Unraveling the 5 Key Components of Your Insurance Policy: A Powerful Guide to Clarity

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unraveling the 5 Key Components of Your Insurance Policy: A Powerful Guide to Clarity. Let’s weave interesting information and offer fresh perspectives to the readers.

Unraveling the 5 Key Components of Your Insurance Policy: A Powerful Guide to Clarity

Insurance policies can be intimidating. They’re often dense, filled with jargon, and seemingly designed to confuse rather than clarify. But understanding your insurance policy is crucial. It’s your safety net, your financial shield, and your protection against life’s unexpected turns. Knowing what your policy covers, what it excludes, and how to navigate its intricacies can save you time, stress, and potentially even significant financial losses.

This guide aims to empower you with the knowledge to navigate your insurance policy with confidence. We’ll break down the 5 key components that form the backbone of every insurance policy, demystifying the language and equipping you to make informed decisions about your coverage.

1. Declarations Page: Your Policy’s Blueprint

The Declarations Page is the first page of your policy, and it’s essentially your policy’s summary. Think of it as the blueprint outlining the fundamental details of your coverage. It’s the document you’ll refer to most often, as it contains the following essential information:

- Policyholder Information: This section lists your name, address, and contact details. It also specifies the policy’s effective date, the period it covers, and the policy number.

- Covered Items: This part clearly defines what is covered under your policy. It might include specific assets, like your home, car, or valuables, or it might cover specific events, like accidents or medical emergencies.

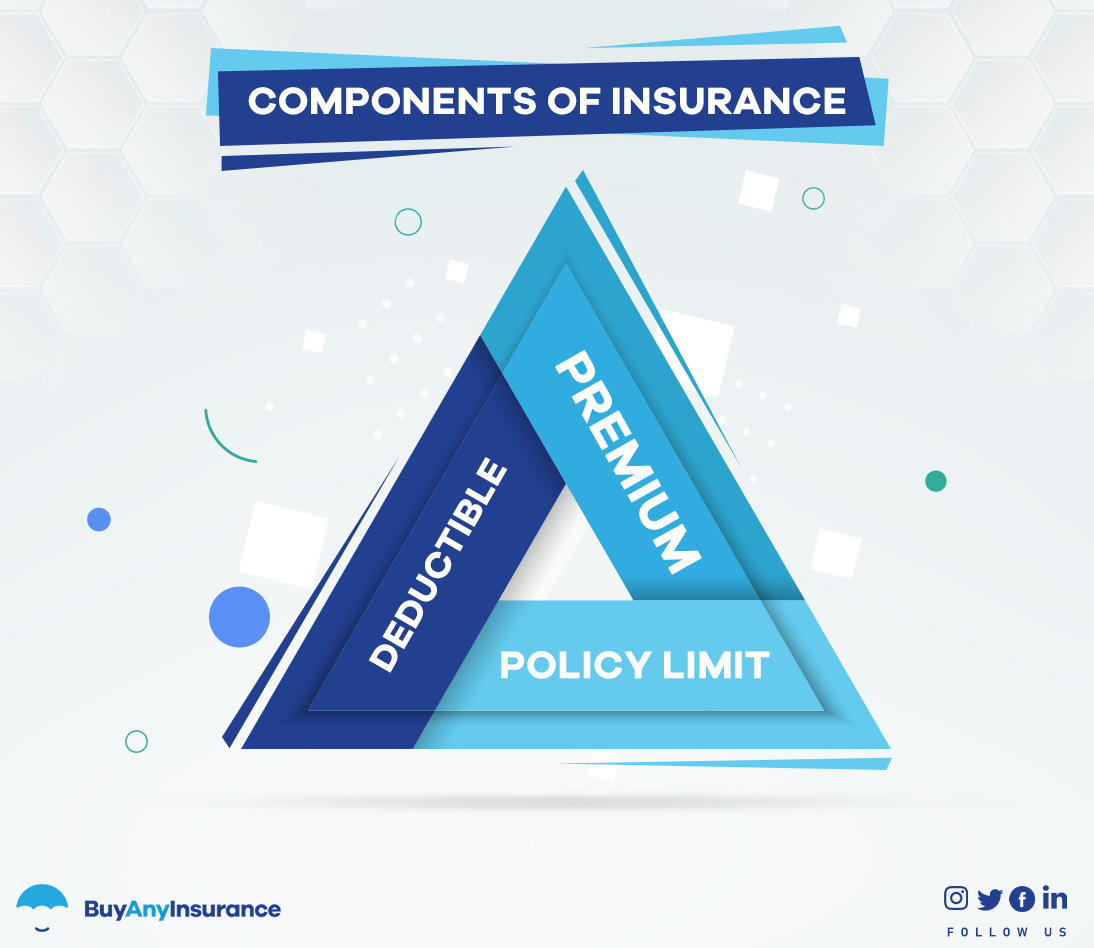

- Premium: The Declarations Page states the premium you pay for the coverage. It might also list any discounts you’re eligible for.

- Deductible: This section specifies the amount you’re responsible for paying out of pocket before your insurance coverage kicks in.

- Limits: This part outlines the maximum amount your insurer will pay for a covered claim.

Understanding the Declarations Page is your first step towards understanding your policy. It provides a concise overview of what you’re covered for and the financial parameters of your protection.

