Unlocking Your 5-Step Blueprint to Ultimate Financial Freedom

Related Articles: Unlocking Your 5-Step Blueprint to Ultimate Financial Freedom

- Unleash Financial Freedom: 7 Powerful Steps To Master Your Monthly Budget

- The Essential 5-Point Framework For Unleashing Financial Accountability

- 5 Unbreakable Strategies For Building A Robust Retirement Portfolio

- 5 Strategic Steps To Conquer Unexpected Expenses And Achieve Financial Peace

- The Unstoppable Power Of Bonds: 5 Reasons They Deserve A Place In Your Portfolio

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking Your 5-Step Blueprint to Ultimate Financial Freedom. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

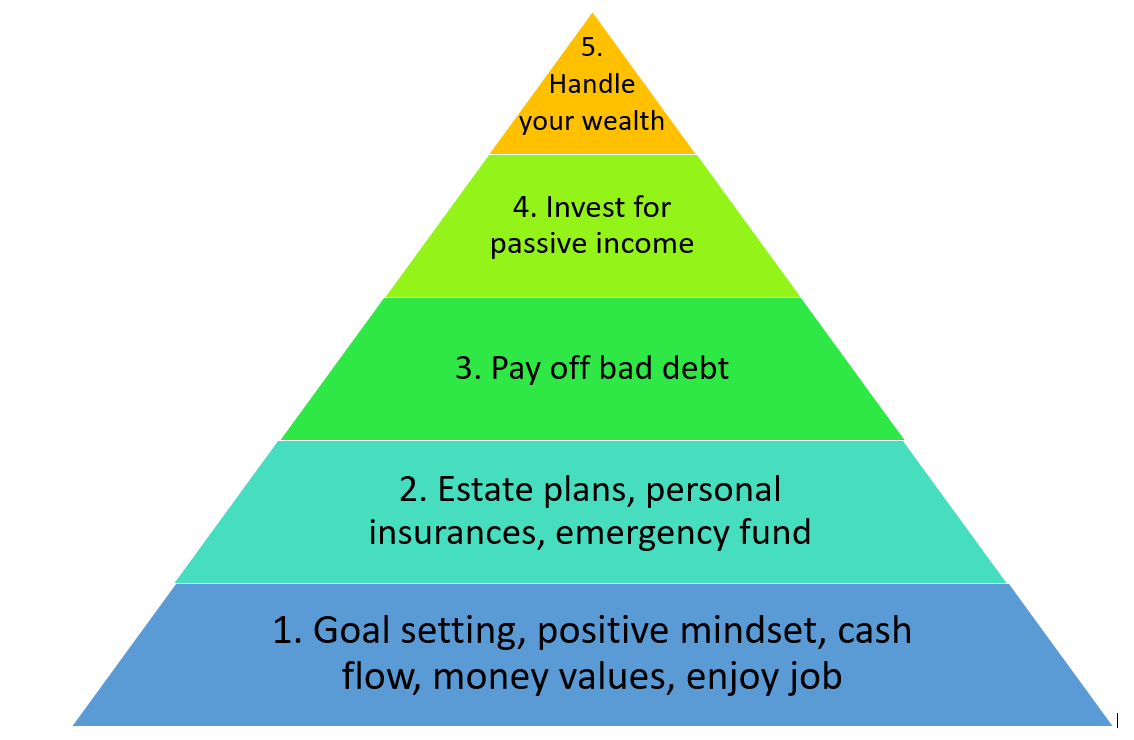

Unlocking Your 5-Step Blueprint to Ultimate Financial Freedom

The pursuit of financial freedom is a universal desire, a beacon of hope guiding us towards a life unburdened by financial constraints. Yet, the journey can feel daunting, a labyrinth of complex concepts and overwhelming choices. But fear not, for this article will equip you with a clear, actionable 5-step blueprint to unlock your own path to financial freedom.

We’ll delve into the core principles, practical strategies, and mindset shifts that will transform your relationship with money. By following this guide, you’ll gain the clarity and confidence to take control of your finances and build a future where money works for you, not the other way around.

Step 1: Define Your Financial Freedom

The first step on this journey is to define what financial freedom truly means to you. It’s not a one-size-fits-all concept. For some, it might mean being debt-free, while others might dream of early retirement or passive income streams.

Ask yourself:

- What does financial freedom look like for you? Visualize your ideal lifestyle and identify the financial components that would make it possible.

- What are your financial goals? Be specific and set both short-term and long-term goals. This could include paying off debt, saving for a down payment, investing for retirement, or building a passive income portfolio.

- What are your values and priorities? Align your financial goals with your values and priorities. For example, if you value travel, you might prioritize saving for vacations.

