Unlock 5 Powerful Strategies to Supercharge Your Investment Portfolio

Related Articles: Unlock 5 Powerful Strategies to Supercharge Your Investment Portfolio

- Master Your Finances: A 5-Step Guide To Creating A Powerful Family Budget

- Conquer Debt: 5 Powerful Strategies To Achieve Financial Freedom Faster

- 5 Crucial Reasons Why Essential Financial Checkups Are Non-Negotiable

- Non profit organization development plan Non profit financial plan template

- The Crucial Power Of 5 Key Financial Literacy Skills

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlock 5 Powerful Strategies to Supercharge Your Investment Portfolio. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlock 5 Powerful Strategies to Supercharge Your Investment Portfolio

The pursuit of financial security is a journey that involves navigating a complex landscape of investment options. While the allure of quick riches might entice some, the path to true wealth lies in building a well-structured and optimized investment portfolio. This strategic approach ensures your investments work tirelessly for you, growing steadily over time and weathering market fluctuations.

This article will delve into five powerful strategies that can transform your portfolio from a passive collection of assets into a dynamic engine of wealth creation. By embracing these strategies, you can unlock the full potential of your investments and confidently stride towards your financial goals.

1. Defining Your Investment Goals: The Foundation of Success

Before embarking on any investment journey, it’s crucial to establish a clear understanding of your financial goals. This step serves as the foundation upon which your entire investment strategy rests. Without well-defined goals, your investments will lack direction, resembling a ship adrift at sea.

What are your investment goals?

- Short-term goals: These are typically achieved within a timeframe of one to five years. Examples include saving for a down payment on a house, a vacation, or a new car.

- Medium-term goals: These goals typically span five to ten years. Examples include funding your child’s education or accumulating a comfortable retirement nest egg.

- Long-term goals: These goals extend beyond ten years and often involve achieving financial independence or leaving a legacy for future generations.

How to define your goals:

-

- Be specific: Instead of simply stating “I want to retire early,” specify the desired age and the annual income you aim to achieve.

- Set realistic expectations: Consider your current financial situation, risk tolerance, and time horizon.

- Prioritize your goals: Rank your goals based on their importance and urgency.

- Write them down: Visualizing your goals in writing reinforces their importance and helps keep you motivated.

