Unlock Your Financial Power: 5 Essential Steps to Decipher Your Credit Report

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlock Your Financial Power: 5 Essential Steps to Decipher Your Credit Report. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlock Your Financial Power: 5 Essential Steps to Decipher Your Credit Report

Understanding your credit report is a vital step towards achieving financial freedom. It’s a detailed document that outlines your credit history, revealing your financial habits and how lenders perceive your trustworthiness. While it might seem daunting at first, navigating your credit report is surprisingly simple. By following these five key steps, you can unlock valuable insights into your financial standing and take control of your financial future.

Step 1: Access Your Credit Report

The first step is to obtain a copy of your credit report. You are entitled to a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every 12 months through AnnualCreditReport.com. This website is the only authorized source for free credit reports, so be wary of any other websites claiming to offer free reports.

Step 2: Understand the Structure of Your Report

Your credit report is organized into several key sections:

-

- Personal Information: This section includes your name, address, Social Security number, and date of birth.

- Credit Accounts: This section lists all your current and past credit accounts, including credit cards, loans, mortgages, and other lines of credit. It details the account type, account number, credit limit, balance, payment history, and date opened.

- Inquiries: This section lists all recent inquiries made by lenders to check your credit history.

- Public Records: This section includes any public records that may affect your credit, such as bankruptcies, foreclosures, or tax liens.

- Credit Score: While your credit score is not directly included in your credit report, it is often provided alongside the report.

Step 3: Analyze Your Credit History

Once you have your credit report, it’s time to analyze your credit history. Start by reviewing the information in each section carefully.

-

- Payment History: This is the most important factor affecting your credit score. Look for any late payments or missed payments. A single late payment can negatively impact your score, while a pattern of late payments can significantly damage your creditworthiness.

- Credit Utilization: This refers to the amount of credit you are using compared to your available credit limit. A high credit utilization ratio can negatively impact your credit score. Aim to keep your credit utilization below 30%.

- Credit Mix: Having a variety of credit accounts, such as credit cards, installment loans, and mortgages, can demonstrate responsible credit management.

- Length of Credit History: The longer your credit history, the better. This shows lenders that you have a track record of managing credit responsibly.

- Inquiries: Hard inquiries, made when lenders check your credit before approving a loan, can temporarily lower your credit score. Soft inquiries, made for purposes like pre-approval or when you check your own credit, do not affect your score.