2. Insuring Agreement: The Heart of Your Coverage

The Insuring Agreement is the heart of your insurance policy. It outlines the specific promises your insurer makes to you. Think of it as the contract outlining the coverage you’re entitled to. It typically contains the following:

- Covered Perils: This section details the events or circumstances your policy covers. It could include things like fire, theft, accidents, natural disasters, or medical emergencies.

- Covered Losses: The Insuring Agreement specifies the types of losses your insurer will cover. This could include damage to your property, medical expenses, lost income, or liability claims.

- Exclusions: This crucial section lists the events or circumstances that are not covered by your policy. It’s important to carefully read through these exclusions, as they can significantly impact your coverage.

By understanding the Insuring Agreement, you can clearly grasp what you’re protected against and what situations might not be covered by your policy.

3. Conditions: The Rules of the Game

The Conditions section of your policy outlines the rules and responsibilities you and your insurer must adhere to. It’s like the fine print, detailing the terms and conditions that govern your coverage.

Here are some common conditions you might find:

- Notice of Loss: This condition outlines the procedures you must follow when reporting a claim. It specifies the timeframe for reporting and the required information.

- Cooperation: This condition states that you must cooperate with your insurer during the claims process, providing necessary documentation and information.

- Subrogation: This condition grants your insurer the right to pursue legal action against a third party responsible for your loss, after they’ve compensated you.

- Cancellation: This section outlines the circumstances under which either you or your insurer can terminate the policy.

Understanding the Conditions section ensures you know how to navigate the claims process, your responsibilities, and the potential consequences of non-compliance.

4. Definitions: Unlocking the Jargon

Insurance policies are notorious for using technical language and jargon. The Definitions section acts as your dictionary, defining the key terms used throughout the policy.

- "Insured": This refers to the individual or entity covered by the policy.

- "Loss": This defines what constitutes a loss under the policy, including financial, physical, or intangible damages.

- "Premium": This term defines the payment you make for your coverage.

- "Deductible": This clarifies the amount you pay out of pocket before your insurance kicks in.

- "Limit": This defines the maximum amount your insurer will pay for a covered claim.

By understanding the definitions, you can decipher the language of your policy and grasp the meaning of specific terms.

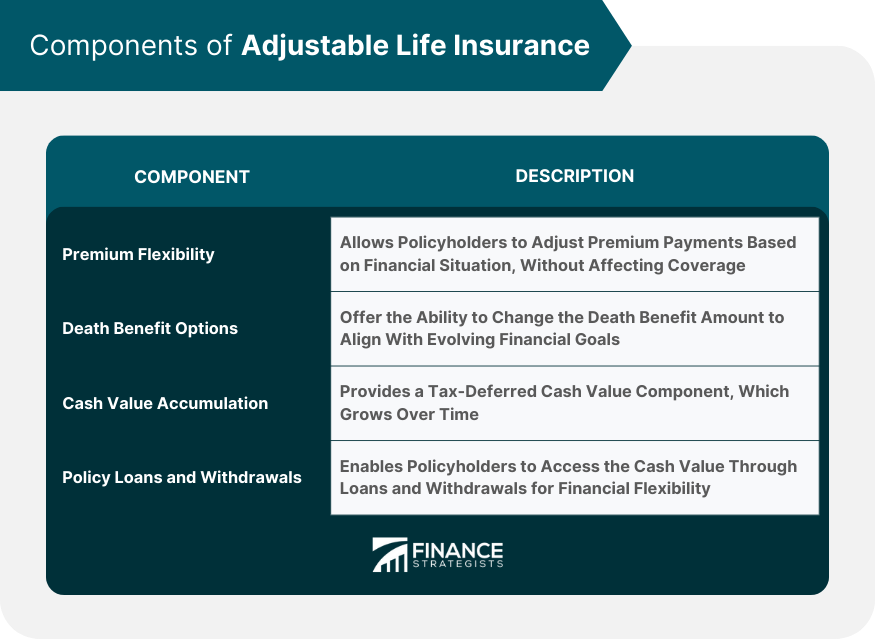

5. Endorsements: Tailoring Your Coverage

Endorsements are additions or modifications made to your policy. Think of them as customizations that tailor your coverage to your specific needs.

- Additional Coverage: Endorsements can extend your coverage to include specific items, events, or circumstances not covered in the original policy.

- Exclusions: Endorsements can also exclude certain items or events from your coverage.

- Changes to Policy Terms: Endorsements can modify the terms and conditions of your policy, such as changing your deductible or premium.

Reviewing your endorsements is crucial to ensure your coverage aligns with your evolving needs and circumstances.

Navigating Your Policy with Confidence

Understanding your insurance policy is not just about deciphering legalese; it’s about empowering yourself with knowledge. By familiarizing yourself with the 5 key components outlined above, you can navigate your policy with confidence.

Here are some additional tips for understanding your insurance policy:

- Read it carefully: Take the time to read your policy thoroughly, even if it seems overwhelming.

- Ask questions: Don’t hesitate to contact your insurance agent or broker if you have any questions or need clarification.

- Review your policy regularly: Make sure your coverage still meets your needs as your life changes.

- Keep a copy of your policy: Store a copy of your policy in a safe and accessible place.

Understanding your insurance policy is an investment in your financial security. It empowers you to make informed decisions, navigate the claims process effectively, and ensure you have the protection you need. Don’t let the complexity of insurance policies intimidate you. Take the time to learn, ask questions, and equip yourself with the knowledge to protect your financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Unraveling the 5 Key Components of Your Insurance Policy: A Powerful Guide to Clarity. We appreciate your attention to our article. See you in our next article!

google.com