Unlocking the Power of 5%: Demystifying Interest Rates and How They Impact Your Finances

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the Power of 5%: Demystifying Interest Rates and How They Impact Your Finances. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking the Power of 5%: Demystifying Interest Rates and How They Impact Your Finances

Interest rates, a seemingly complex financial concept, are often shrouded in mystery, leaving many individuals feeling lost and overwhelmed. But understanding interest rates is not just about navigating the intricacies of financial jargon; it’s about empowering yourself to make informed decisions that can significantly impact your financial well-being.

This article aims to demystify the world of interest rates, breaking down the fundamentals and exploring how they influence your everyday financial life. By the end, you’ll be equipped with the knowledge to navigate the world of interest rates with confidence, whether you’re saving for the future, taking out a loan, or managing your debt.

What are Interest Rates?

At its core, an interest rate is simply the cost of borrowing money or the reward for lending money. It’s expressed as a percentage of the principal amount borrowed or lent. Think of it as a rental fee for using someone else’s money.

- Borrowing: When you take out a loan, you’re essentially renting money from a lender. The interest rate represents the price you pay for that privilege. The higher the interest rate, the more expensive the loan becomes.

- Saving: When you deposit money into a savings account, you’re lending money to the bank. The interest rate represents the reward you receive for letting the bank use your money. The higher the interest rate, the more your savings grow over time.

Types of Interest Rates:

Interest rates can be categorized into different types, each with its own specific application:

- Fixed Interest Rates: These rates remain constant throughout the loan term. This provides predictability and stability, especially in times of fluctuating interest rates.

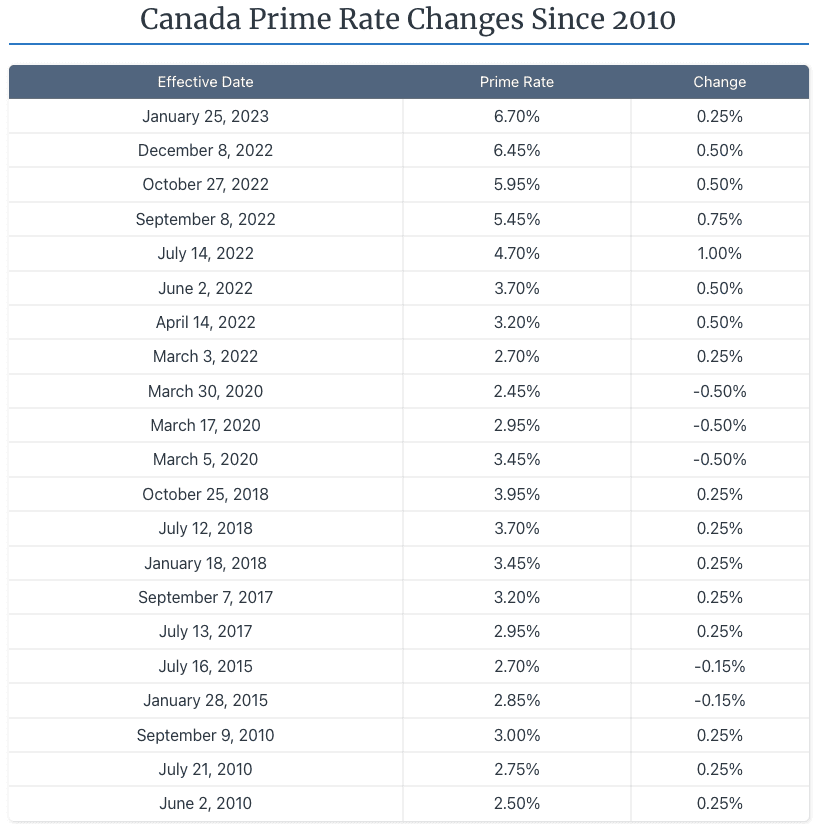

- Variable Interest Rates: These rates fluctuate based on market conditions, such as the prime rate or a specific benchmark. While they offer potential for lower initial rates, they also carry the risk of increasing over time.

- Simple Interest: This is calculated only on the principal amount borrowed or lent. It’s the most basic form of interest calculation.

- Compound Interest: This is calculated on both the principal and accumulated interest. It’s often referred to as "interest on interest" and can lead to significant growth over time, especially when invested for long periods.

Factors Influencing Interest Rates:

Interest rates are influenced by a complex interplay of economic factors, including:

- Inflation: When inflation rises, lenders demand higher interest rates to compensate for the decreasing purchasing power of their money.

- Economic Growth: Strong economic growth often leads to lower interest rates as lenders are more willing to lend money. Conversely, weak economic growth can lead to higher interest rates as lenders become more cautious.

- Government Policies: Central banks, like the Federal Reserve in the United States, influence interest rates through monetary policy tools such as adjusting the federal funds rate.

- Supply and Demand: The availability of funds and the demand for borrowing influence interest rates. When demand for loans is high, interest rates tend to rise.

Impact of Interest Rates on Your Finances:

Interest rates play a significant role in various aspects of your financial life:

- Mortgages: The interest rate on your mortgage directly impacts your monthly payments and the total cost of your home. Lower interest rates lead to lower monthly payments and lower overall borrowing costs.

- Loans: Interest rates on personal loans, auto loans, and student loans determine the cost of borrowing. Lower interest rates mean lower monthly payments and less interest paid over the life of the loan.

- Savings Accounts: The interest rate on your savings account determines how much your savings grow over time. Higher interest rates lead to faster growth of your savings.

- Credit Cards: The interest rate on your credit card determines the cost of carrying a balance. High interest rates can quickly lead to significant debt accumulation.

Strategies for Managing Interest Rates:

- Shop Around: Compare interest rates from different lenders before taking out a loan or opening a savings account.

- Improve Your Credit Score: A higher credit score can qualify you for lower interest rates on loans.

- Consider Fixed-Rate Options: Fixed-rate loans provide stability and predictability, especially during periods of rising interest rates.

- Negotiate: Don’t be afraid to negotiate with lenders to try and secure a lower interest rate.

- Pay Down Debt: Prioritize paying down high-interest debt, such as credit card debt, to minimize interest charges.

- Maximize Savings: Look for savings accounts with higher interest rates to maximize the growth of your savings.

Conclusion:

Understanding interest rates is crucial for making informed financial decisions. By recognizing how interest rates work and how they influence your financial life, you can take control of your finances and make choices that benefit your financial well-being. Whether you’re saving for retirement, buying a home, or managing your debt, a solid understanding of interest rates can empower you to navigate the financial landscape with confidence.

Remember, knowledge is power, and understanding interest rates can unlock a world of financial possibilities.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Power of 5%: Demystifying Interest Rates and How They Impact Your Finances. We thank you for taking the time to read this article. See you in our next article!

google.com