Unlocking Your Financial Future: 5% High-Yield Savings Accounts – The Ultimate Guide to Growing Your Money

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking Your Financial Future: 5% High-Yield Savings Accounts – The Ultimate Guide to Growing Your Money. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking Your Financial Future: 5% High-Yield Savings Accounts – The Ultimate Guide to Growing Your Money

In a world of rising inflation and stagnant interest rates, it can feel like your hard-earned money is losing value faster than ever. But there’s a powerful tool that can help you fight back: high-yield savings accounts (HYSA).

These accounts offer significantly higher interest rates than traditional savings accounts, allowing your money to grow faster and outpace inflation. But navigating the world of HYSAs can be daunting. With so many options available, it can be tough to find the best fit for your needs and goals.

This comprehensive guide will equip you with the knowledge and tools to unlock the power of high-yield savings accounts and begin building a brighter financial future.

Understanding the Power of High-Yield Savings Accounts

Imagine a scenario where your savings account earns a meager 0.01% interest. While your money sits there, it’s essentially losing value due to inflation. Now, picture this: you switch to a high-yield savings account offering a 5% annual percentage yield (APY). Your money starts working harder for you, generating substantial growth over time.

Why Choose a High-Yield Savings Account?

- Higher Returns: HYSAs offer significantly higher interest rates compared to traditional savings accounts. This means your money grows faster, helping you reach your financial goals sooner.

- Safety and Security: HYSAs are FDIC-insured up to $250,000 per depositor, per insured bank, ensuring the safety of your funds.

- Accessibility: You can easily access your money through online banking, mobile apps, or ATM withdrawals.

- Convenience: Many HYSAs offer features like bill pay, automatic transfers, and mobile check deposit, making managing your money effortless.

Factors to Consider When Choosing a High-Yield Savings Account

- APY: Look for accounts with the highest APY possible. Remember, even a small difference in APY can significantly impact your earnings over time.

- Minimum Deposit: Some HYSAs require a minimum deposit to open an account. Ensure the minimum deposit aligns with your budget.

- Fees: Be aware of any fees associated with the account, such as monthly maintenance fees or withdrawal fees.

- Accessibility: Choose an account with easy access to your funds through online banking, mobile apps, or ATM withdrawals.

- Customer Service: Look for a bank with excellent customer service, especially if you prefer to handle transactions over the phone or in person.

Top Tips for Maximizing Your High-Yield Savings Account

- Set Realistic Goals: Determine your financial goals, whether it’s saving for a down payment, retirement, or an emergency fund. This will help you choose the right account and stay motivated.

- Automate Your Savings: Set up automatic transfers from your checking account to your HYSAs to ensure regular contributions.

- Avoid Unnecessary Withdrawals: Resist the urge to withdraw money from your HYSAs unless absolutely necessary. Frequent withdrawals can hinder your savings growth.