2. Understanding Your Risk Tolerance: Navigating the Volatility Spectrum

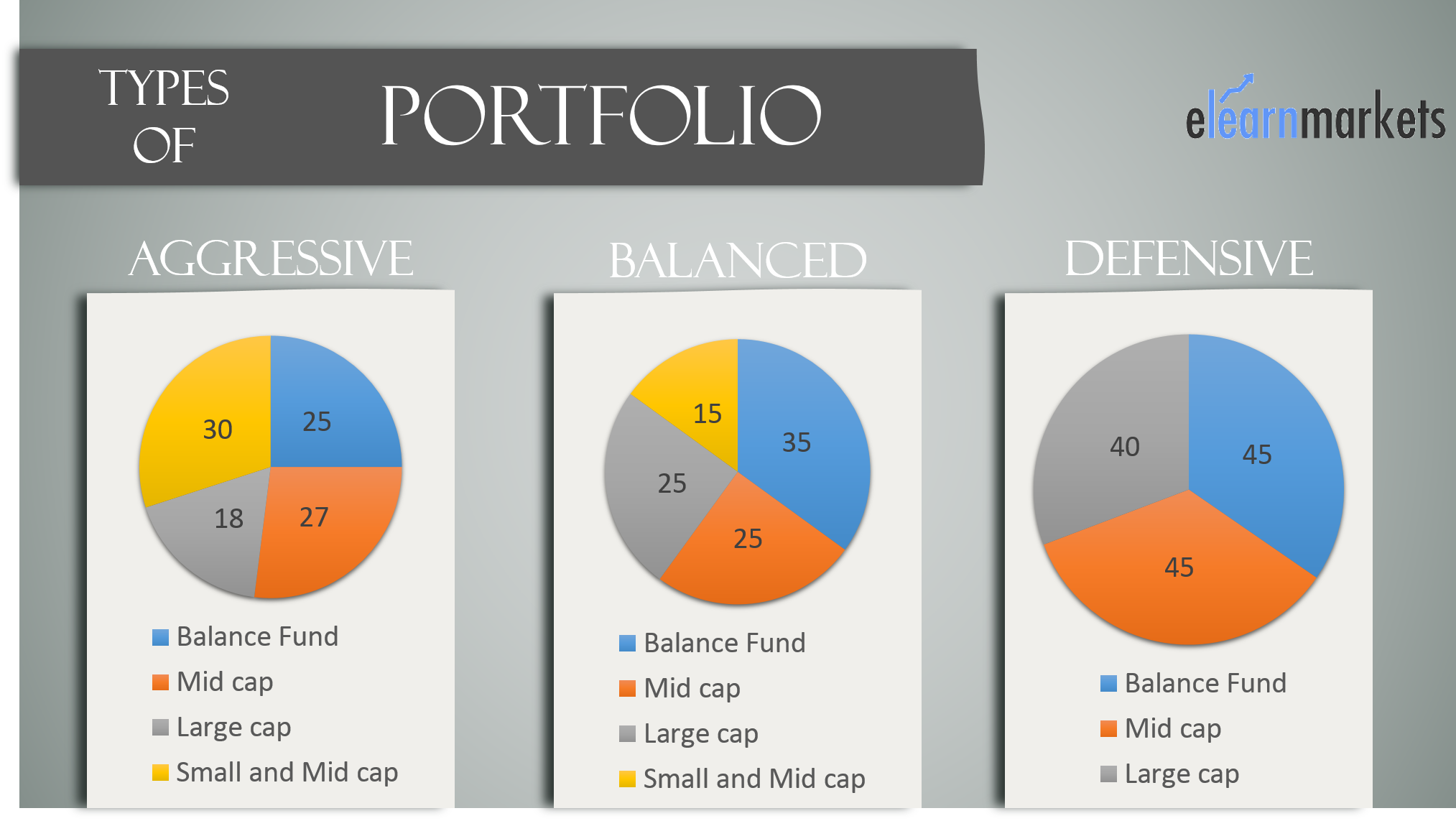

Every investor possesses a unique risk tolerance, a measure of their ability and willingness to accept potential losses in pursuit of higher returns. Recognizing your risk tolerance is crucial for making informed investment decisions.

What is your risk tolerance?

- High risk tolerance: Investors with a high risk tolerance are comfortable with the possibility of significant losses in exchange for the potential for substantial gains. They typically favor investments like growth stocks, emerging markets, and high-yield bonds.

- Moderate risk tolerance: Investors with moderate risk tolerance seek a balance between risk and reward. They might invest in a mix of stocks, bonds, and real estate.

- Low risk tolerance: Investors with a low risk tolerance prioritize capital preservation over potential gains. They tend to favor conservative investments like fixed deposits, government bonds, and low-yield bonds.

How to determine your risk tolerance:

- Consider your financial situation: Evaluate your income, expenses, and existing assets.

- Assess your time horizon: The longer your investment horizon, the more time you have to recover from potential losses.

- Analyze your emotional response to market fluctuations: How would you react to a significant market downturn?

- Take a risk tolerance questionnaire: Many financial institutions offer online questionnaires to help you assess your risk profile.

