Unlocking Your Financial Freedom: 5 Essential Steps to Mastering Financial Planning

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking Your Financial Freedom: 5 Essential Steps to Mastering Financial Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking Your Financial Freedom: 5 Essential Steps to Mastering Financial Planning

Financial planning. It’s a phrase that can evoke a range of emotions, from dread to excitement. For some, it’s a daunting task, a labyrinth of confusing jargon and complex calculations. For others, it’s a liberating journey, a path towards achieving their financial goals and securing a brighter future.

No matter your perspective, financial planning is essential. It’s not just about accumulating wealth; it’s about creating a life you desire, a life free from financial worries and anxieties. It’s about taking control of your money, making informed decisions, and building a solid foundation for your future.

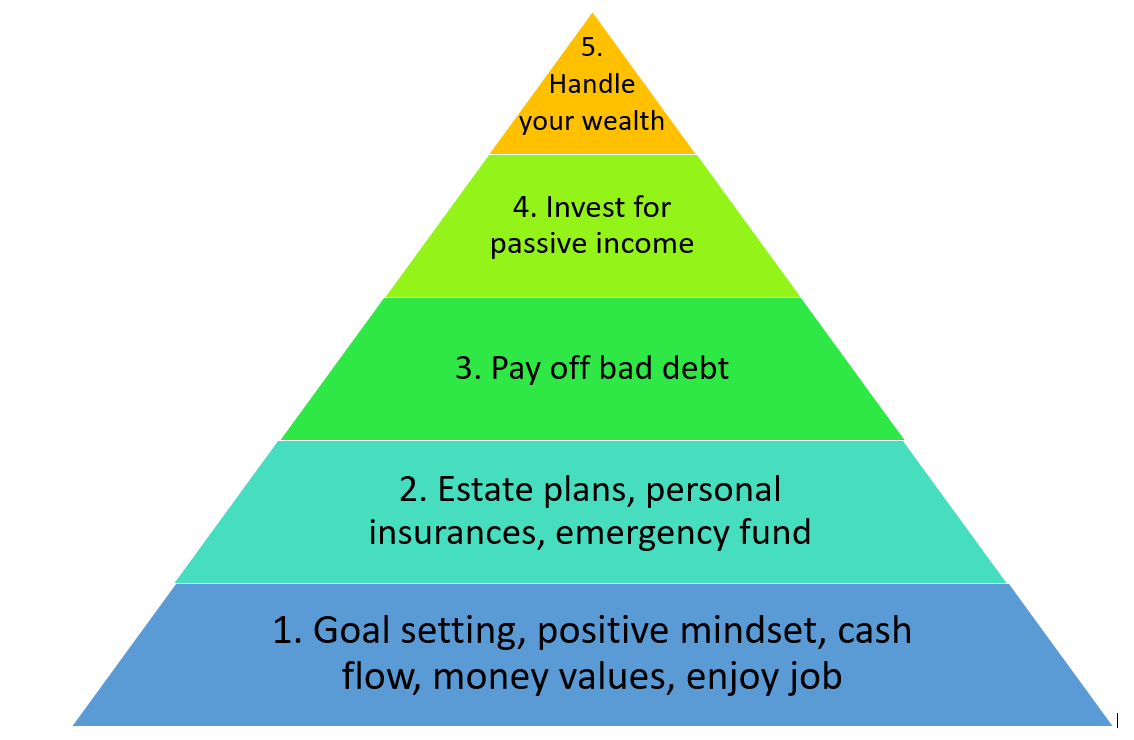

This article will demystify the world of financial planning, breaking it down into 5 actionable steps that anyone can follow. By understanding these key principles and implementing them in your life, you can unlock your financial freedom and embark on a journey towards financial security.

Step 1: Define Your Financial Goals

The first step in financial planning is to identify what you want to achieve. What are your dreams, aspirations, and financial ambitions? Do you want to buy a home, retire early, fund your children’s education, travel the world, or simply have peace of mind knowing you have a secure financial future?

Be specific and realistic about your goals. Instead of simply saying "I want to retire comfortably," define what "comfortably" means to you. How much money do you need to live on? What lifestyle do you envision?

Once you have a clear picture of your goals, you can start to develop a plan to achieve them. This involves:

- Prioritizing your goals: Rank your goals based on their importance and urgency.

- Setting timelines: Assign a timeframe for achieving each goal.

- Quantifying your goals: Determine how much money you need to reach each goal.

![]()

Step 2: Assess Your Current Financial Situation

Before you can start planning for the future, you need to understand your current financial situation. This involves:

- Tracking your income and expenses: Create a budget that accurately reflects your income and spending habits.

- Evaluating your assets: List all your assets, including savings, investments, real estate, and valuables.

- Analyzing your liabilities: Identify all your debts, including mortgages, loans, credit card balances, and other outstanding obligations.

- Calculating your net worth: Subtract your liabilities from your assets to determine your net worth, a snapshot of your financial health.

This step can be daunting, but it’s crucial for making informed decisions about your finances. By understanding your current financial standing, you can identify areas where you can improve and make adjustments to your spending habits.

