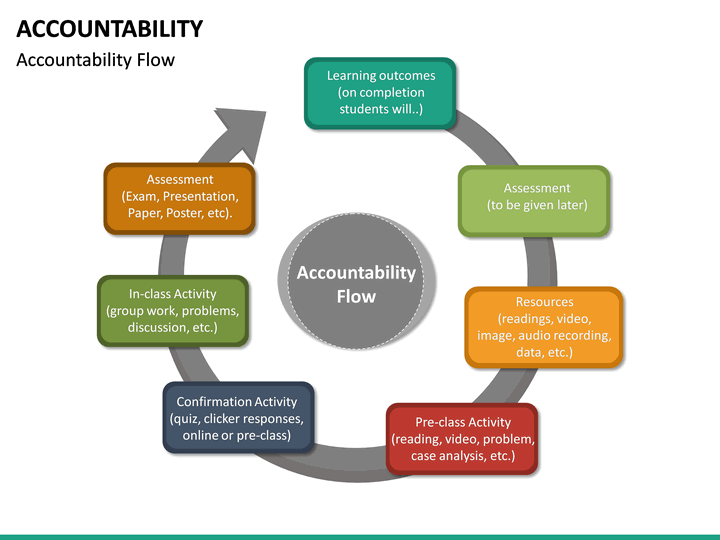

The Importance of Financial Accountability in Everyday Life

Financial accountability is not just about spreadsheets and budgets; it’s about cultivating a mindset that prioritizes responsible financial habits. It’s about making informed choices that align with your long-term goals.

- Mindful Spending: Before you spend, ask yourself: “Is this a need or a want? Can I afford it?” Avoid impulse purchases and focus on value.

- Negotiating and Saving: Don’t be afraid to negotiate prices, shop around for better deals, and take advantage of discounts and promotions.

- Living Below Your Means: Avoid lifestyle inflation. Just because you earn more doesn’t mean you have to spend more.

- Investing in Yourself: Invest in your education, skills, and health. These investments can pay dividends for years to come.

By incorporating these principles into your daily life, you’ll gradually develop a stronger financial foundation and a more empowered mindset.

The Benefits of Financial Accountability

The benefits of embracing financial accountability are numerous and far-reaching:

- Reduced Financial Stress: Knowing you have a plan and are in control of your finances reduces anxiety and worry.

- Increased Financial Security: A solid financial foundation provides a safety net during unexpected events and allows you to pursue your dreams.

- Greater Freedom and Flexibility: Financial accountability gives you the freedom to make choices that align with your values and priorities.

- Improved Relationships: Financial stress can strain relationships. By being financially accountable, you can strengthen your personal and professional bonds.

Conclusion: Embracing a Brighter Financial Future

Financial accountability is not about deprivation; it’s about empowerment. It’s about taking control of your financial destiny and creating a future filled with possibilities. By embracing the principles outlined in this article, you can unleash your financial potential, build a secure future, and achieve your financial dreams. Remember, financial accountability is a journey, not a destination. It requires commitment, discipline, and a willingness to learn and adapt. But the rewards are well worth the effort.

Start your journey today. Take the first step towards a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into The Essential 5-Point Framework for Unleashing Financial Accountability. We thank you for taking the time to read this article. See you in our next article!

google.com