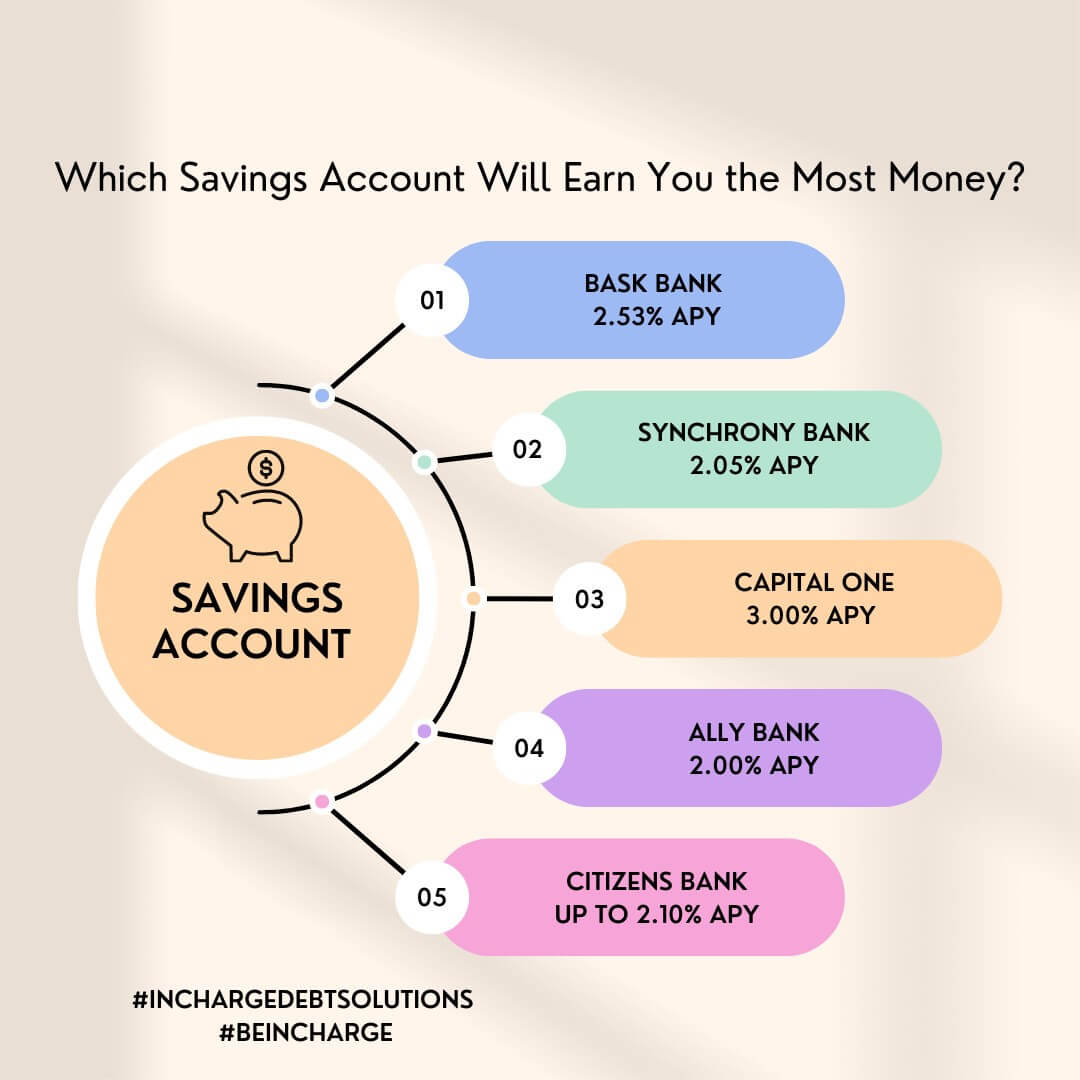

- Shop Around: Compare APYs, fees, and features offered by different banks and credit unions to find the best deal.

- Take Advantage of Bonuses: Many banks offer sign-up bonuses for opening a new HYSAs. These bonuses can provide a head start on your savings journey.

Understanding the Impact of Interest Compounding

The magic of compound interest lies at the heart of high-yield savings accounts. Compounding is like earning interest on your interest. Here’s how it works:

- Initial Deposit: You deposit $10,000 into a HYSAs with a 5% APY.

- First Year: After one year, you earn $500 in interest ($10,000 x 0.05).

- Second Year: Your balance is now $10,500. You earn $525 in interest ($10,500 x 0.05).

- Continued Growth: This cycle continues, with each year’s interest earning interest in the following years, resulting in exponential growth.

The Power of Time and Compounding

The longer your money stays in a high-yield savings account, the more time it has to compound and grow. Even small differences in APY can lead to significant differences in earnings over time.

Example:

- Account 1: $10,000 at 1% APY for 10 years = $11,046.22

- Account 2: $10,000 at 5% APY for 10 years = $16,288.95

As you can see, the account with a higher APY generates significantly more earnings over the same period.

Harnessing the Power of High-Yield Savings Accounts

High-yield savings accounts are a powerful tool for building wealth and reaching your financial goals. By understanding the benefits, choosing the right account, and utilizing strategies to maximize your earnings, you can unlock the potential of your savings and achieve financial freedom.

Beyond Savings Accounts: Exploring Other Investment Options

While HYSAs are a great starting point for building a strong financial foundation, they may not be the most effective option for long-term wealth accumulation. Consider exploring other investment options, such as:

- Index Funds: Diversified investments that track specific market indexes, offering a low-cost and potentially high-return option.

- Exchange-Traded Funds (ETFs): Similar to index funds but traded on stock exchanges, offering greater flexibility and potential for higher returns.

- Real Estate: Investing in rental properties can provide passive income and potential appreciation.

- Bonds: Fixed-income securities that offer regular interest payments and a lower risk profile compared to stocks.

Consult with a Financial Advisor

Before making any investment decisions, it’s essential to consult with a qualified financial advisor. They can help you develop a personalized financial plan tailored to your individual goals, risk tolerance, and time horizon.

Conclusion: Embracing the Power of High-Yield Savings

In today’s economic climate, it’s more important than ever to make your money work harder for you. High-yield savings accounts offer a powerful tool to grow your wealth, outpace inflation, and achieve your financial goals. By understanding the key factors, maximizing your earnings, and exploring other investment options, you can unlock the full potential of your savings and secure a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Your Financial Future: 5% High-Yield Savings Accounts – The Ultimate Guide to Growing Your Money. We thank you for taking the time to read this article. See you in our next article!

google.com