Step 3: Develop a Budget

A budget is a roadmap for your finances. It helps you allocate your income towards your goals, track your spending, and identify areas where you can save money.

Here are some tips for creating an effective budget:

- Use budgeting tools: There are numerous budgeting apps and software available that can automate the process and provide valuable insights into your spending habits.

- Categorize your expenses: Group your expenses into categories like housing, transportation, food, entertainment, and savings.

- Track your spending: Monitor your spending regularly to ensure you’re staying within your budget.

- Adjust your budget as needed: Life is unpredictable, so be prepared to adjust your budget as your circumstances change.

Step 4: Plan for Retirement

Retirement planning is often overlooked, but it’s one of the most important aspects of financial planning. The sooner you start saving for retirement, the more time your money has to grow.

Here are some key considerations for retirement planning:

- Choose a retirement savings plan: Explore options like 401(k)s, Roth IRAs, and traditional IRAs.

- Determine your contribution amount: Aim to contribute as much as possible to your retirement savings plan, taking advantage of any employer matching programs.

- Invest your savings wisely: Consider investing in a diversified portfolio of stocks, bonds, and other assets to maximize your returns.

- Review your retirement plan regularly: Adjust your savings contributions and investment strategy as needed to ensure you’re on track to achieve your retirement goals.

Step 5: Protect Yourself and Your Family

Financial planning is not just about accumulating wealth; it’s also about protecting your assets and ensuring your family’s financial security in case of unexpected events. This involves:

- Purchasing insurance: Consider getting adequate insurance coverage for your home, car, health, and life.

- Creating an estate plan: Develop a will and other estate planning documents to ensure your assets are distributed according to your wishes.

- Protecting your identity: Take steps to prevent identity theft and fraud.

The Power of Financial Planning

Financial planning is not a one-time event; it’s an ongoing process that requires regular review and adjustments. By following these 5 steps, you can take control of your finances, achieve your financial goals, and live a life free from financial stress.

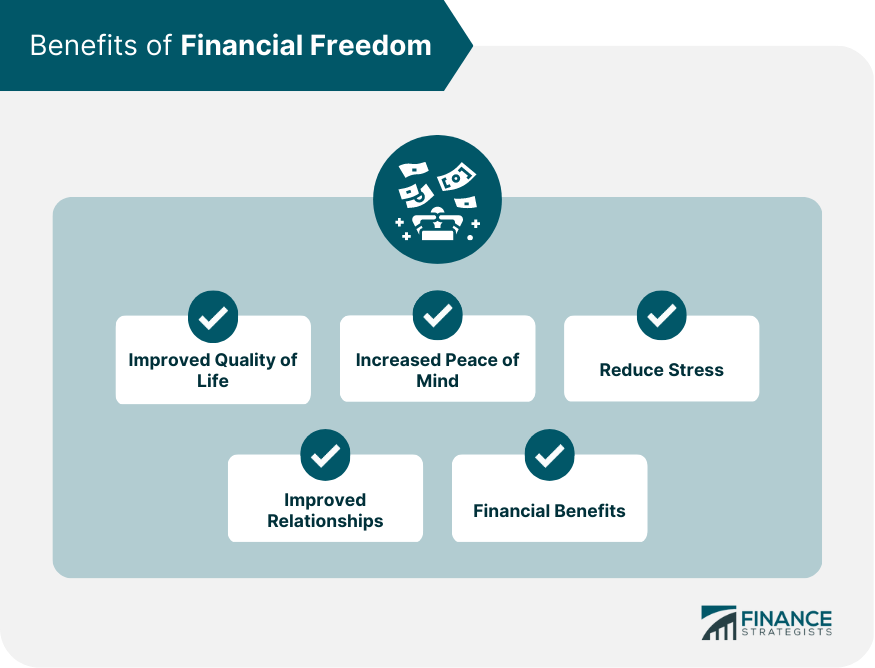

Here are some of the benefits of effective financial planning:

- Reduced financial stress: Knowing you have a plan in place for your financial future can provide peace of mind and reduce anxiety.

- Increased financial security: Financial planning helps you build a solid foundation for your future, protecting you from unexpected financial shocks.

- Achieving your financial goals: By setting clear goals and developing a plan to achieve them, you can make your dreams a reality.

- Improved financial literacy: The process of financial planning helps you learn about different financial products and services, enhancing your financial knowledge.

- Greater control over your money: Financial planning empowers you to take control of your finances and make informed decisions about your money.

Conclusion

Financial planning is a powerful tool for achieving your financial goals and securing a brighter future. It’s not about becoming rich; it’s about living a life you desire, free from financial worries. By taking the time to define your goals, assess your current situation, create a budget, plan for retirement, and protect yourself and your family, you can unlock your financial freedom and embark on a journey towards financial security. Remember, financial planning is a marathon, not a sprint. It requires patience, discipline, and a commitment to achieving your financial goals. By taking action today, you can start building a brighter financial future for yourself and your loved ones.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Your Financial Freedom: 5 Essential Steps to Mastering Financial Planning. We thank you for taking the time to read this article. See you in our next article!

google.com