Unlock 5 Powerful Strategies to Effortlessly Refinance Your Mortgage

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlock 5 Powerful Strategies to Effortlessly Refinance Your Mortgage. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlock 5 Powerful Strategies to Effortlessly Refinance Your Mortgage

The current economic landscape has many homeowners questioning whether refinancing their mortgage is the right move. With interest rates fluctuating and the housing market in a state of flux, it’s easy to feel overwhelmed by the decision. However, refinancing can be a powerful tool to unlock significant savings and improve your financial future.

This article will guide you through 5 key strategies to effortlessly navigate the refinancing process, empowering you to make an informed decision that aligns with your individual financial goals.

1. Determine Your Refinancing Goals:

Before diving into the details of refinancing, it’s crucial to define your objectives. Ask yourself:

- What are you hoping to achieve by refinancing?

- Are you aiming to lower your monthly payments?

- Do you want to shorten your loan term?

- Are you looking to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage for greater stability?

- What are your financial constraints?

- Do you have sufficient equity in your home to qualify for refinancing?

- What is your credit score?

- How much can you afford for closing costs?

By understanding your motivations and limitations, you can clearly identify the best refinancing options for your situation.

2. Research and Compare Loan Options:

Once you know your goals, it’s time to explore the different loan options available. Consider factors like:

- Loan type: Fixed-rate mortgages offer predictable payments, while ARMs can start with lower rates but may increase over time.

- Interest rate: Compare interest rates from multiple lenders to secure the best deal.

- Loan term: A shorter term leads to higher monthly payments but faster payoff, while a longer term results in lower monthly payments but higher overall interest costs.

- Closing costs: These fees can vary significantly between lenders, so factor them into your calculations.

3. Analyze Your Current Mortgage:

Before you commit to refinancing, take a close look at your current mortgage. Consider:

- Remaining loan balance: This will determine the amount you need to refinance.

- Interest rate: Compare your current rate to the rates offered by lenders.

- Loan term: How much time remains on your current mortgage?

- Prepayment penalties: Some mortgages have penalties for early repayment, so check your loan documents carefully.

4. Gather Necessary Documents:

To apply for a refinance, lenders will require certain documents to verify your financial information. This typically includes:

- Proof of income: Pay stubs, tax returns, or W-2 forms.

- Credit report: Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion).

- Bank statements: These will demonstrate your financial stability and ability to repay the loan.

- Home appraisal: Lenders will require an appraisal to assess the current market value of your home.

5. Shop Around and Negotiate:

Don’t settle for the first offer you receive. Compare rates and terms from multiple lenders to find the best deal.

- Use online mortgage calculators: These tools can help you estimate monthly payments and compare different loan options.

- Talk to a mortgage broker: Brokers can connect you with multiple lenders and negotiate on your behalf.

- Be prepared to negotiate: Don’t be afraid to ask for a lower interest rate or reduced closing costs.

Navigating the Refinancing Process:

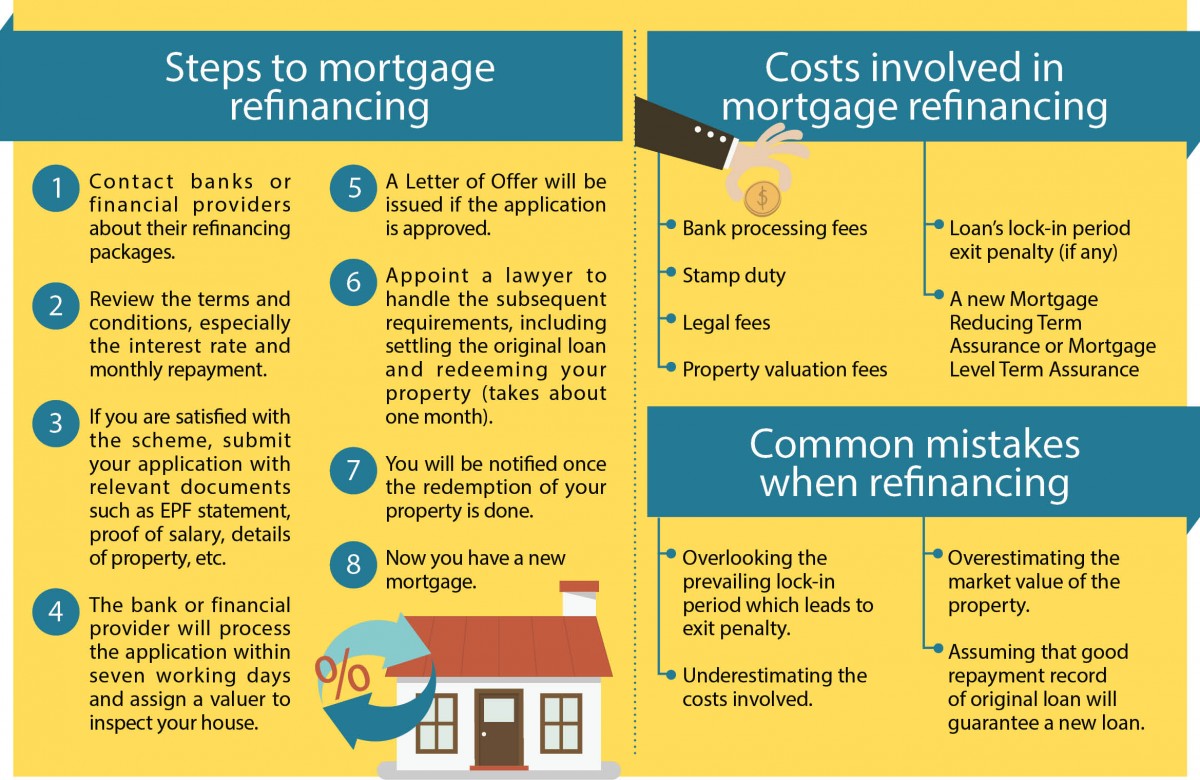

Once you’ve chosen a lender and secured a loan offer, the refinancing process typically involves the following steps:

- Application: Submit your application and supporting documents to the lender.

- Underwriting: The lender will review your application and verify your financial information.

- Appraisal: A professional appraiser will assess the value of your home.

- Closing: You will sign all necessary documents and receive the new loan proceeds.

Considerations and Potential Pitfalls:

While refinancing can be a beneficial financial move, it’s essential to consider potential downsides:

- Closing costs: These fees can range from 2% to 5% of the loan amount, so factor them into your calculations.

- Interest rate lock: Ensure you understand the terms of the rate lock and its expiration date.

- Prepayment penalties: Some lenders may charge penalties if you pay off your loan early.

- Impact on your credit score: A hard inquiry on your credit report can temporarily lower your score.

Conclusion:

Refinancing your mortgage can be a powerful tool to unlock significant financial benefits. By following these 5 strategies, you can effortlessly navigate the process and make an informed decision that aligns with your individual goals. Remember to carefully research your options, compare rates and terms, and consider all potential costs and risks before making a final decision.

Remember: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor to determine if refinancing is right for you and to develop a personalized financial plan.

Closure

Thus, we hope this article has provided valuable insights into Unlock 5 Powerful Strategies to Effortlessly Refinance Your Mortgage. We appreciate your attention to our article. See you in our next article!

google.com