Unlocking Your Financial Power: The 700+ Credit Score Advantage

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking Your Financial Power: The 700+ Credit Score Advantage. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking Your Financial Power: The 700+ Credit Score Advantage

In the intricate world of finance, few numbers hold as much sway as your credit score. This three-digit number, often shrouded in mystery, can dramatically impact your financial future. It determines your access to loans, credit cards, and even insurance rates. But understanding the nuances of credit scores can be a daunting task. This article aims to demystify this crucial metric, empowering you to unlock your financial power with a 700+ credit score.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It reflects how responsible you are with borrowing and repaying debt. Lenders use this score to assess the risk associated with lending you money. The higher your score, the lower the risk, leading to better interest rates and loan terms.

The Credit Score Spectrum:

Credit scores are typically categorized into five tiers:

- Poor (300-579): Indicates a history of missed payments, high credit utilization, or other negative credit behaviors.

- Fair (580-669): Suggests some credit challenges but a willingness to improve.

- Good (670-739): Shows a solid credit history with responsible borrowing and repayment.

- Very Good (740-799): Indicates excellent credit management and a low risk for lenders.

- Exceptional (800+): Represents exceptional creditworthiness and access to the best financial products.

Why Aim for 700+?

While a score above 670 is considered good, aiming for 700+ unlocks significant advantages:

- Lower Interest Rates: A higher credit score translates to lower interest rates on loans, mortgages, and credit cards. This means you’ll pay less in interest over the life of your loan, saving you thousands of dollars.

- Easier Loan Approvals: Lenders are more likely to approve your loan application with a higher score, giving you access to the financing you need for major purchases like a home or car.

- Increased Credit Limits: Credit card companies often offer higher credit limits to individuals with excellent credit, providing greater financial flexibility.

- Better Insurance Rates: Some insurance companies offer discounts on premiums for policyholders with good credit scores.

- Enhanced Financial Reputation: A high credit score demonstrates financial responsibility, boosting your reputation and opening doors to opportunities.

