5 Ways Peer-to-Peer Lending Can Revolutionize Your Finances: A Comprehensive Guide to the Basics

Related Articles: 5 Ways Peer-to-Peer Lending Can Revolutionize Your Finances: A Comprehensive Guide to the Basics

- The Ultimate Guide To 5 Essential Cryptocurrency Concepts

- 5 Powerful Financial Strategies For Single Parents To Thrive

- Unleash Your Financial Power: 5 Reasons Why A Financial Planner Is Your Secret Weapon

- The Pros And Cons Of Leasing Vs Buying A Car

- Unlocking Your Financial Freedom: 5 Powerful Strategies To Maximize Your 401(k)

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Ways Peer-to-Peer Lending Can Revolutionize Your Finances: A Comprehensive Guide to the Basics. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

5 Ways Peer-to-Peer Lending Can Revolutionize Your Finances: A Comprehensive Guide to the Basics

Peer-to-peer (P2P) lending has emerged as a powerful force in the financial landscape, offering both borrowers and lenders a compelling alternative to traditional banking. This innovative approach allows individuals to connect directly, bypassing intermediaries and unlocking a world of possibilities.

While the concept may seem daunting at first, understanding the basics of P2P lending can unlock a wealth of opportunities. This article delves into the fundamental aspects of this growing industry, empowering you to make informed decisions and harness its potential.

1. Understanding the Fundamentals:

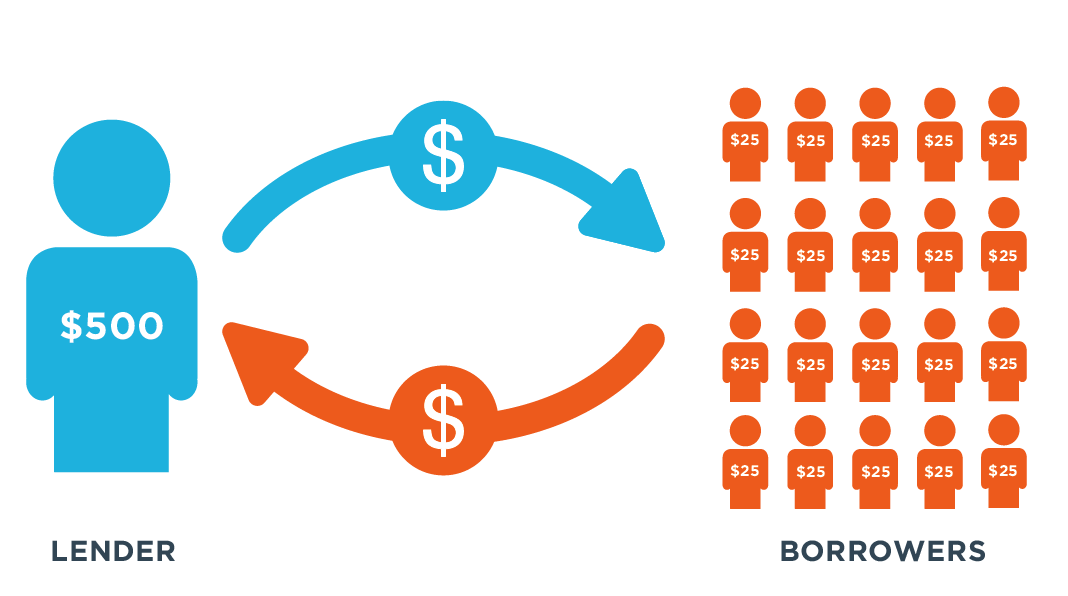

At its core, P2P lending is a simple concept. Individuals seeking loans (borrowers) connect with individuals willing to lend money (lenders) through online platforms. These platforms act as intermediaries, facilitating the matching process, loan origination, and loan management.

Borrowers benefit from P2P lending by accessing loans at potentially lower interest rates than traditional banks. This is often due to the reduced overhead costs associated with online platforms. Moreover, borrowers can tap into a wider pool of lenders, increasing their chances of loan approval, even if they have less-than-perfect credit.

Lenders benefit from P2P lending by earning higher returns on their investments compared to traditional savings accounts. They have the flexibility to choose loans based on their risk tolerance and desired return. The platform’s technology allows for diversification of investments, spreading risk across multiple borrowers.