Step 2: Analyze Your Current Financial Situation

Once you have a clear vision of your financial freedom, it’s time to assess your current financial standing. This involves a honest and thorough evaluation of your income, expenses, assets, and liabilities.

Here’s how to do it:

-

- Track your income and expenses: Use a budgeting app, spreadsheet, or notebook to track all your income and expenses for a month or two. This will provide a clear picture of your spending habits and identify areas where you can save.

- Create a detailed budget: Based on your tracked expenses, create a budget that allocates your income to different categories like housing, transportation, food, entertainment, and savings.

- Evaluate your assets and liabilities: List all your assets, including savings, investments, property, and valuables. Then list your liabilities, such as loans, credit card debt, and outstanding bills.

- Calculate your net worth: Subtract your liabilities from your assets to determine your net worth. This provides a snapshot of your overall financial health.

Step 3: Develop a Strategic Financial Plan

Now that you have a solid understanding of your current financial situation, it’s time to create a roadmap to achieve your financial freedom goals. This plan should be tailored to your unique needs and circumstances.

Here are some key elements to include:

- Debt management strategy: Develop a plan to pay off debt, prioritizing high-interest debt first. Consider debt consolidation or debt snowball methods.

- Savings plan: Determine how much you need to save each month to reach your goals. Consider setting up automatic transfers to your savings account.

- Investment strategy: Choose investment options that align with your risk tolerance and time horizon. Diversify your portfolio across different asset classes like stocks, bonds, and real estate.

- Income generation strategies: Explore ways to increase your income, such as getting a raise, taking on a side hustle, or starting a business.

- Regular review and adjustments: Review your plan at least annually, or more frequently if your circumstances change, and make adjustments as needed.

Step 4: Implement Your Plan with Discipline and Consistency

Creating a plan is just the first step. The real magic happens when you consistently put your plan into action. This requires discipline, commitment, and a willingness to make necessary adjustments along the way.

Here are some tips to stay on track:

- Automate your savings and investments: Set up automatic transfers from your checking account to your savings and investment accounts. This ensures you save consistently even when you’re busy.

- Track your progress: Regularly monitor your progress and make adjustments to your plan as needed. Celebrate your milestones and stay motivated.

- Seek professional guidance: Consider working with a financial advisor to develop a personalized plan and receive ongoing support.

- Don’t be afraid to adjust: Life is unpredictable, and your financial plan may need to be adjusted to accommodate unexpected events or changes in your circumstances.

Step 5: Cultivate a Mindset of Financial Freedom

Financial freedom is not just about money; it’s also about your mindset. Cultivating a positive and empowered mindset is crucial to achieving your goals.

Here are some key mindset shifts to embrace:

- Shift your focus from scarcity to abundance: Believe that you have the ability to create wealth and abundance in your life.

- Develop a growth mindset: Embrace challenges as opportunities to learn and grow. Be willing to step outside your comfort zone and take calculated risks.

- Embrace delayed gratification: Learn to prioritize long-term goals over immediate gratification. This means being willing to save and invest for the future, even if it means sacrificing some short-term pleasures.

- Be patient and persistent: Building financial freedom takes time and effort. Stay focused on your goals and don’t get discouraged by setbacks.

Building Your Financial Freedom: A Journey of Empowerment

The path to financial freedom is not a destination but a journey of self-discovery and empowerment. It’s about taking control of your finances, making conscious choices, and aligning your money with your values and priorities. By following these five steps, you can create a clear and actionable plan that will guide you towards a life of financial freedom.

Remember, it’s a journey that requires discipline, consistency, and a mindset shift. But with dedication and the right strategies, you can unlock the power of financial freedom and build a future where money works for you, not the other way around.

Bonus Tips for Accelerating Your Journey to Financial Freedom:

- Negotiate your salary: Don’t be afraid to ask for a raise or negotiate a better salary when you’re due for a review.

- Explore side hustles: Find ways to generate additional income through freelance work, online businesses, or part-time jobs.

- Take advantage of free resources: Utilize free online resources like budgeting apps, financial education websites, and investment platforms.

- Learn about investing: Educate yourself about different investment options and strategies to make informed decisions.

- Seek out mentors and communities: Connect with others who are on their own financial freedom journey for support and inspiration.

Conclusion:

Financial freedom is not a dream, it’s a tangible goal you can achieve through a combination of knowledge, discipline, and a positive mindset. By following this blueprint, you can create a personalized financial plan that empowers you to take control of your finances and build a future where money works for you.

Start your journey today and unlock the power of financial freedom for a life of abundance and fulfillment.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Your 5-Step Blueprint to Ultimate Financial Freedom. We hope you find this article informative and beneficial. See you in our next article!

google.com