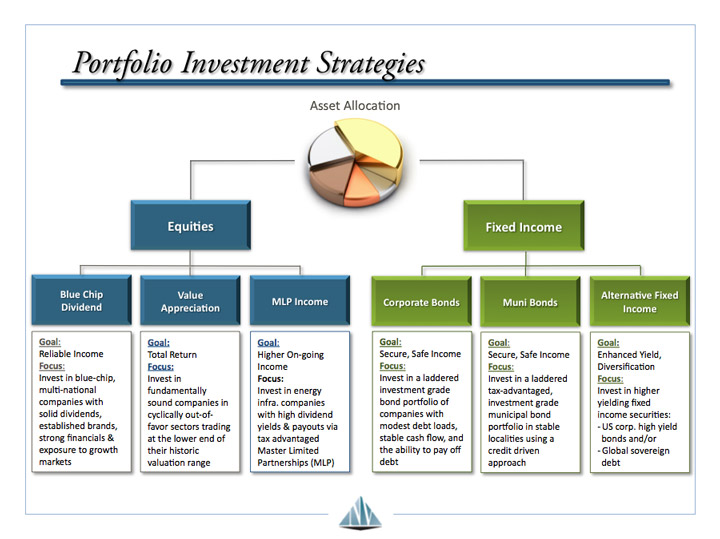

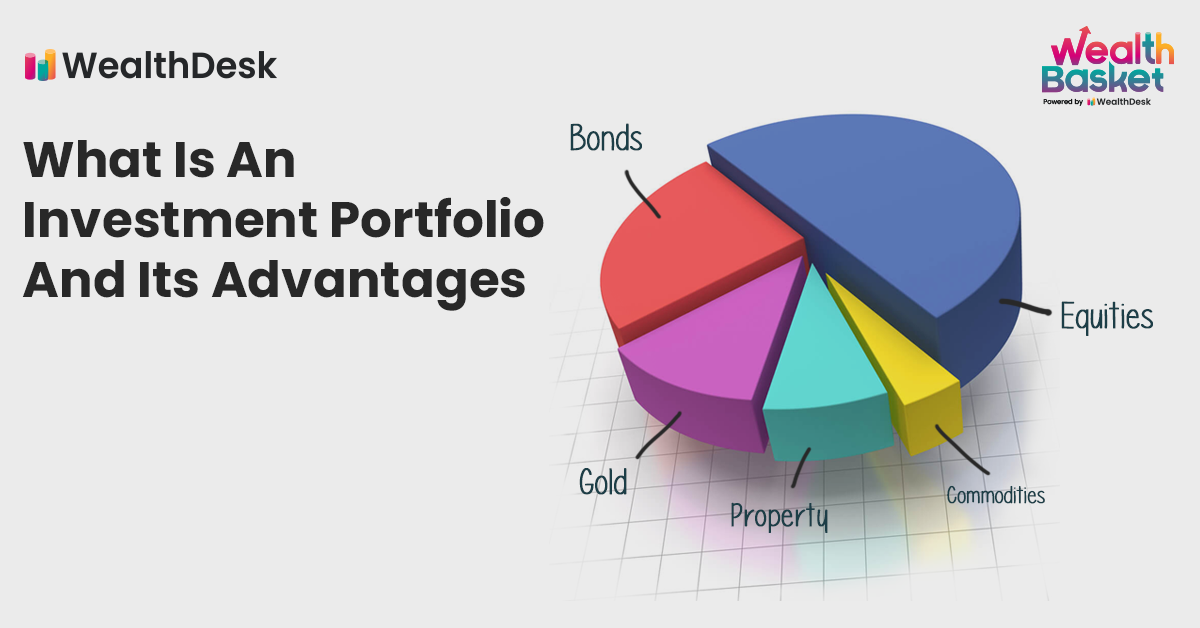

3. Diversification: Spreading Your Risk Across Multiple Asset Classes

Diversification is the cornerstone of a well-optimized investment portfolio. It involves allocating your investments across a variety of asset classes, such as stocks, bonds, real estate, and commodities. This strategy reduces the overall risk of your portfolio by mitigating the impact of any single asset class’s poor performance.

Why diversify?

- Reduces risk: By spreading your investments across different asset classes, you minimize the potential for significant losses.

- Enhances returns: Diversification allows you to capitalize on the potential for growth across multiple asset classes.

- Provides stability: In a volatile market, diversifying your portfolio can help maintain its overall value.

How to diversify:

- Allocate your investments across different asset classes: Determine the appropriate asset allocation based on your risk tolerance and investment goals.

- Invest in different sectors within each asset class: Don’t just invest in the S&P 500; consider investing in individual stocks across various sectors, such as technology, healthcare, and energy.

- Utilize ETFs and mutual funds: These vehicles allow you to diversify your investments across a broad range of assets with a single investment.

4. Regularly Rebalancing Your Portfolio: Staying Aligned with Your Goals

As your investments grow and market conditions fluctuate, your portfolio’s asset allocation can drift away from your original target. Regular rebalancing ensures your portfolio remains aligned with your investment goals and risk tolerance.

Why rebalance?

- Maintains desired asset allocation: Rebalancing ensures your portfolio remains balanced and aligned with your risk tolerance.

- Reduces risk: By selling off overperforming assets and reinvesting in underperforming ones, you can mitigate potential losses.

- Enhances returns: By rebalancing, you can capitalize on opportunities in underperforming asset classes.

How to rebalance:

- Set a rebalancing schedule: Rebalance your portfolio annually, semi-annually, or quarterly depending on your investment goals and risk tolerance.

- Monitor your portfolio’s performance: Track the performance of each asset class and compare it to your target allocation.

- Adjust your holdings: If your portfolio has drifted significantly from your target allocation, adjust your holdings by selling off overperforming assets and reinvesting in underperforming ones.

5. Seeking Professional Advice: Navigating the Labyrinth of Investment Options

While the principles of investing are relatively straightforward, the labyrinth of investment options can be overwhelming. Seeking advice from a qualified financial advisor can provide valuable guidance and support throughout your investment journey.

Why seek professional advice?

- Expert knowledge and experience: Financial advisors possess extensive knowledge and experience in the investment world.

- Personalized guidance: They can tailor investment strategies to your specific goals, risk tolerance, and financial situation.

- Objective perspective: They can provide an unbiased perspective and help you avoid emotional decision-making.

- Ongoing support: They can offer ongoing support and guidance as your financial needs evolve.

How to find a qualified financial advisor:

- Seek recommendations from trusted sources: Ask friends, family, or colleagues for referrals.

- Check credentials and experience: Ensure the advisor is licensed and has a proven track record.

- Consider their fees: Understand the advisor’s fee structure and ensure it aligns with your budget.

- Schedule a consultation: Meet with potential advisors to discuss your financial goals and investment philosophy.

Conclusion: Embracing a Strategic Approach to Investment Success

Optimizing your investment portfolio is an ongoing process that requires continuous monitoring, adjustments, and professional guidance. By embracing the five strategies outlined above, you can build a robust and dynamic portfolio that works tirelessly for you, driving you closer to your financial goals.

Remember, the path to financial security is not a sprint but a marathon. It demands patience, discipline, and a commitment to long-term growth. With a well-defined investment strategy, a proactive approach to risk management, and a willingness to seek professional guidance, you can unlock the full potential of your investments and achieve financial independence.

Closure

Thus, we hope this article has provided valuable insights into Unlock 5 Powerful Strategies to Supercharge Your Investment Portfolio. We thank you for taking the time to read this article. See you in our next article!

google.com