2. The P2P Lending Process:

The P2P lending process is relatively straightforward and can be broken down into five key steps:

-

- Registration and Profile Creation: Both borrowers and lenders need to register on a P2P lending platform and provide basic information, including financial details, credit history, and loan purpose.

- Loan Application and Review: Borrowers submit loan applications, outlining the loan amount, purpose, and repayment terms. The platform then reviews the application and assesses the borrower’s creditworthiness.

- Loan Listing and Matching: Once approved, the loan is listed on the platform. Lenders can browse available loans and choose those that align with their investment criteria, such as interest rate, loan amount, and borrower profile.

- Funding and Loan Disbursement: Once a lender commits to funding a loan, the platform facilitates the transfer of funds from the lender to the borrower. The loan is then disbursed to the borrower, typically within a few business days.

- Loan Repayment and Management: The borrower makes monthly payments to the platform, which then distributes the funds to the lenders. The platform also manages loan servicing, tracking payments, and handling any delinquencies.

3. Types of P2P Loans:

P2P lending platforms offer a variety of loan types to cater to different needs:

-

- Personal Loans: These are unsecured loans used for a wide range of personal expenses, such as debt consolidation, home improvement, medical bills, or travel.

- Business Loans: Small and medium-sized businesses can access funding through P2P platforms for working capital, equipment purchases, or expansion projects.

- Real Estate Loans: P2P platforms facilitate loans for real estate investments, including mortgages, bridge loans, and commercial property financing.

- Peer-to-Peer Marketplace Lending: This category encompasses a diverse range of loans, including student loans, auto loans, and even loans for specific purposes, such as solar panel installation.

4. Key Considerations for Borrowers:

While P2P lending offers attractive benefits, borrowers must carefully consider the following factors:

- Interest Rates: While P2P loans often have lower interest rates than traditional loans, it’s crucial to compare rates across platforms and ensure you’re getting the best deal.

- Loan Terms: Understand the loan term, repayment schedule, and any associated fees before accepting a loan.

- Credit Score Impact: P2P loans can affect your credit score, so make sure you understand how the platform reports your loan activity to credit bureaus.

- Risk Assessment: Evaluate your ability to repay the loan on time, considering your income, expenses, and financial obligations.

5. Key Considerations for Lenders:

Lenders should also consider these factors when investing in P2P loans:

- Risk Tolerance: P2P lending involves inherent risk, as there’s always a chance that borrowers may default on their loans.

- Diversification: Spread your investments across multiple borrowers to mitigate risk and increase the likelihood of positive returns.

- Platform Reputation: Choose a reputable P2P lending platform with a proven track record of security, transparency, and customer service.

- Loan Screening: Carefully review borrower profiles and loan details to assess the risk associated with each investment.

6. The Future of P2P Lending:

P2P lending is rapidly evolving, driven by technological advancements and increasing demand for alternative financing solutions. Here are some key trends shaping the future of this industry:

- Increased Regulation and Transparency: Regulatory frameworks are being developed to ensure the safety and fairness of P2P lending platforms. This will enhance consumer protection and build trust in the industry.

- Technological Innovations: Artificial intelligence (AI) and machine learning are being integrated into P2P platforms to automate loan origination, risk assessment, and loan management.

- Expansion into New Markets: P2P lending is expanding beyond traditional lending categories, entering areas such as microfinance, renewable energy financing, and agricultural loans.

- Integration with Traditional Finance: P2P platforms are collaborating with banks and other financial institutions to offer hybrid lending solutions and expand their reach.

7. Conclusion:

P2P lending offers a compelling alternative to traditional banking, providing both borrowers and lenders with unique opportunities. Understanding the basics of this innovative industry empowers you to make informed decisions and harness its potential. Whether you’re seeking a lower-interest loan or seeking higher returns on your investments, P2P lending presents a world of possibilities. By carefully considering the factors outlined in this article, you can navigate this exciting landscape and unlock the power of peer-to-peer finance.

Remember: P2P lending is not a “get rich quick” scheme. It requires careful planning, risk assessment, and a long-term perspective. By approaching it with diligence and informed decision-making, you can unlock the potential of this dynamic and evolving industry.

Closure

Thus, we hope this article has provided valuable insights into 5 Ways Peer-to-Peer Lending Can Revolutionize Your Finances: A Comprehensive Guide to the Basics. We hope you find this article informative and beneficial. See you in our next article!

google.com