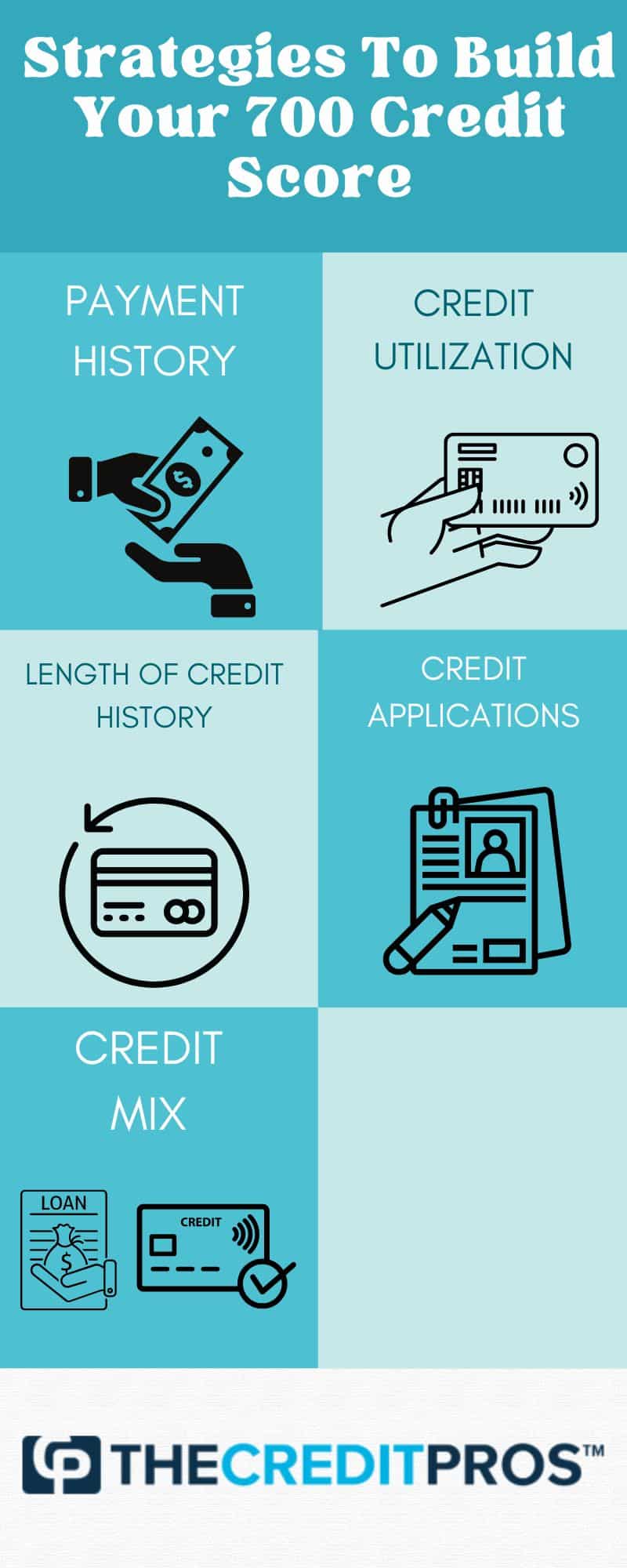

Factors Influencing Your Credit Score:

Your credit score is calculated based on five key factors:

- Payment History (35%): This is the most important factor, reflecting your on-time payment history for all credit accounts. Late or missed payments negatively impact your score.

- Amounts Owed (30%): This factor considers the amount of debt you owe across all credit accounts. A high credit utilization ratio (the percentage of available credit you’re using) can lower your score.

- Length of Credit History (15%): A longer credit history indicates stability and responsible credit management. Opening new accounts too frequently can negatively affect this factor.

- Credit Mix (10%): Having a mix of different credit accounts, such as credit cards, installment loans, and mortgages, demonstrates responsible borrowing practices.

- New Credit (10%): This factor considers how often you apply for new credit. Too many applications within a short period can lower your score, as it suggests increased risk.

Boosting Your Credit Score:

Here’s a roadmap to achieving a 700+ credit score:

- Pay Bills on Time: Make all payments, from credit cards to utilities, on time. Set reminders and consider automatic payments to ensure consistency.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit.

- Avoid Opening Too Many Accounts: Limit new credit applications to avoid unnecessary hard inquiries that can lower your score.

- Pay Down Debt: Focus on paying down high-interest debt, like credit card balances, as quickly as possible.

- Monitor Your Credit Report: Review your credit report regularly for errors or inaccuracies. You can access your report for free at AnnualCreditReport.com.

- Become an Authorized User: If you have a trusted family member or friend with excellent credit, ask to be added as an authorized user on their credit card. This can help improve your score.

- Consider a Secured Credit Card: A secured credit card requires a security deposit, making it easier to get approved even with limited credit history. Responsible use can help build your credit score.

The Power of a 700+ Credit Score:

A 700+ credit score unlocks a world of financial opportunities. You’ll be eligible for lower interest rates, better loan terms, and increased financial flexibility. This translates to significant savings over time, allowing you to achieve your financial goals faster and more efficiently.

Beyond the Numbers:

While credit scores are important, they are just one piece of the financial puzzle. Building a solid financial foundation requires responsible budgeting, saving, and investing. A 700+ credit score is a valuable asset, but it’s crucial to cultivate a holistic financial strategy that encompasses all aspects of your financial well-being.

Conclusion:

Your credit score is a powerful tool that can unlock your financial potential. By understanding the factors that influence your score and taking proactive steps to improve it, you can achieve a 700+ credit score and enjoy the benefits of exceptional creditworthiness. Remember, your financial future is in your hands, and a strong credit score is the key to unlocking its full potential.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Your Financial Power: The 700+ Credit Score Advantage. We appreciate your attention to our article. See you in our next article!

google.com