Step 4: Identify and Resolve Errors

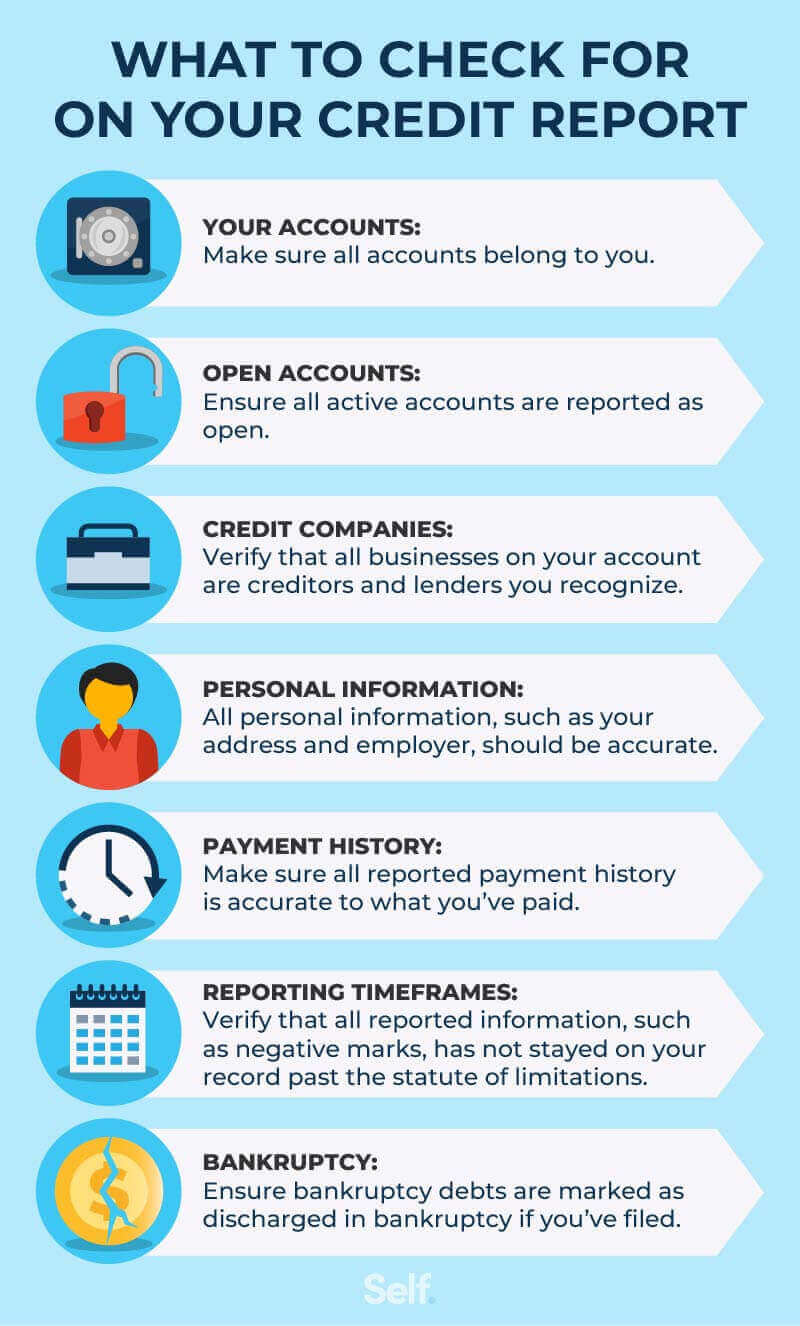

Credit reports are not always perfect. Errors can occur due to data entry mistakes, identity theft, or even outdated information. It’s crucial to carefully review your credit report for any inaccuracies.

- Incorrect Information: Look for any errors in your personal information, account details, payment history, or public records.

- Unfamiliar Accounts: If you see any accounts you don’t recognize, it could be a sign of identity theft.

- Outdated Information: Check for any outdated information, such as closed accounts or accounts that are no longer active.

If you find any errors, dispute them immediately with the credit bureau. You can file a dispute online, by mail, or by phone. The credit bureau will investigate your claim and correct any errors within 30 days.

Step 5: Create a Credit Improvement Plan

Once you have a clear understanding of your credit history, you can create a plan to improve your credit score. Here are some tips:

- Pay Your Bills on Time: This is the most important step in improving your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

- Lower Your Credit Utilization: Reduce your credit card balances and avoid maxing out your cards.

- Become an Authorized User: Ask a friend or family member with good credit to add you as an authorized user on their credit card account. This can help you build your credit history.

- Consider a Secured Credit Card: If you have limited credit history, a secured credit card can help you build credit. You make a security deposit, which acts as your credit limit.

- Avoid Applying for Too Much Credit: Too many hard inquiries can lower your credit score. Only apply for credit when you truly need it.

- Monitor Your Credit Report Regularly: Check your credit report at least once a year to ensure there are no errors and to track your progress.

Beyond the Numbers: The True Value of Your Credit Report

Understanding your credit report is more than just a number; it’s a window into your financial well-being. It can help you:

- Secure Lower Interest Rates: A good credit score qualifies you for lower interest rates on loans, mortgages, and credit cards, saving you money in the long run.

- Qualify for Better Financial Products: A strong credit history can open doors to better financial products, such as credit cards with rewards, lower insurance premiums, and more favorable loan terms.

- Improve Your Financial Habits: By understanding your credit report, you can identify areas where you can improve your financial habits, such as paying bills on time and managing credit responsibly.

- Protect Yourself from Identity Theft: Regularly monitoring your credit report can help you detect any signs of identity theft, allowing you to take action quickly to minimize damage.

The Power of Knowledge:

Your credit report is a powerful tool that can help you achieve your financial goals. By understanding its structure, analyzing your credit history, and taking proactive steps to improve your credit score, you can unlock financial freedom and build a secure financial future. Remember, your credit report is a reflection of your financial responsibility, and by taking control of it, you take control of your financial destiny.

Closure

Thus, we hope this article has provided valuable insights into Unlock Your Financial Power: 5 Essential Steps to Decipher Your Credit Report. We thank you for taking the time to read this article. See you in our next article!

google.com